CLIENT ANNOUNCEMENT: I will be out of the office January 1 through January 8 for a family wedding. I will still be working during this time, but from a different time zone, so response times may vary.

After spending most of December in a tightening, less forgiving structure, the market exited last week with internal support improving across multiple dimensions simultaneously. Gamma stayed supportive, realized volatility declined, systematic flows turned back into a tailwind, and breadth stabilized.

It does not remove risk.

It changes how risk behaves.

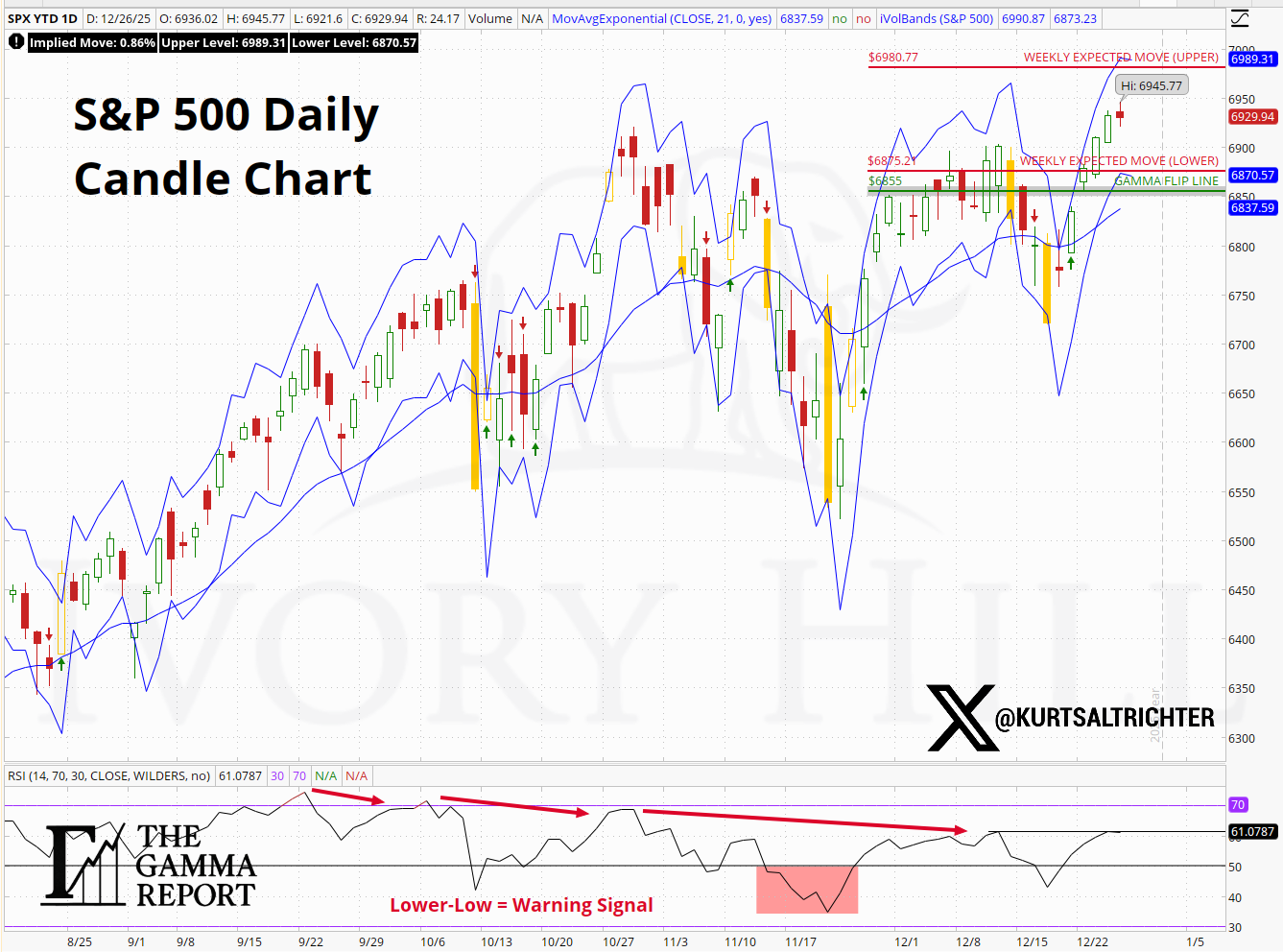

Gamma and Price Structure

SPX closed Friday at 6,929.94, holding above the Gamma Flip Line near 6,855. That keeps dealers in positive gamma and continues to suppress downside acceleration.

