CLIENT ANNOUNCEMENT: We welcomed our baby boy on Thursday. I’ll be slow to respond to emails and calls for the next few days. If something is time-sensitive, please text my cell or leave a voicemail on my office line.

Schedule your Q4 meeting by clicking HERE

Market Overview

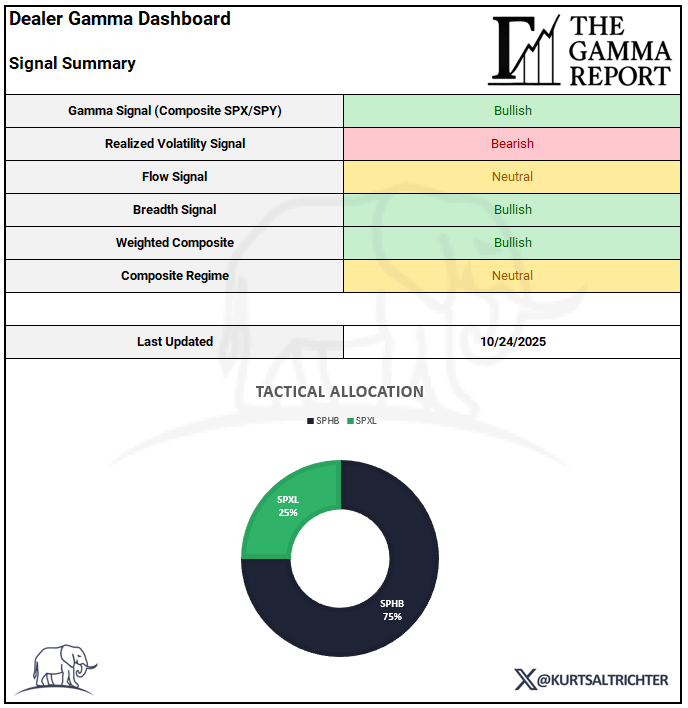

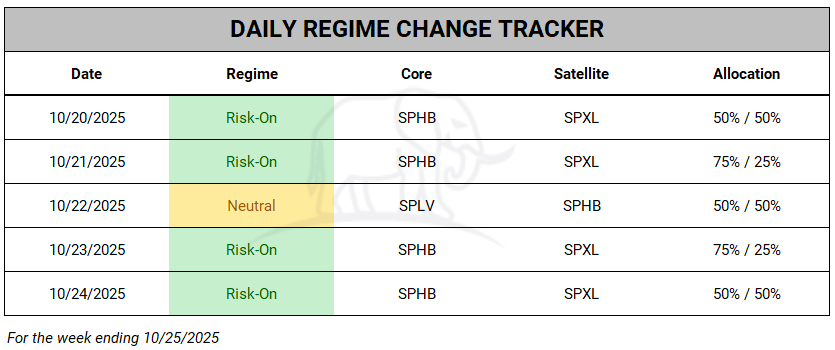

The model flipped to Risk-On into the Friday close. Volatility eased from the early month spike but remains active. Dealer positioning improved as spot pushed through key flip levels. Systematic flows are stabilizing, and breadth continued to firm. The model now favors 75% SPHB and 25% SPXL.

