Last week was not about breaking higher. It was about holding structure.

Price stayed intact, but the margin for error narrowed. The market spent the week rotating through levels instead of extending the trend.

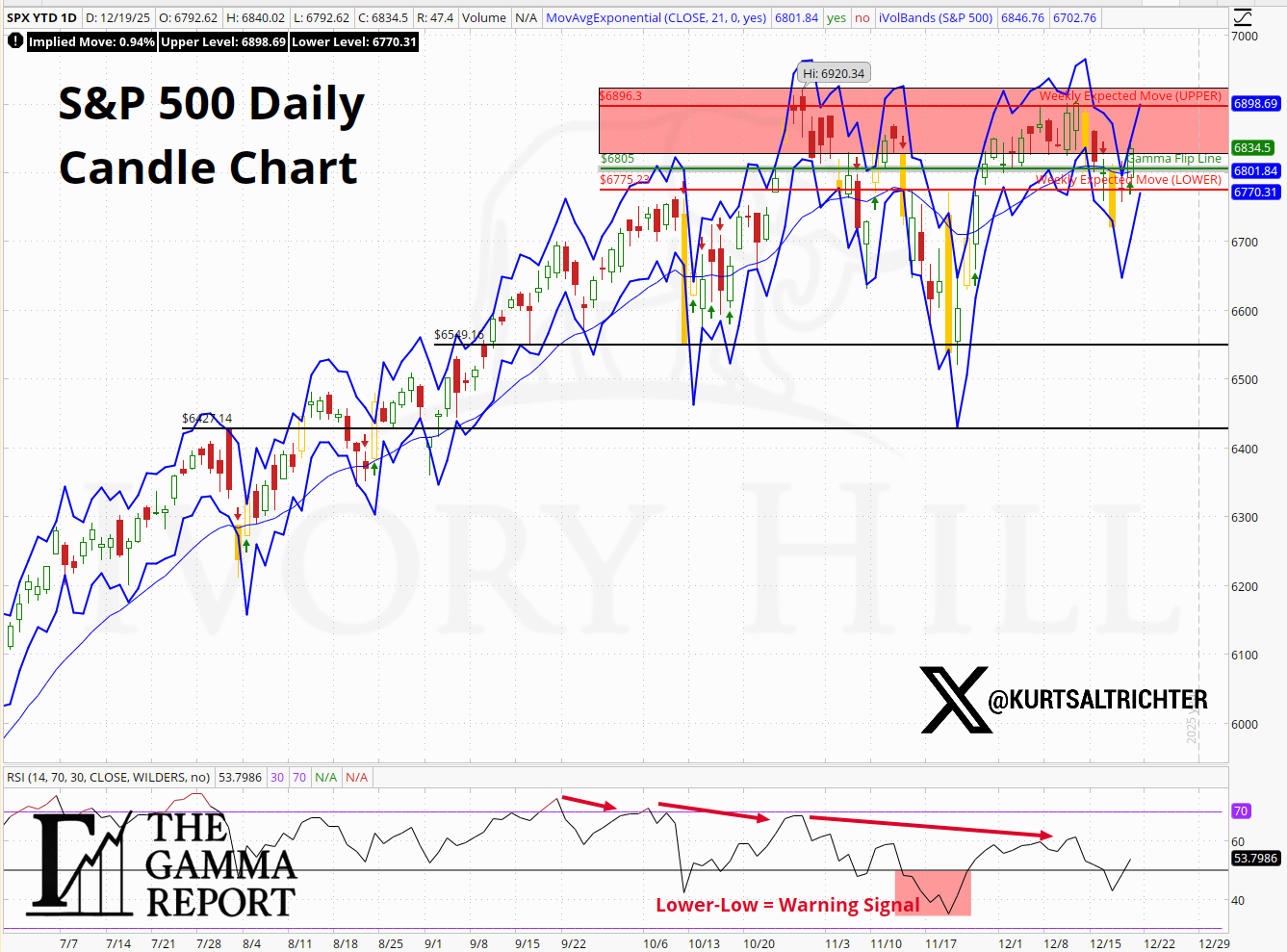

Gamma and Price Structure

The S&P 500 finished the week above the gamma flip line, meaning dealers ended the week hedging against moves rather than amplifying them.

