Last week looked slow at the index level, but the underlying structure did not match the surface. The daily regime shifted three separate times, realized volatility firmed on both the 30-day and 90-day lookbacks, breadth weakened, and dealers transitioned from positive gamma early in the week to negative gamma by Thursday and Friday. These internal changes matter more than the modest headline moves because they determine how sensitive the tape is to incremental volatility.

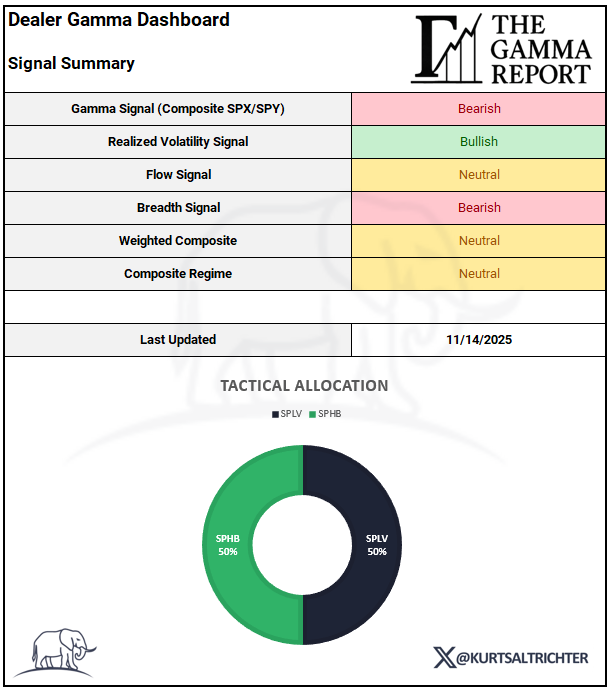

The composite regime ended the week Neutral, matching the prior week's reading, but the path was far less stable. Daily flips from Neutral to Risk-On to Risk-Off reflect an environment where directional conviction is low and the market is trading on flow, not trend.