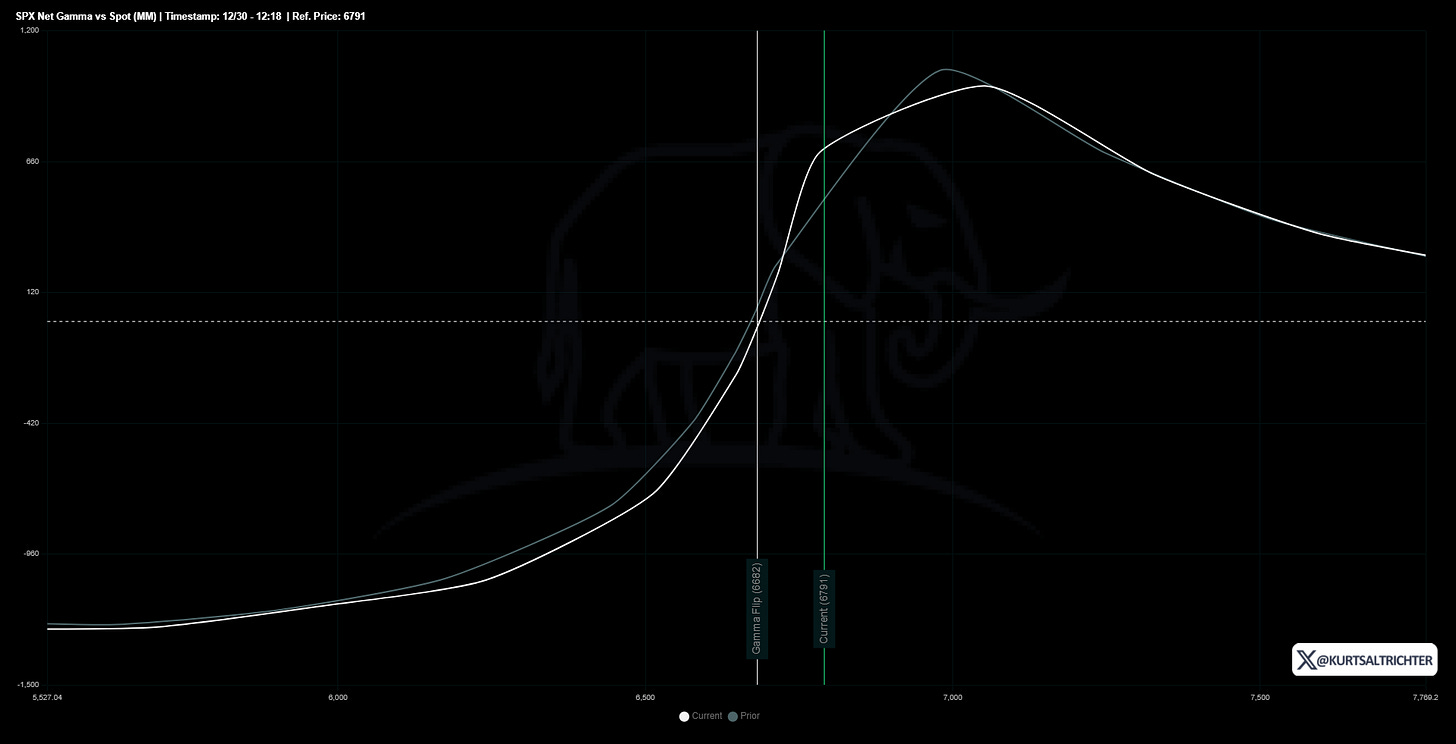

Gamma Signal

SPX reclaimed its gamma flip and finished the week above it.

Updated SPX gamma flip level: 6,682.

SPY flip level remains near 671.

Positive gamma means dealer hedging suppresses volatility, which supports trend persistence and shallower intraday ranges compared with short gamma conditions. The composite uses SPX and SPY with a 70 to 30 weighting, so institutional index flow leads, while ETF options flow adds short-term sensitivity.

Realized Volatility

Updated realized volatility readings

30-day RV: 11.52 percent

90-day RV: 9.93 percent

Short-term RV remains above the 90-day, but the week-over-week path cooled from the earlier burst. The model’s RV component recognized improvement at midweek, then flagged firmness into Friday, which is consistent with a Risk On posture that still respects intraday noise.