But the path there was not clean.

Midweek, the price slipped below the flip line before reclaiming it into the close on Friday, bouncing off last week’s lower expected move. Positive gamma is still present, but it is no longer dominant enough to suppress volatility throughout the week. The structure still absorbs dips, but upside progress is slower and more conditional on direction.

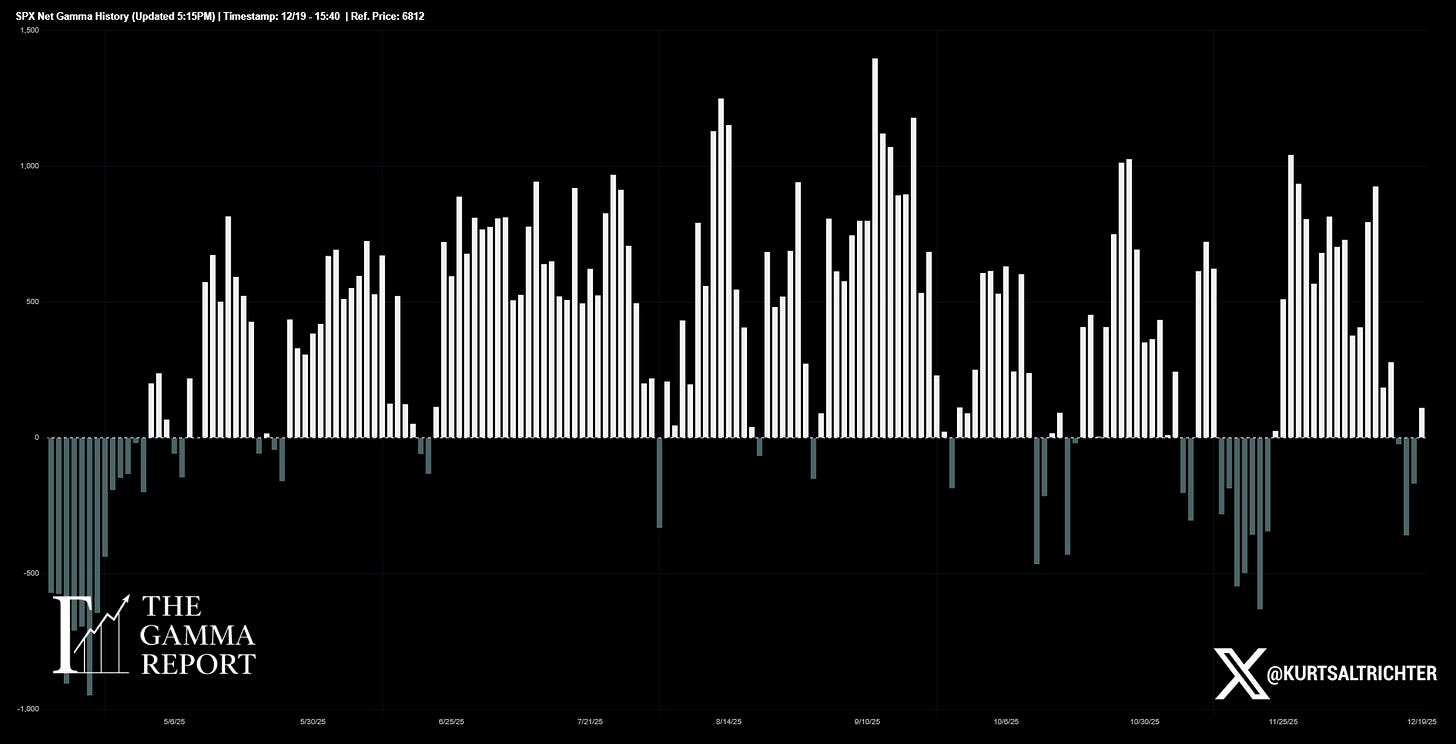

Net Gamma Positioning

Net gamma remains positive, but the profile is thinner than it was earlier in December.

When gamma is positive but weaker, the market becomes more sensitive to flow and participation.