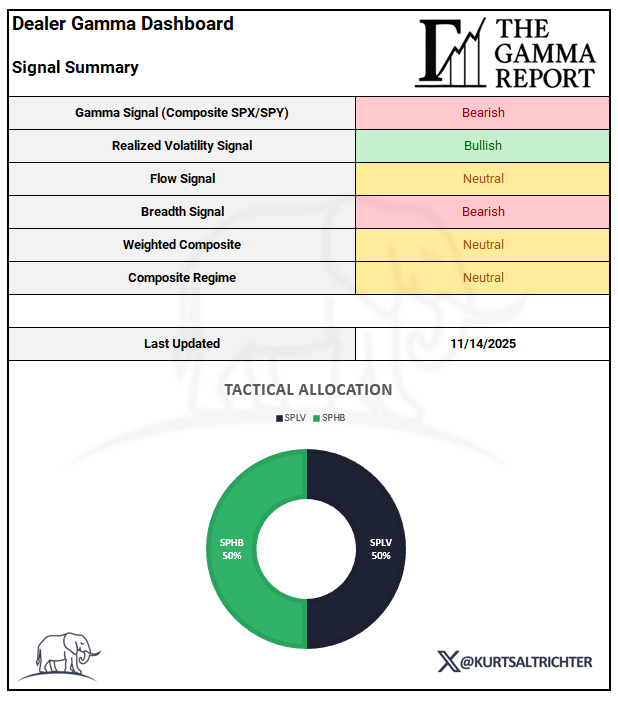

Gamma Signal

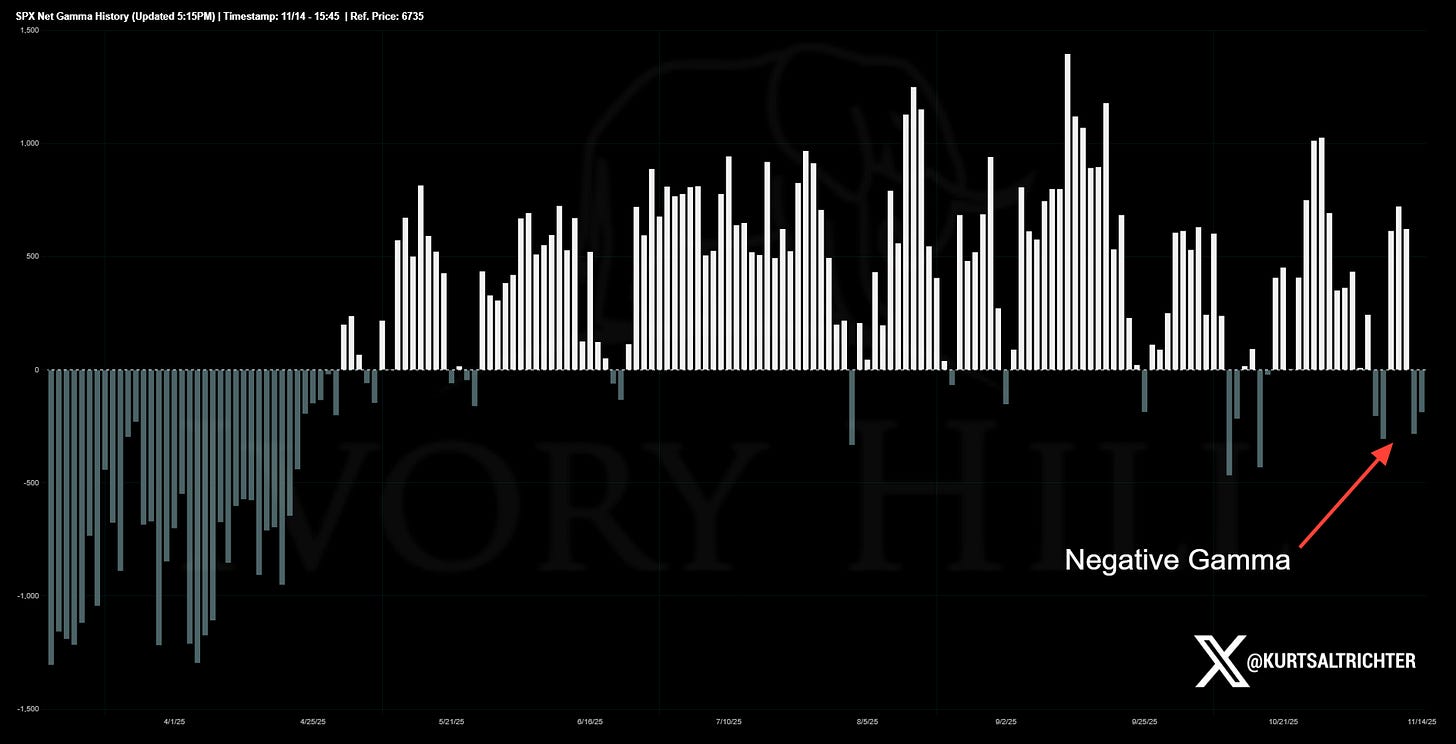

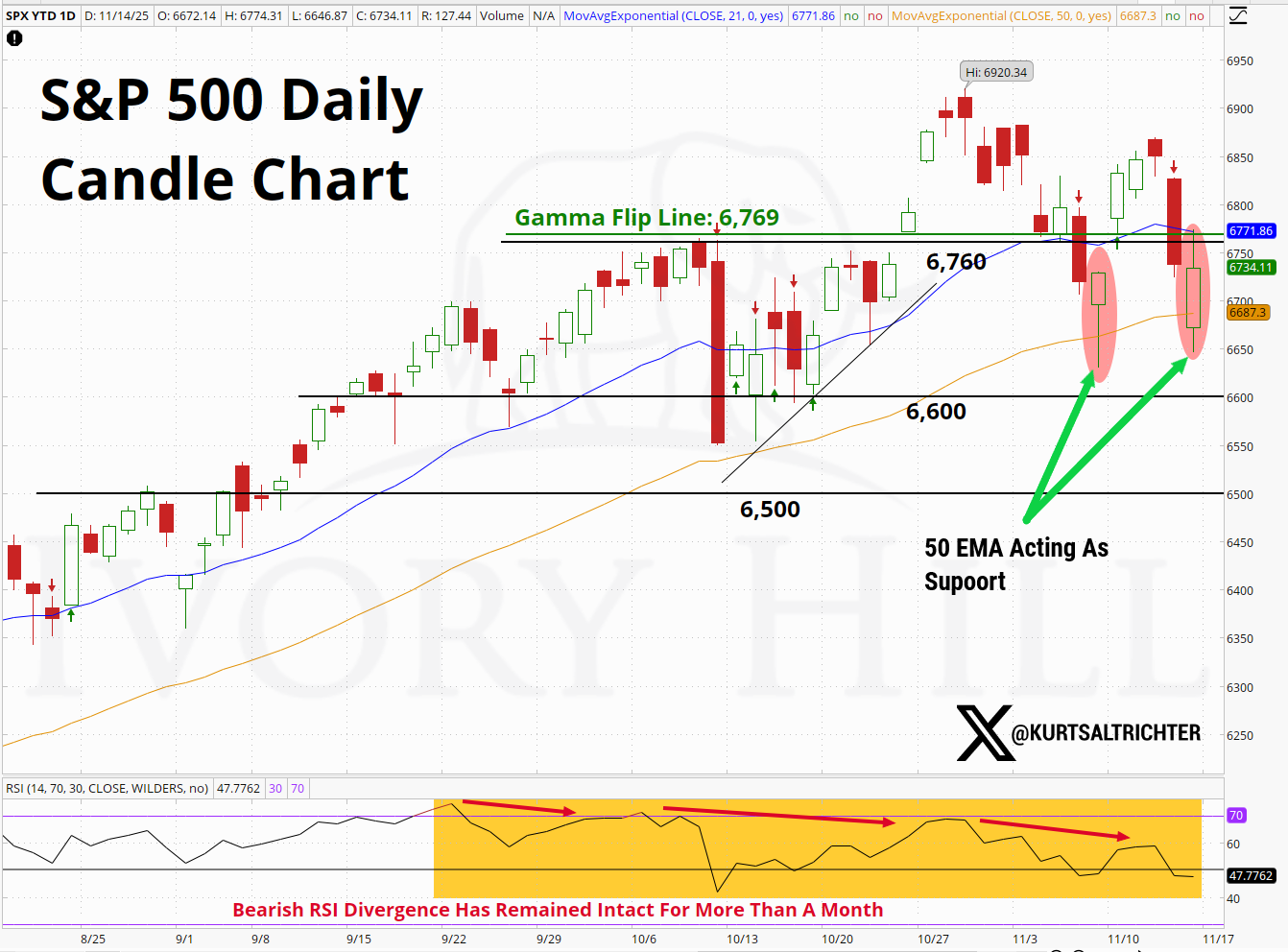

Dealers spent Monday through Wednesday in positive gamma, keeping intraday vol muted and reducing the ability for the price to trend. SPX sat above the flip region during those sessions, so dealer hedging acted as a stabilizer.

By Thursday, the picture changed. SPX moved back into the flip zone, and the composite SPX/SPY gamma complex shifted into negative territory, where it remained into Friday. That transition removed the stabilizing force that supported the early-week tape.

This is not an explosive negative gamma pocket yet, but the suppression force that helped stabilize the early November rally is gone. Until SPX can reclaim the flip region decisively, intraday swings should stay choppy, twitchy, and flow-driven.