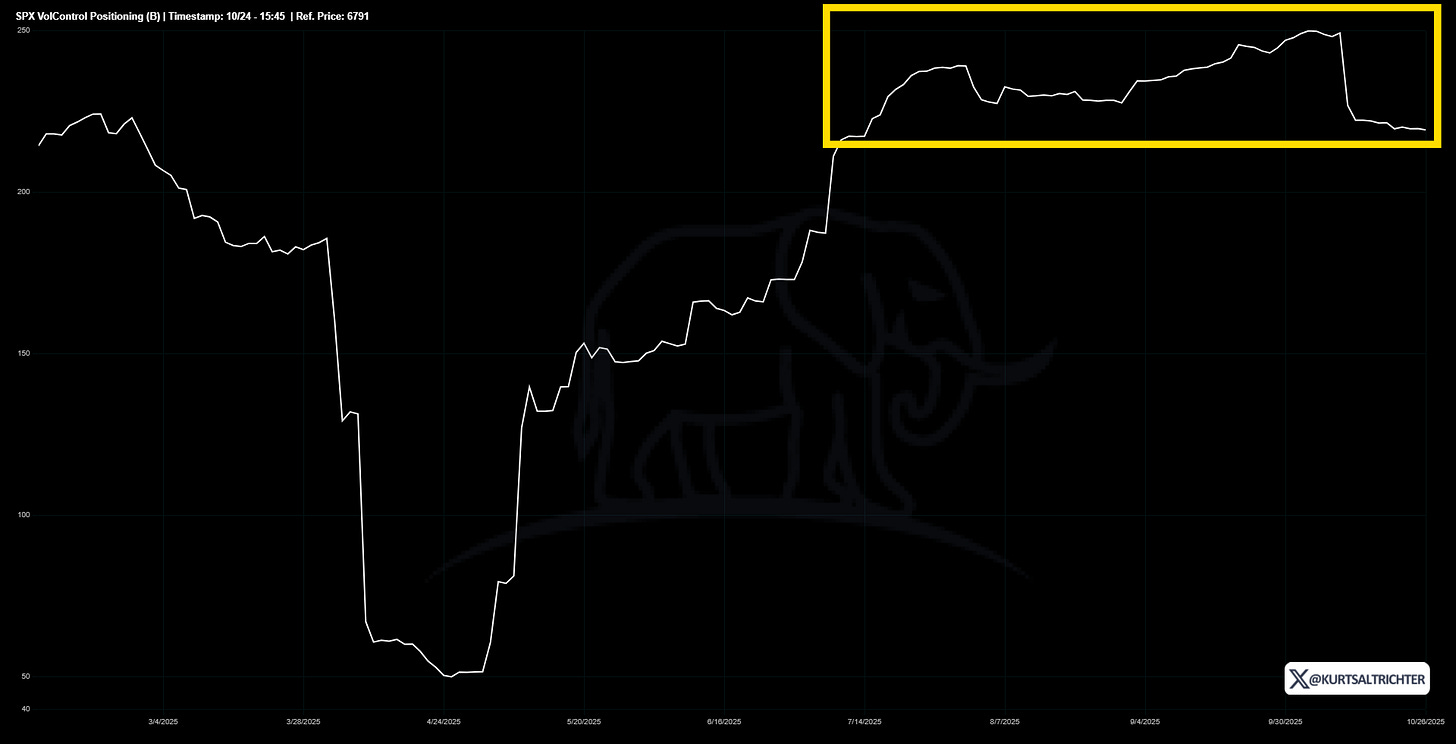

Systematic Flows

Vol Control exposure stabilized as realized volatility cooled from the early October surge. CTA positioning held steady with no broad selling impulse. The combination removes the mechanical selling overhang and allows price to respond more cleanly to improving gamma and breadth. We are not out of the woods here until both lines start pointing up.

Breadth

The percentage of S&P 500 stocks above the 200-day moving average is about 64.8 percent. That is an improvement from the prior week and sits just under the stronger confirmation zone in the mid to high sixties. Direction of change matters. Participation broadened and supports the Risk-On composite read.