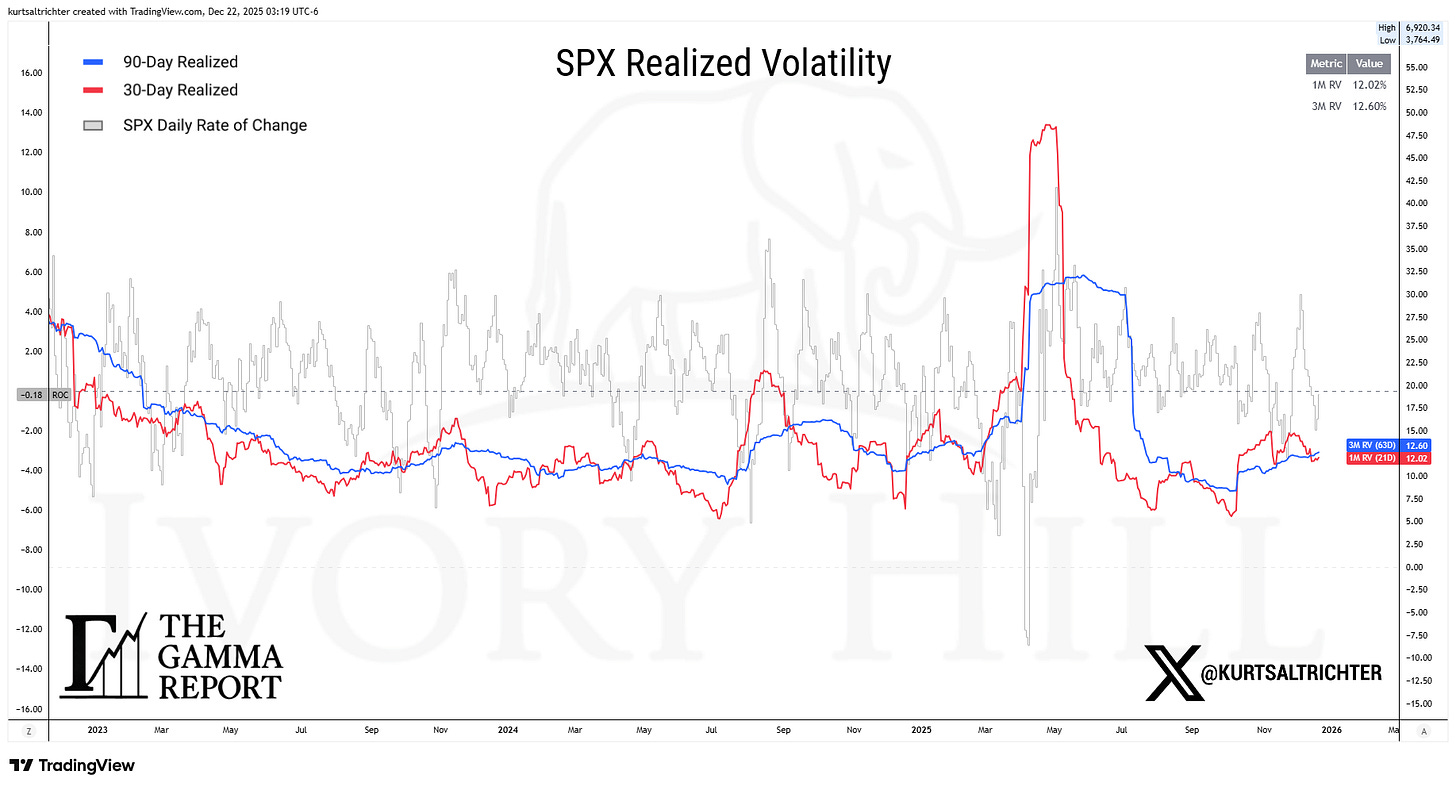

Volatility Is No Longer Cooperating

Short-term realized volatility eased on the week, while medium-term realized volatility continued to firm. That divergence is something to note.

Volatility is not expanding aggressively, but it is also no longer compressing in a way that fuels upside momentum. When realized volatility stops trending lower, volatility targeting strategies stop adding exposure. I think this will change this week.