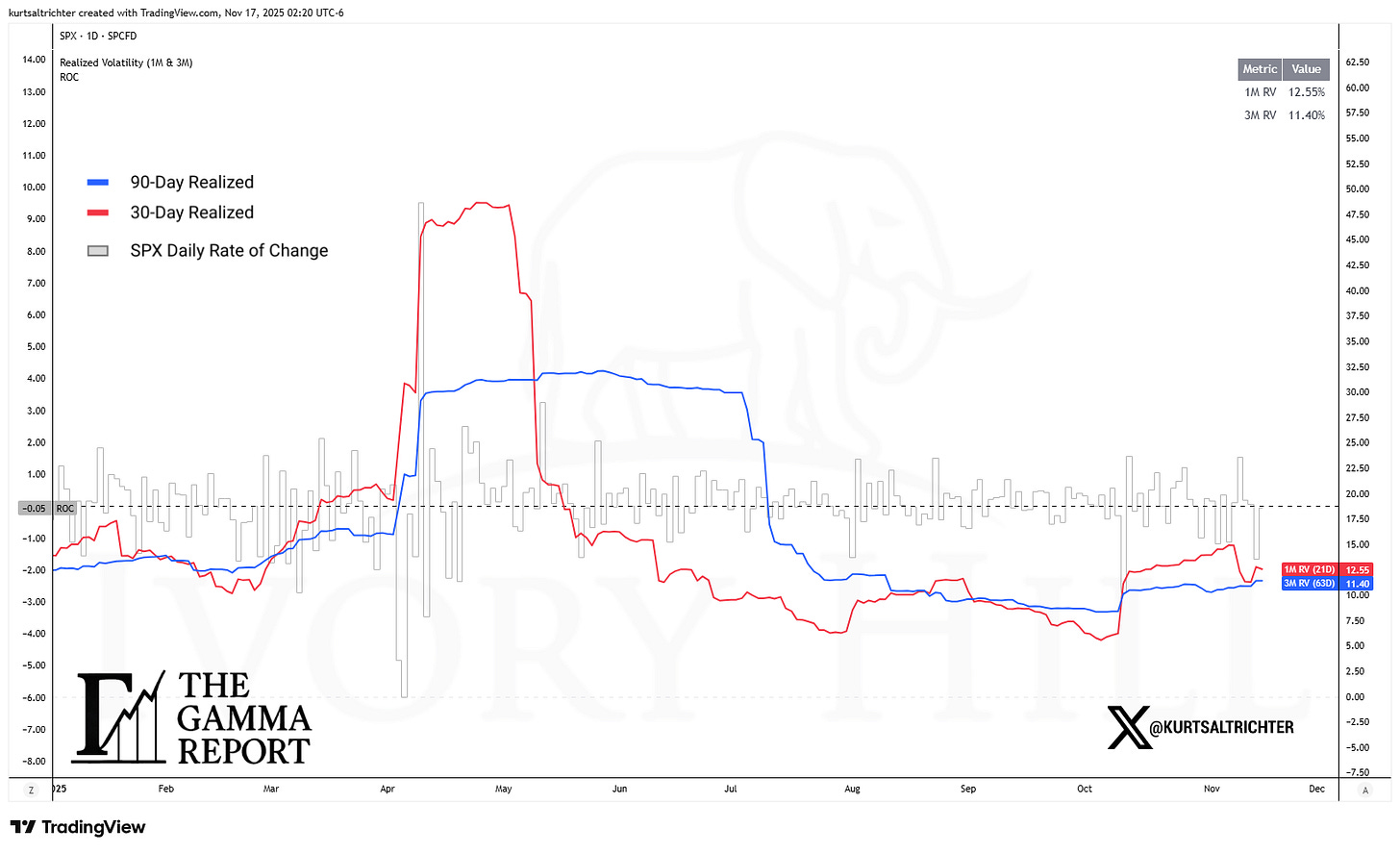

2. Realized Volatility Signal

30-day realized volatility ended the week at 12.55, up from 12.27 last week. 90-day realized volatility closed at 11.40, also up from 10.88 the prior week.

The message is simple: realized vol is firming, not collapsing.

The upturn in realized vol matters because vol-controlled strategies adjust based on realized, not implied, volatility. As 30-day and 90-day RV tick up, the amount of systematic bid underneath the market shrinks. These players don’t care about narratives, elections, or positioning. They react to math.

The signal scored +1 (bullish) because RV remains low in an absolute sense, but the direction of travel shifted from declining to rising. That directional change is what markets trade off.

3. Flow Signal

This week, the flow signal ended neutral.