Price exited last week pressing into the upper half of the weekly expected move range rather than rotating around the flip line. That is a structural improvement from the prior week.

Pullbacks continue to get absorbed, and sellers still need follow-through to gain traction. That does not guarantee upside extension, but it does limit how easily downside can compound as long as price remains above the flip line.

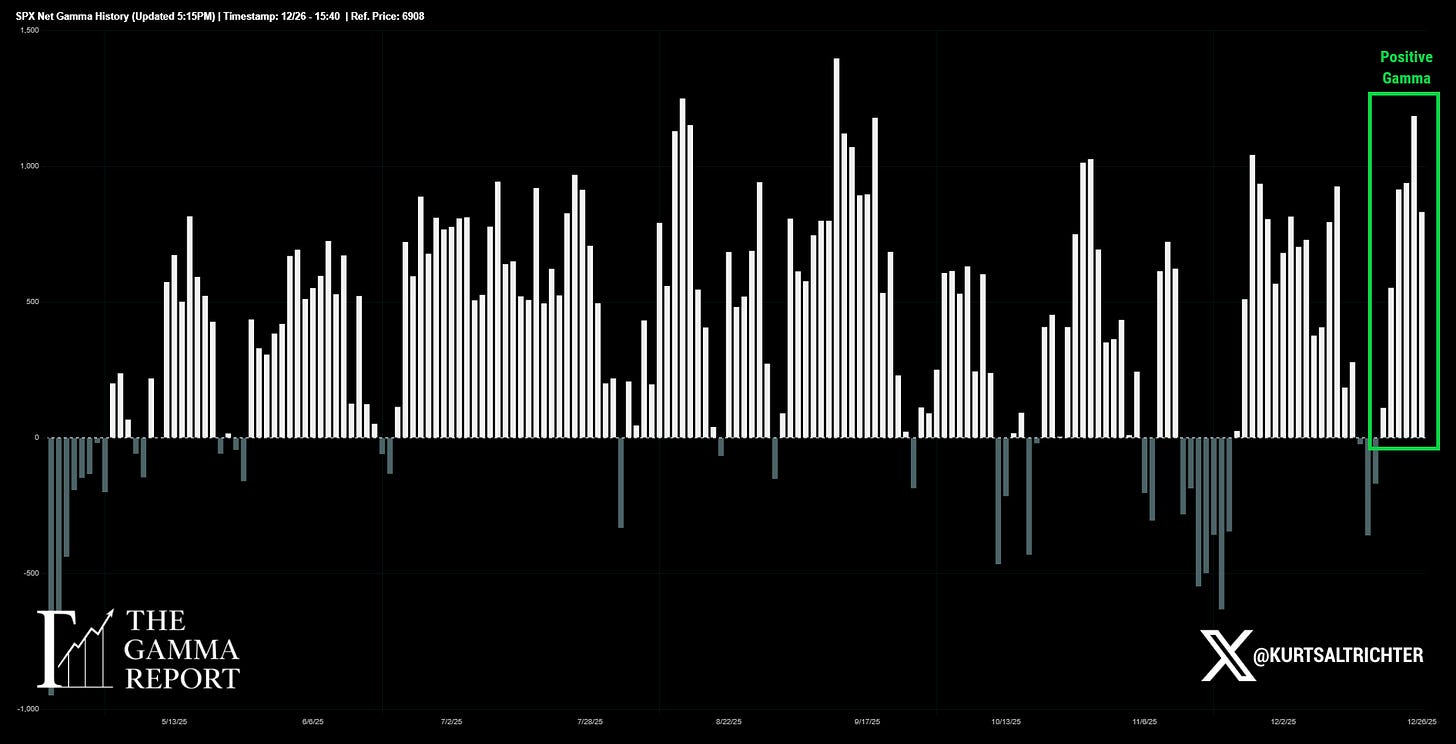

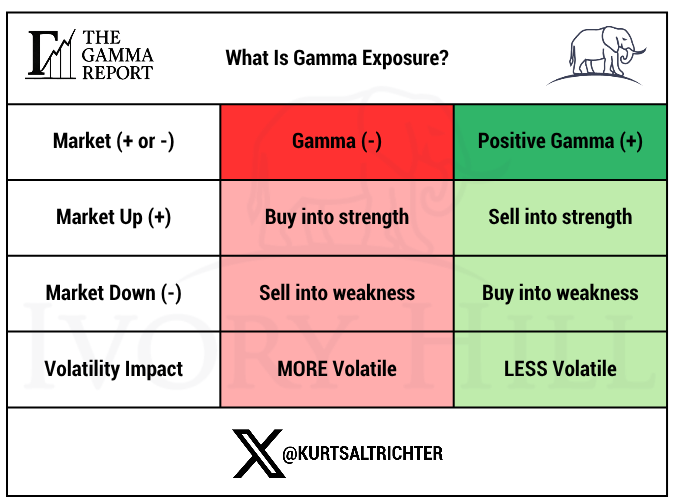

Net Gamma Positioning

Net gamma remains positive.

When gamma is positive, dealers hedge against moves rather than with them. That suppresses volatility, slows intraday swings, and forces the market to work harder to trend in either direction.

This is not a new regime, but it is a reinforced one.