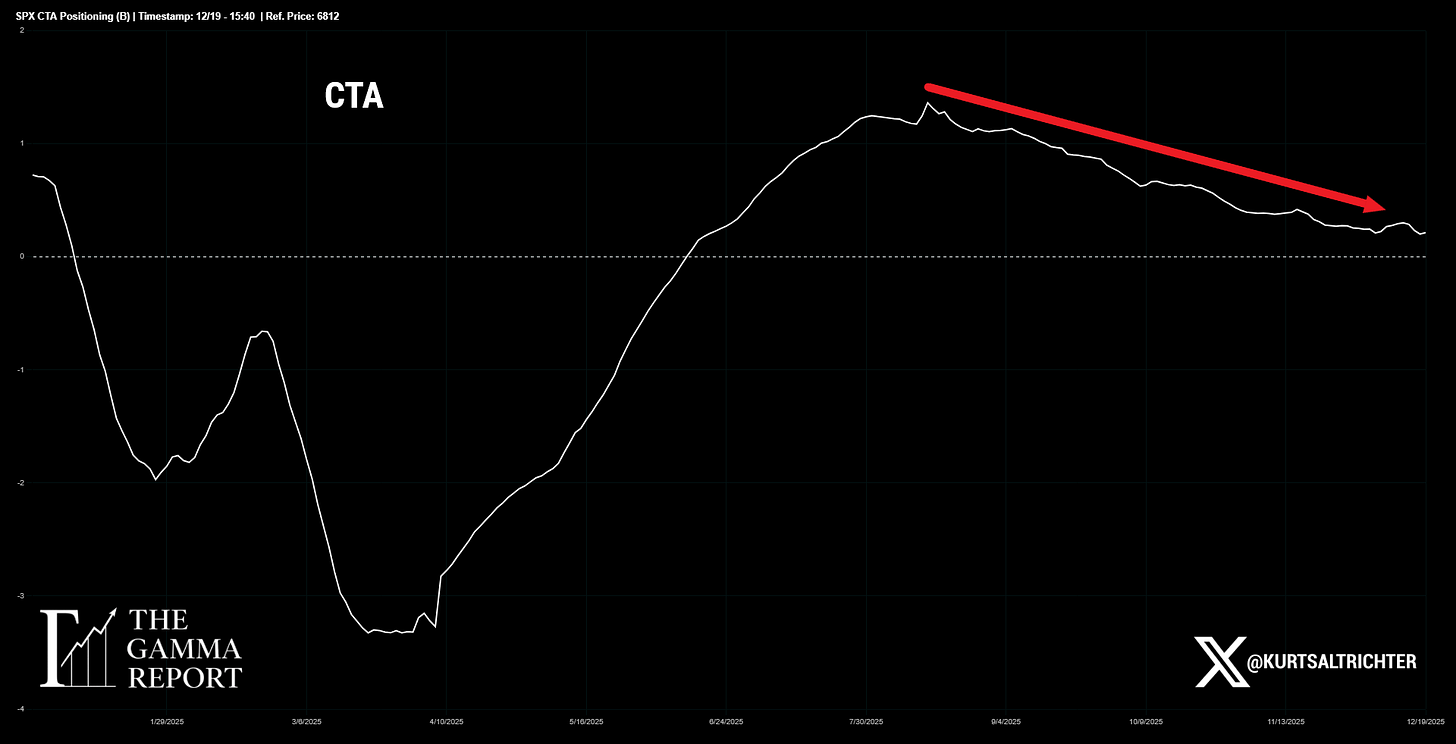

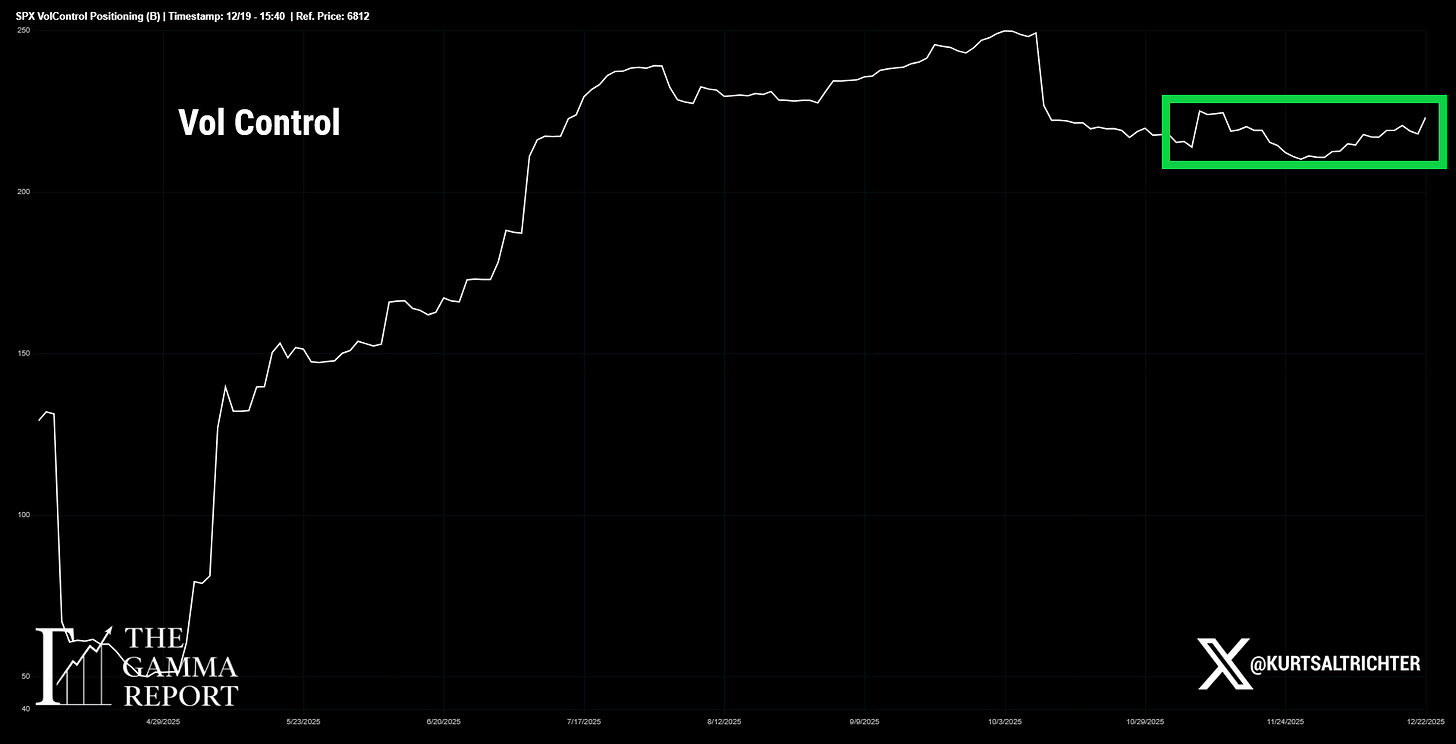

Systematic Flows Are Fading

CTA exposure continues to trend lower. They remain net long, but momentum has weakened enough that they are no longer buying.

Vol control exposure stabilized briefly but is still in an uptrend. We need to see sustained realized volatility before Vol Control funds can start aggressively amplifying exposure.

That is not outright bearish. It is just less forgiving.