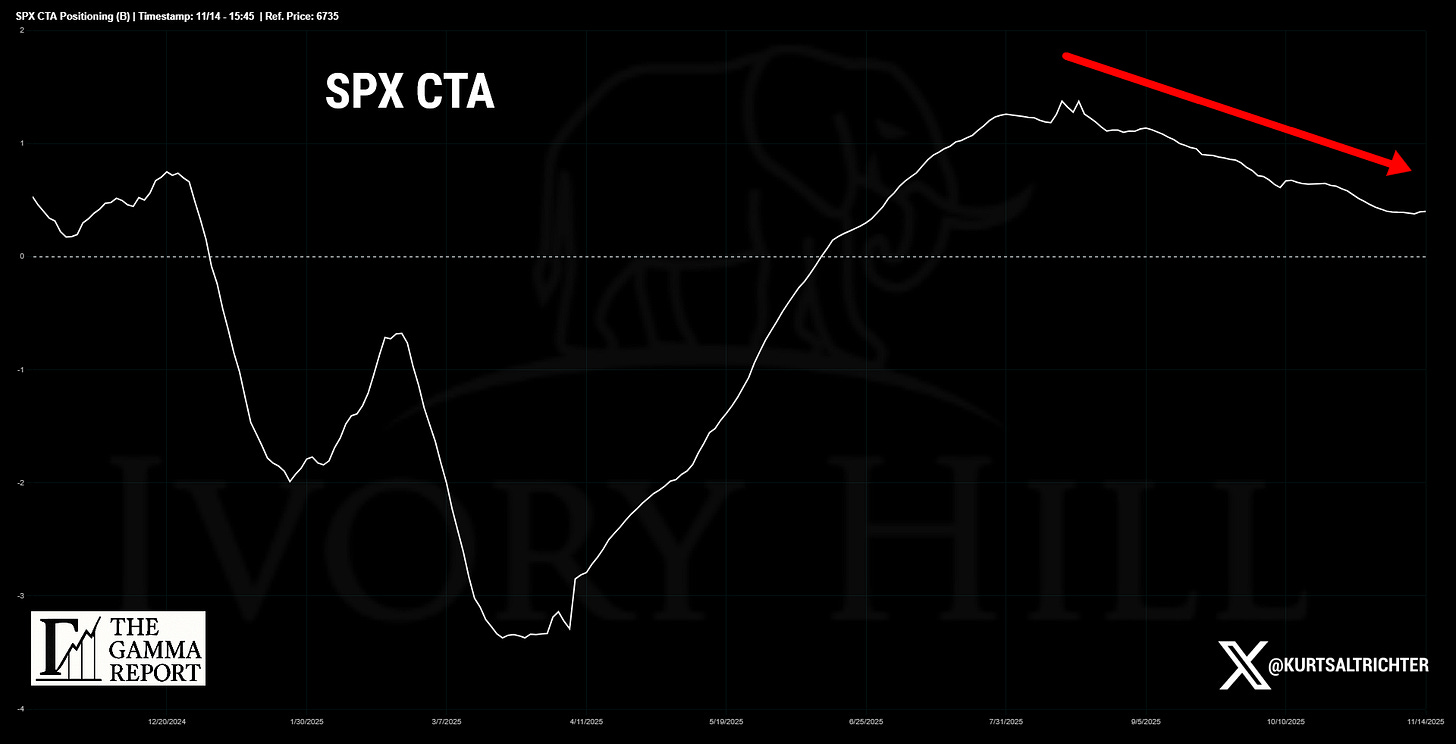

CTA positioning has been bleeding lower since late October. They are no longer the incremental buyers who pushed markets higher to the November peak. But they are not short either. This is a dead zone for CTAs, where they neither supply support nor create pressure.

Meanwhile, vol-control flows have been slowly rebuilding exposure, but nowhere near the pace seen earlier this quarter. Their stabilizing effect is present, but weaker than before.

When CTAs are neutral and vol-control is only moderately supportive, the tape becomes more dependent on liquidity and dealer behavior. With dealers in negative gamma at the end of the week, that’s a fragile setup.