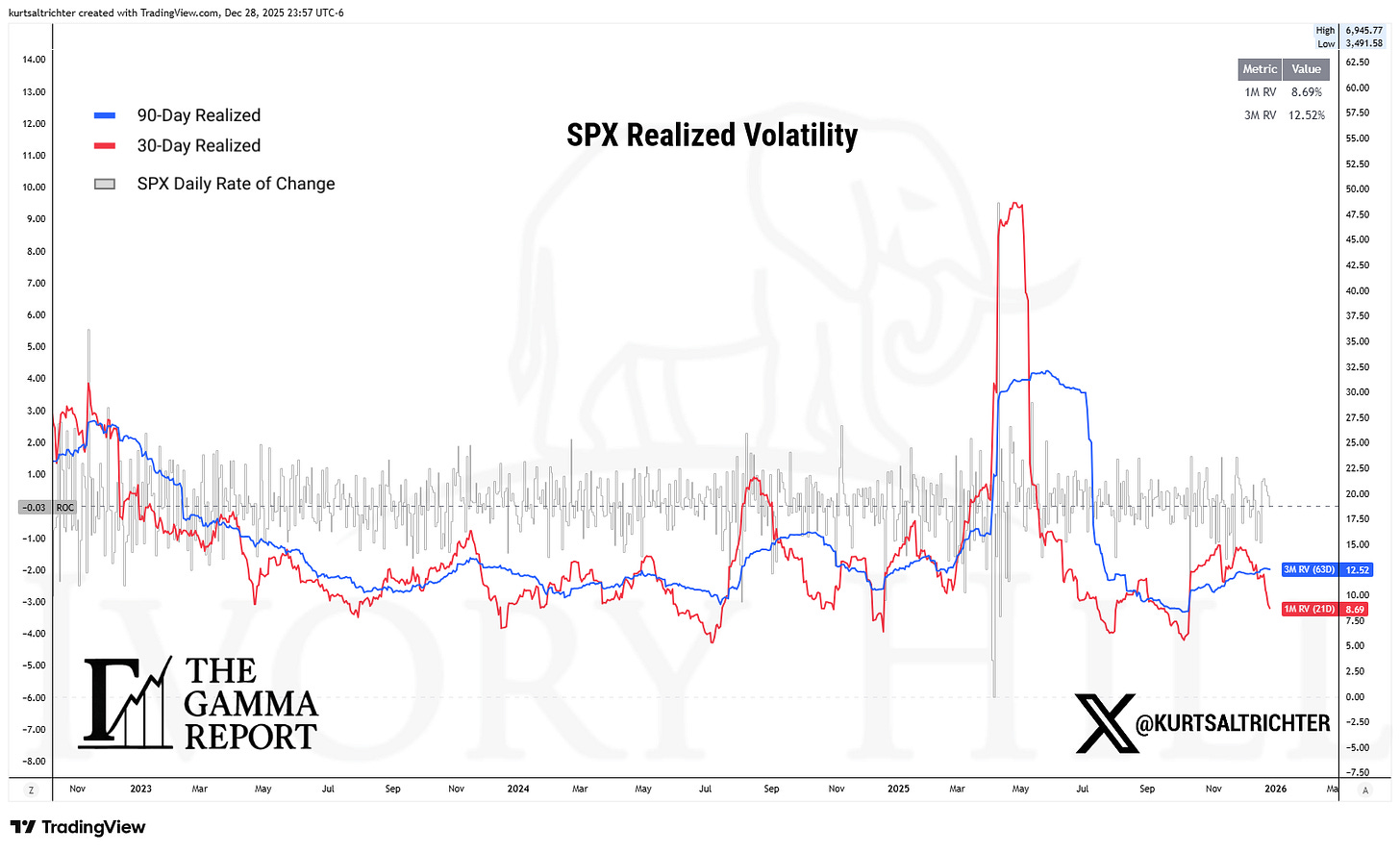

Realized Volatility

Realized volatility is supportive.

Short-term realized volatility continued to drop, while medium-term volatility remained contained. Remember: this matters because volatility targeting strategies respond to direction, not level.

Last week’s message was that volatility stopped helping. By the 12/26 close, volatility had started helping again.