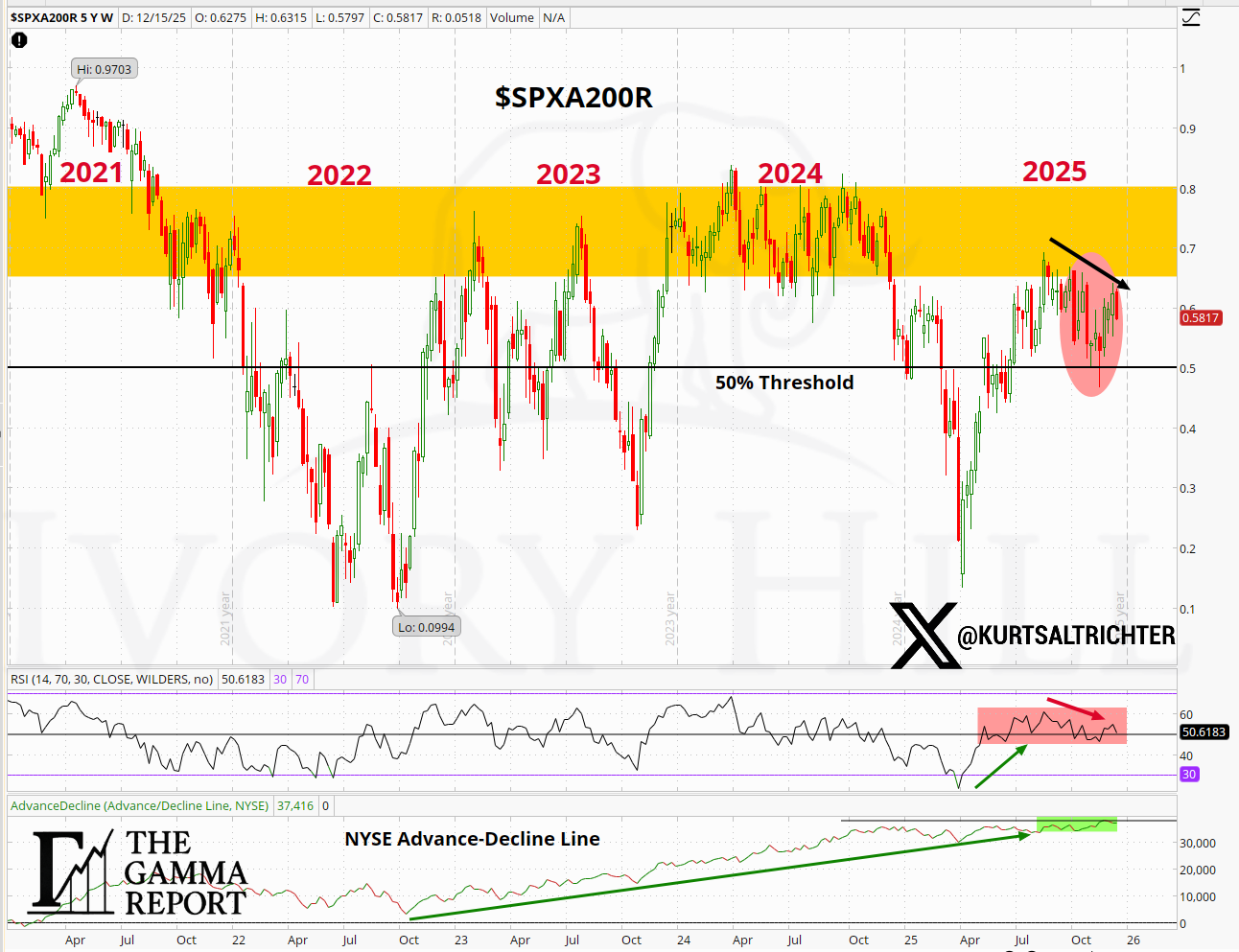

Breadth Is Rolling Over Again

Participation deteriorated through the week. The percentage of stocks above their 200-day moving average declined and failed again in the same congestion zone that has capped breadth since 2022.

The advance-decline line remains elevated, but momentum has flattened. When the index holds near highs while participation slips, the market becomes more top-heavy.

That is when gamma matters more and trend matters less.