Composite Regime

Signals at the Friday close

Gamma: supportive above flips

Realized volatility: firm but cooling versus the recent spike

Systematic flows: stable to improving

Breadth: trending higher near confirmation

Weighted composite: Bullish

Composite regime: Risk-On

Tactical allocation: 75% SPHB and 25% SPXL

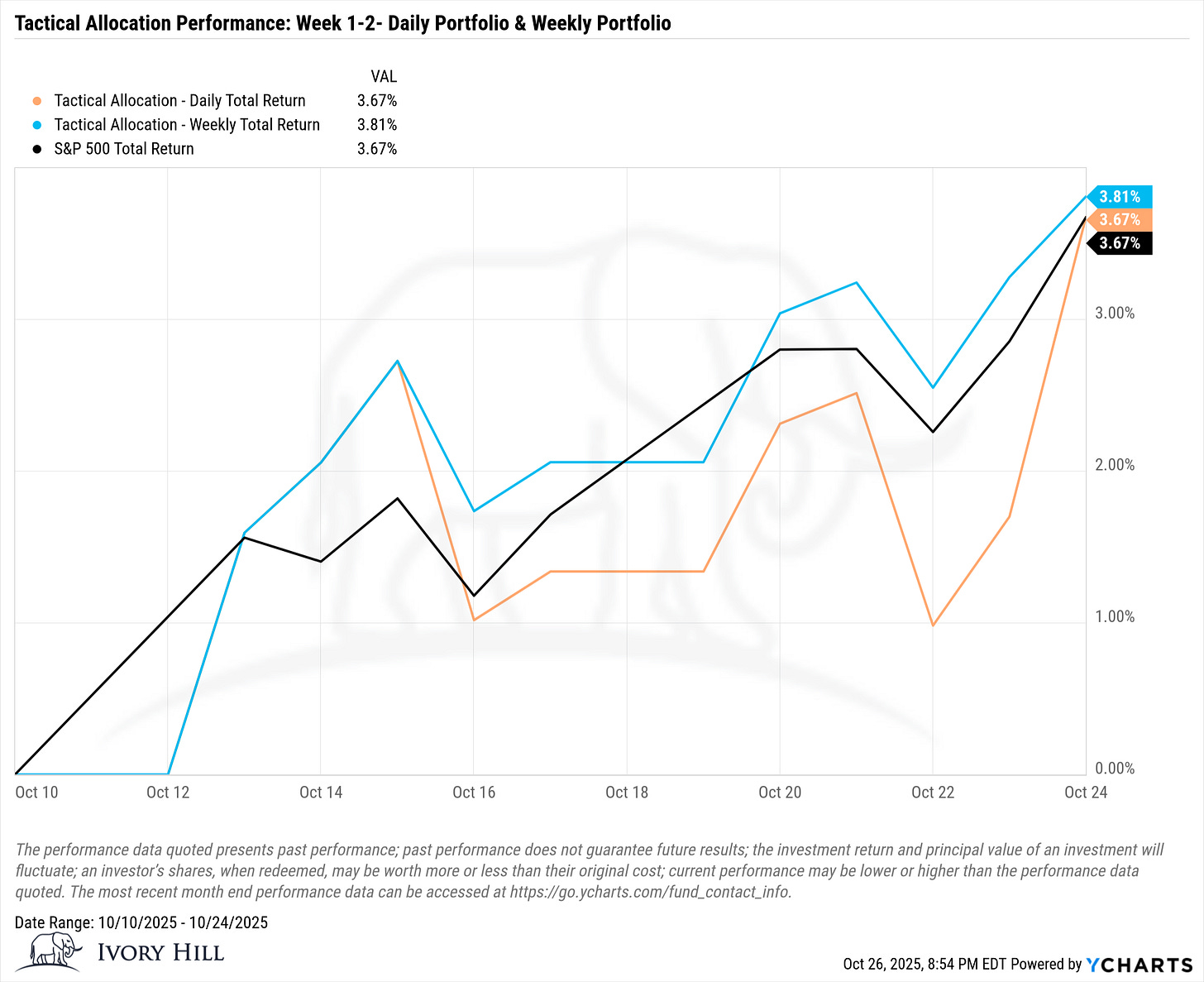

Tactical Allocation Performance

The daily model shifted from Neutral into Risk On as gamma turned supportive and realized volatility cooled. That rotation captured the late-week strength. The weekly model delivered a smoother path and lower turnover as flows stabilized.

Investor Takeaway

The model is back on offense. Positive gamma and stabilizing systematic flows reduce the probability of forced selling. Breadth is improving. Keep the tilt to SPHB with a tactical SPXL sleeve while monitoring realized volatility for confirmation.

Final Thoughts and Key Levels

The market continues to look more uncertain than fearful, but the structure has improved. Positive gamma and steadier flows argue for buying dips rather than chasing morning volatility spikes. I will keep refining the model each week, so check the Monday report to stay aligned with any adjustments to inputs and weights.

Key levels to watch this week

SPX gamma flip 6,682

SPY gamma flip 671

30-day RV watch for a move toward 9% to confirm further vol compression

Breadth watch for a push above 65% to confirm broad participation

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The Gamma Report is published by Ivory Hil, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.