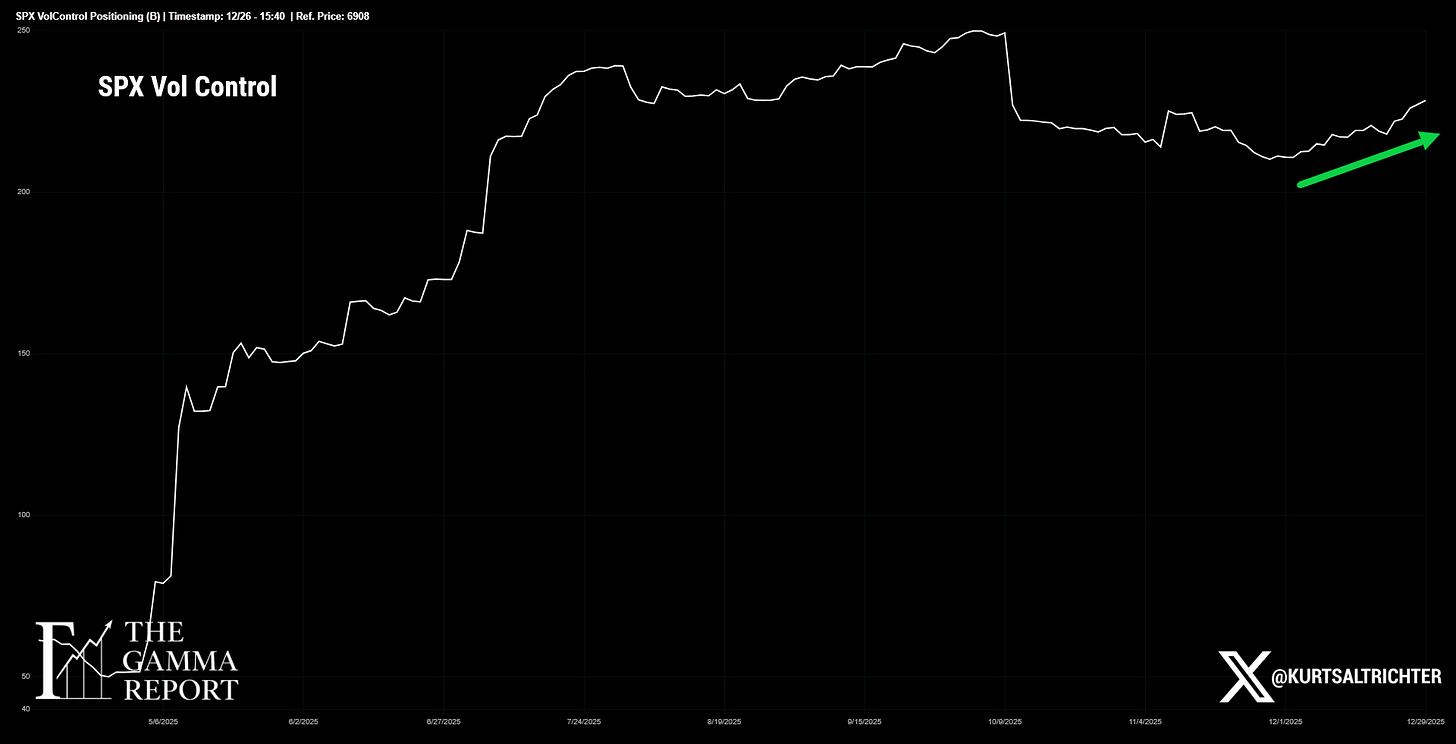

Systematic Flows

Systematic flows accelerated last week.

CTA exposure stabilized and began to base, while vol control positioning started to rebuild as realized volatility declined. That combo removes the systematic drag that was present earlier in December.

This does not imply aggressive buying pressure. It implies that systematic strategies are no longer standing in the way of upside, and they are less likely to amplify downside in the near term.