4. Breadth Signal

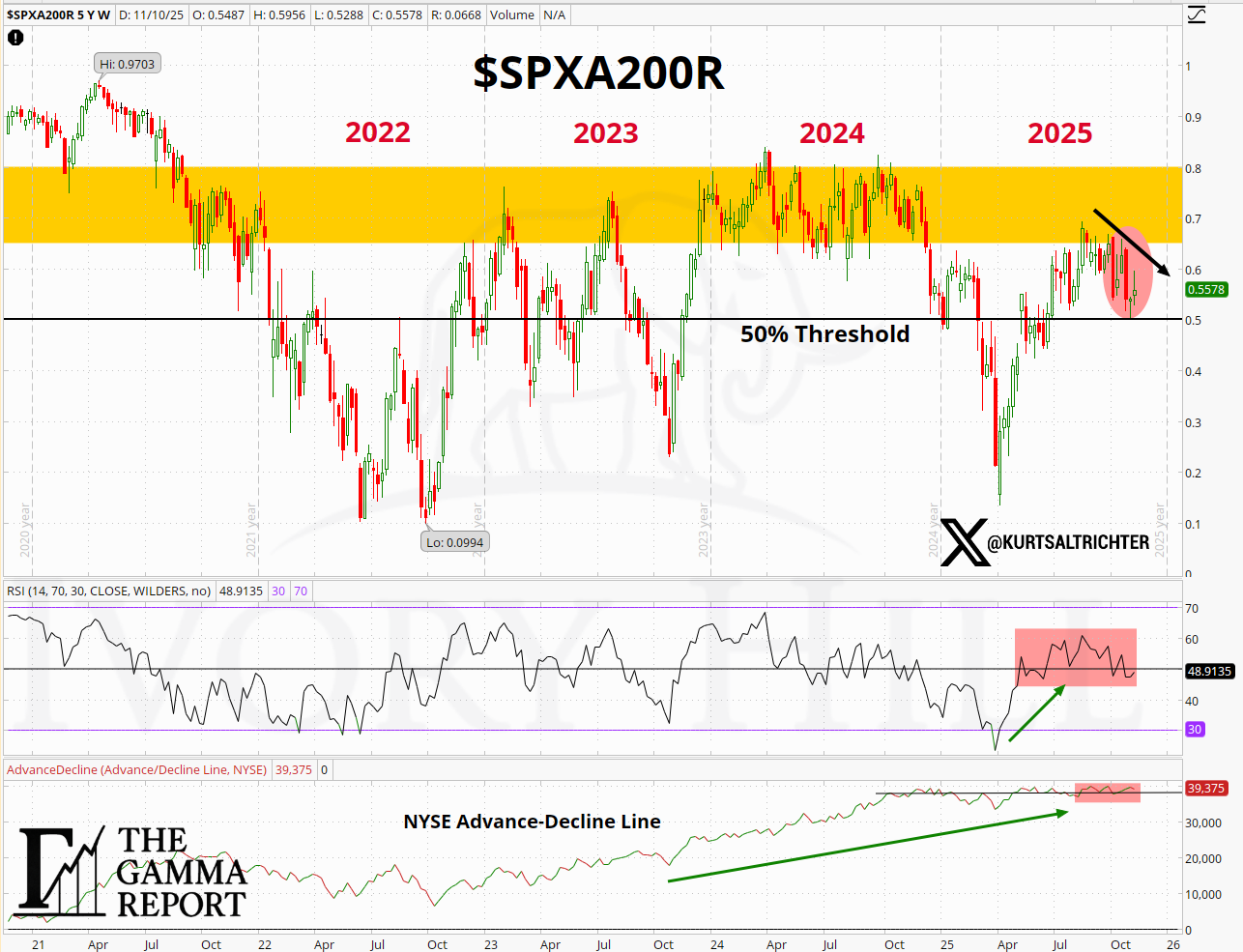

Breadth deteriorated all week.

Only 57.8% of the S&P 500 remained above their 200-day moving average by Friday, down from 59.6% earlier in the week. The weighted breadth signal printed -1 for five consecutive sessions.

The top-heavy nature of the market is becoming more visible.

The A/D line flattened, RSI for the SPXA200R rolled over, and the index failed again at the same congestion zone that has capped advances since 2022.

When leadership narrows while underlying participation weakens, it is usually a sign that the next directional move will carry more force than market watchers expect.

5. Weighted Composite & Regime

The weighted composite closed the week out in Neutral territory.

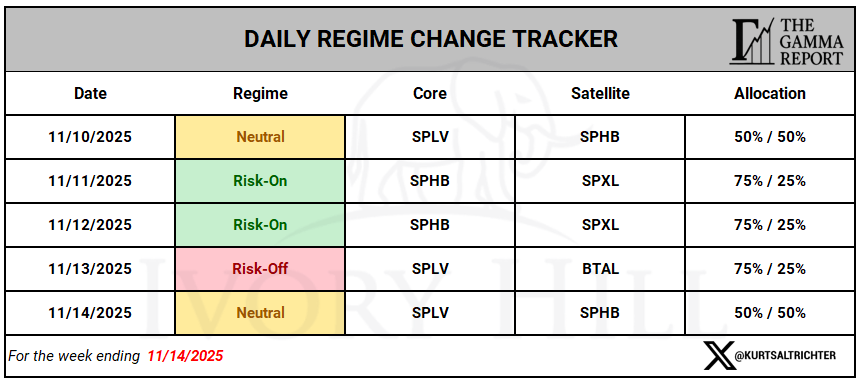

The daily regimes told the story better than words:

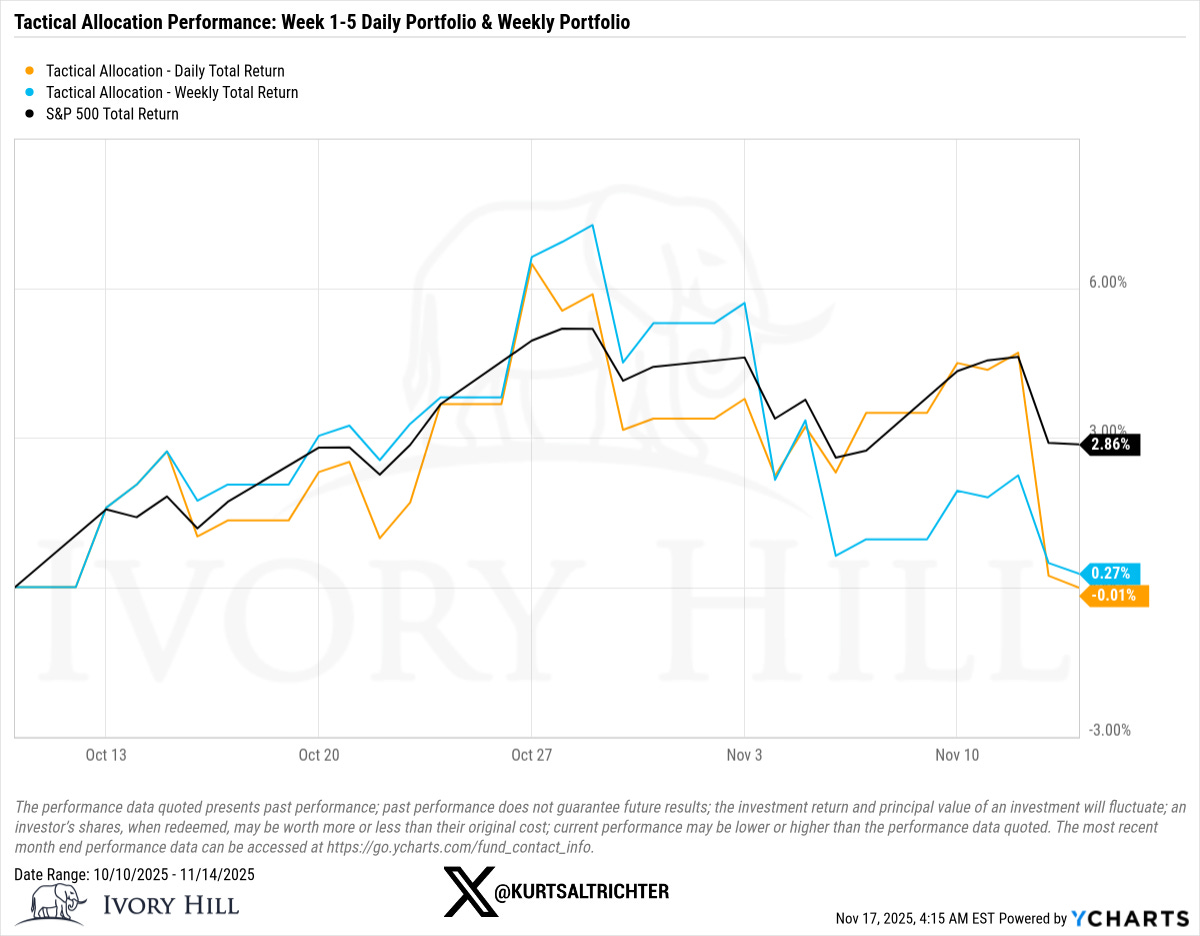

6. Weekly Performance

The gap was driven almost entirely by the Thursday flip into Risk-Off, which shifted allocation into SPLV + BTAL during a period where spot bounced off intraday lows.

This is the cost of operating a rules-based system in a volatile market.

Bottom Line:

Last week was a transition week.

Dealers flipped negative.

Realized volatility firmed.

Breadth weakened.

Systematic flows softened.

Regimes shifted fast and without conviction.

None of these signals alone is enough to make a directional call. Together, they tell you something important: the tape is fragile, and the next move will likely be driven by positioning rather than narrative.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The Gamma Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.