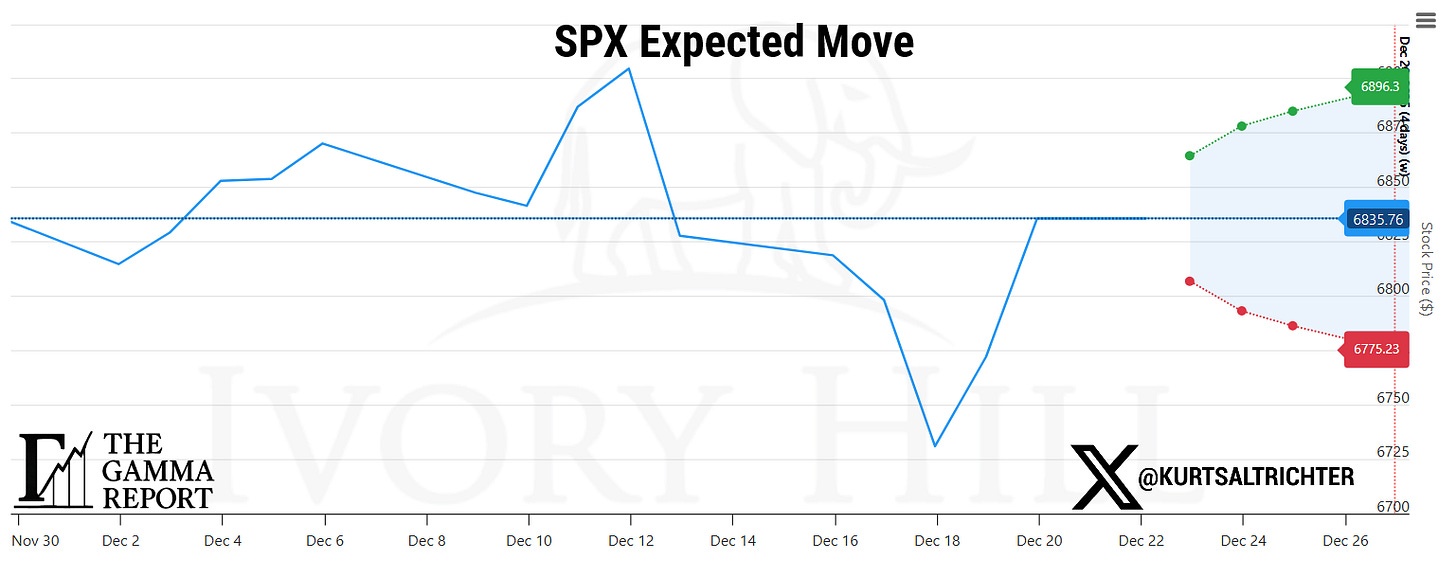

Expected Move Context

The expected move range defines the box. Price spent the week rotating inside it.

The upper and lower bounds are no longer expanding. The lower band is making a higher high this week, while the higher band dropped slightly. Risk is being priced tighter. That environment does not reward chasing strength or pressing weakness just yet.

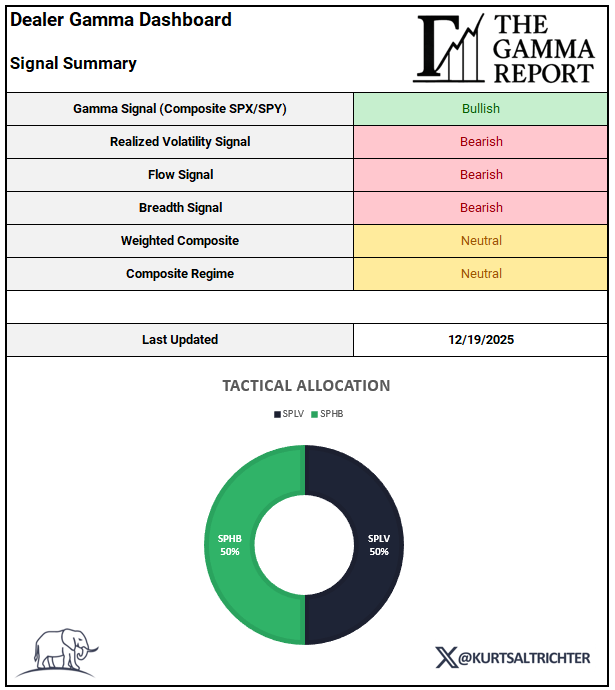

Composite Signal and Regime

Gamma remains supportive. Realized volatility, flows, and breadth finished the week bearish. The weighted composite moved to neutral, and the composite regime remains neutral.

Compared to last week, this is a downgrade in internal strength, not a breakdown.

Neutral here means balanced, not defensive.