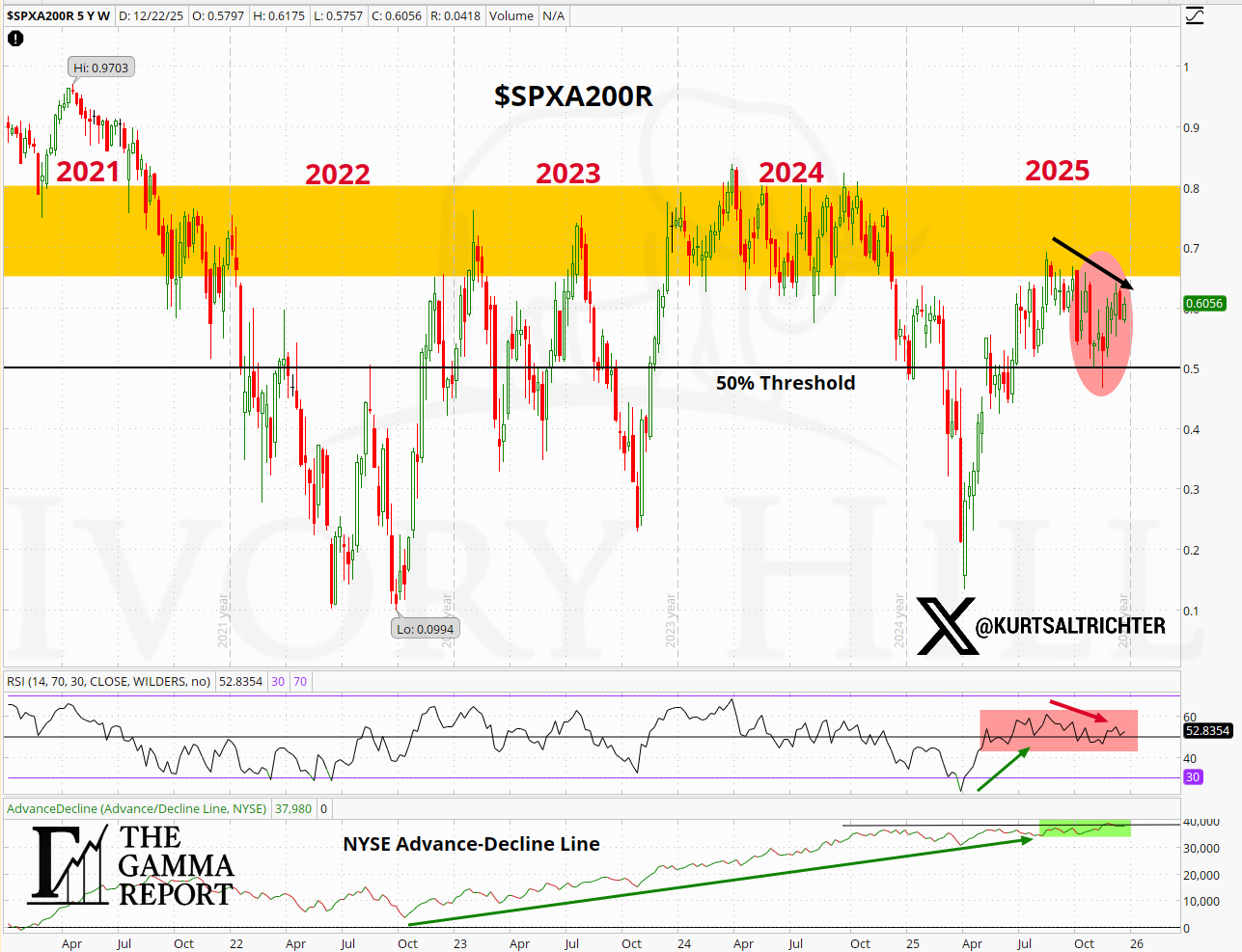

Breadth

Breadth finished last week supportive, but still constrained by longer-term structure.

Roughly 60% of S&P 500 constituents remain above their 200-day moving average. That is an improvement from earlier December lows, but it remains inside the same congestion zone that has stopped participation since 2022. This is not a breakout in breadth. I would consider this stabilization.

RSI for the breadth index remained in the low-50s. That confirms participation is no longer deteriorating, but it also shows momentum has not transitioned into expansion. The NYSE advance-decline line remains elevated and continues to trend higher, which supports the index holding near highs even as fewer names do the heavy lifting. You typically don’t see this in bear markets.

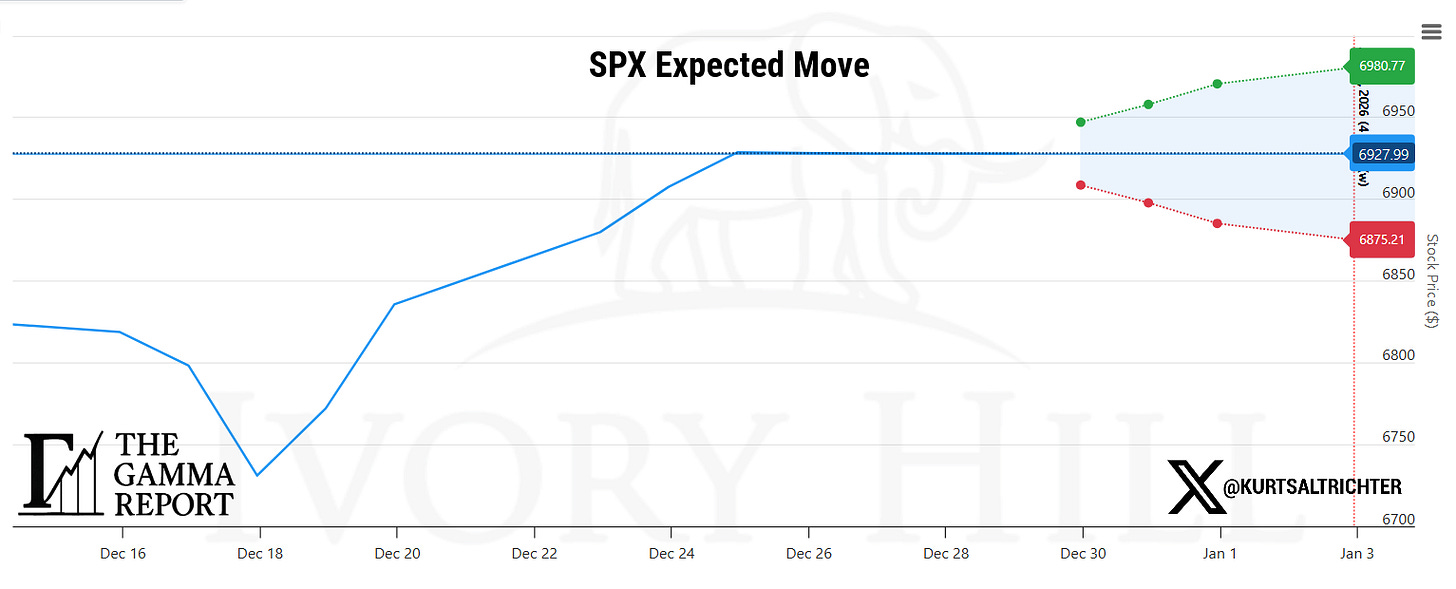

Expected Move

The expected move shifted higher.