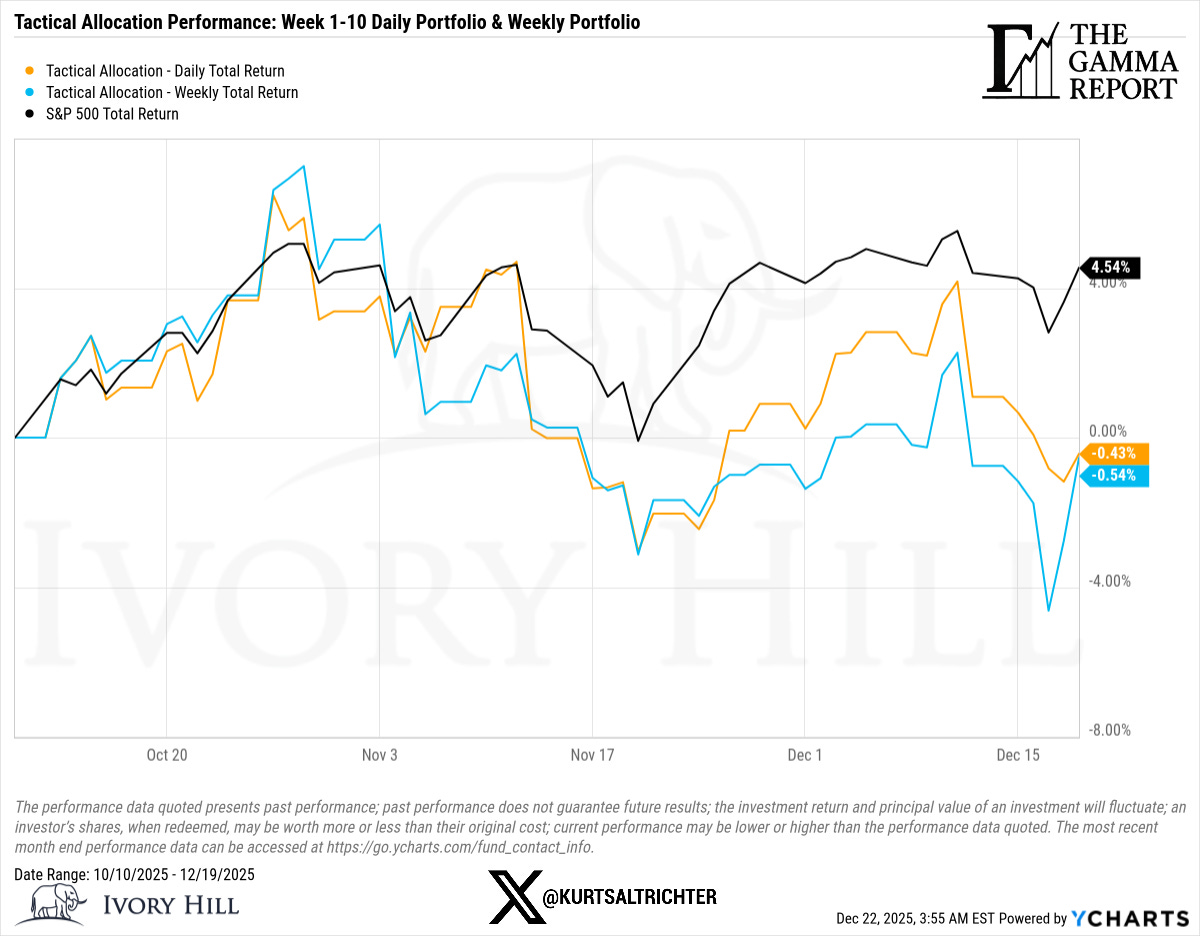

Tactical Allocation

The daily regime shifted multiple times during the week. When regimes flip, conviction gets punished.

Both the daily and weekly models finish the week neutral at 50% SPLV and 50% SPHB.

Performance Context

Since October 10, the S&P 500 has continued to grind higher. Tactical sleeves have lagged during this phase.

That is not a flaw. It reflects discipline in an environment where upside is harder to monetize, and internal risk is rising.

This is exactly when models protect against forced errors.

Closing Thoughts

Nothing broke last week.

But several things weakened.

Gamma support held, but thinned.

Volatility stopped helping.

Systematic flows neutralized.

Breadth started to roll over again.

This is not a market that rewards urgency. It rewards patience, range awareness, and alignment with structure.

Until then, staying balanced is not caution. It is part of the process.

Feel free to use me as a sounding board.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The Gamma Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.