Both the upper and lower bounds of the range moved up versus last week, and the midpoint moved higher with them. This tells you the market is repricing risk upward, not compressing it.

When both ends of the expected move move higher, the market is accepting higher prices and a higher tolerance for downside at the same time.

This is how ranges advance in supportive structures. The box moves up first. Price follows if momentum confirms.

Expected moves are not directional forecasts. They define where risk is priced.

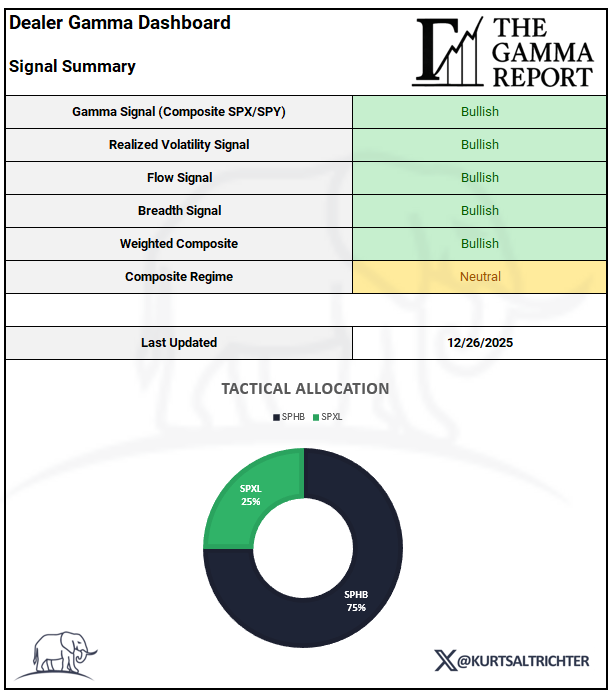

Composite Signal and Regime

As of the 12/26/2025 close, the signal stack reads as follows:

Gamma Signal: Bullish

Realized Volatility Signal: Bullish

Flow Signal: Bullish

Breadth Signal: Bullish

Weighted Composite: Bullish

Composite Regime: Neutral

This is a clear improvement in internal strength versus last week. All four components are now contributing positively to the composite.

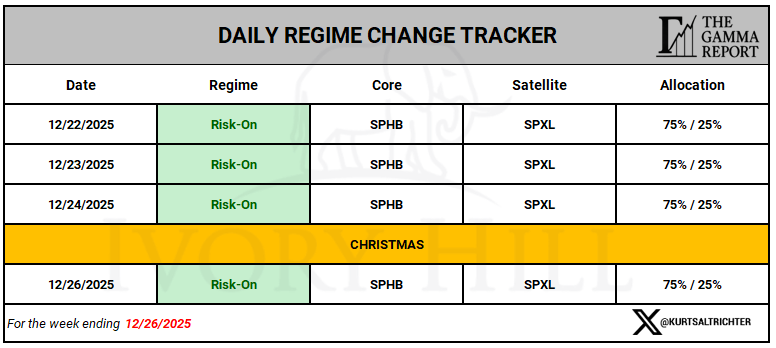

Tactical Allocation

The daily model remained stable throughout the shortened holiday week.

The regime held Risk-On into the 12/26 close, with the allocation unchanged:

Core: SPHB 75%

Satellite: SPXL 25%

There were no regime flips and no forced adjustments. This shows that internals are improving, not just price alone.

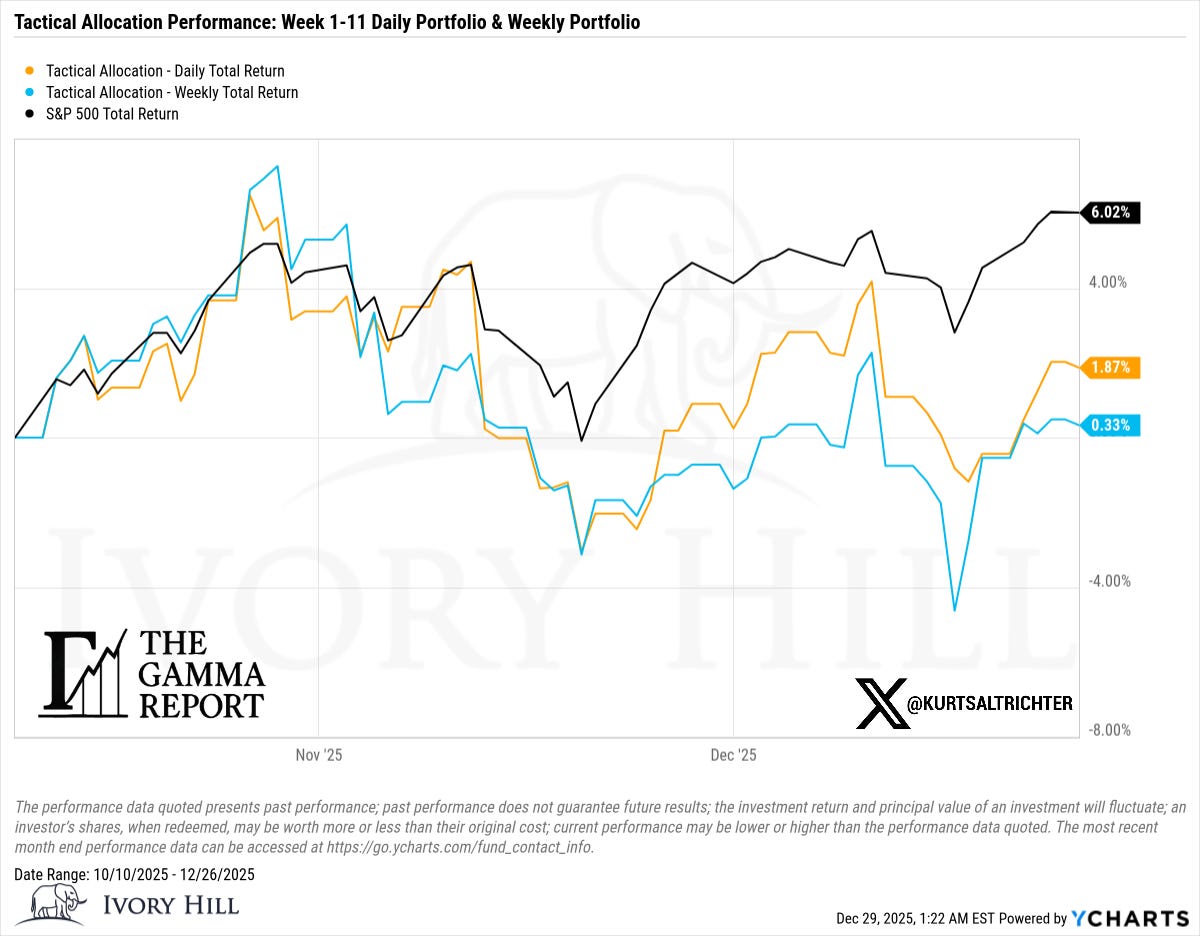

Tactical Model Performance

From 10/10/2025 through 12/26/2025, performance stands as follows:

S&P 500 Total Return: +6.02%

Daily Tactical Sleeve: +1.87%

Weekly Tactical Sleeve: +0.33%

The difference versus the index comes from staying rules-based during a slow grind higher. The tactical sleeves were risk-on all week and stayed aligned with the regime rather than reacting to short-term price noise. And there was a lot of worthless noise last week to be bearish on.

This is precisely the environment where patience matters more than urgency.

Final Thoughts

The market exited the week with structure intact and internal support back in place. That does not mean risk disappeared. It means risk became more defined.

Positive gamma continues to absorb pullbacks, but upside is still earned, not given.

This is not a market that rewards forcing conviction. It rewards respecting levels, letting structure guide exposure, and staying patient.

Feel free to use me as a sounding board.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The Gamma Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.

Kurt Altrichter, I really appreciate your reports; clear, concise and educational. Wish I had become more computer/media literate years ago. I would have been better financially situated.

Thank you for the report, maybe one of these when things improve...

John Erving