Christmas Came Early, RiskSIGNAL™ Still Says “Buy”

Pullbacks inside rising trend structure are where you add size, not trim.

Markets do not hand out invitations at the lows; they force you to act when it feels uncomfortable, and this pullback is exactly that moment. Pullbacks into support during an uptrend are where the real money is made, not after the breakout. This is where you have to decide if this is a regime change or if you should add to your winners. The Ivory Hill RiskSIGNAL remains green, which means we do not hide under the desk here; we get our shopping list out, and we position into weakness. That is the job. That is the process.

VolControl positioning is stabilizing off the lows and beginning to re-add exposure. When VolControl crawls higher after a hard unwind, it often marks the “sloppy low window” that then feeds the ramp.

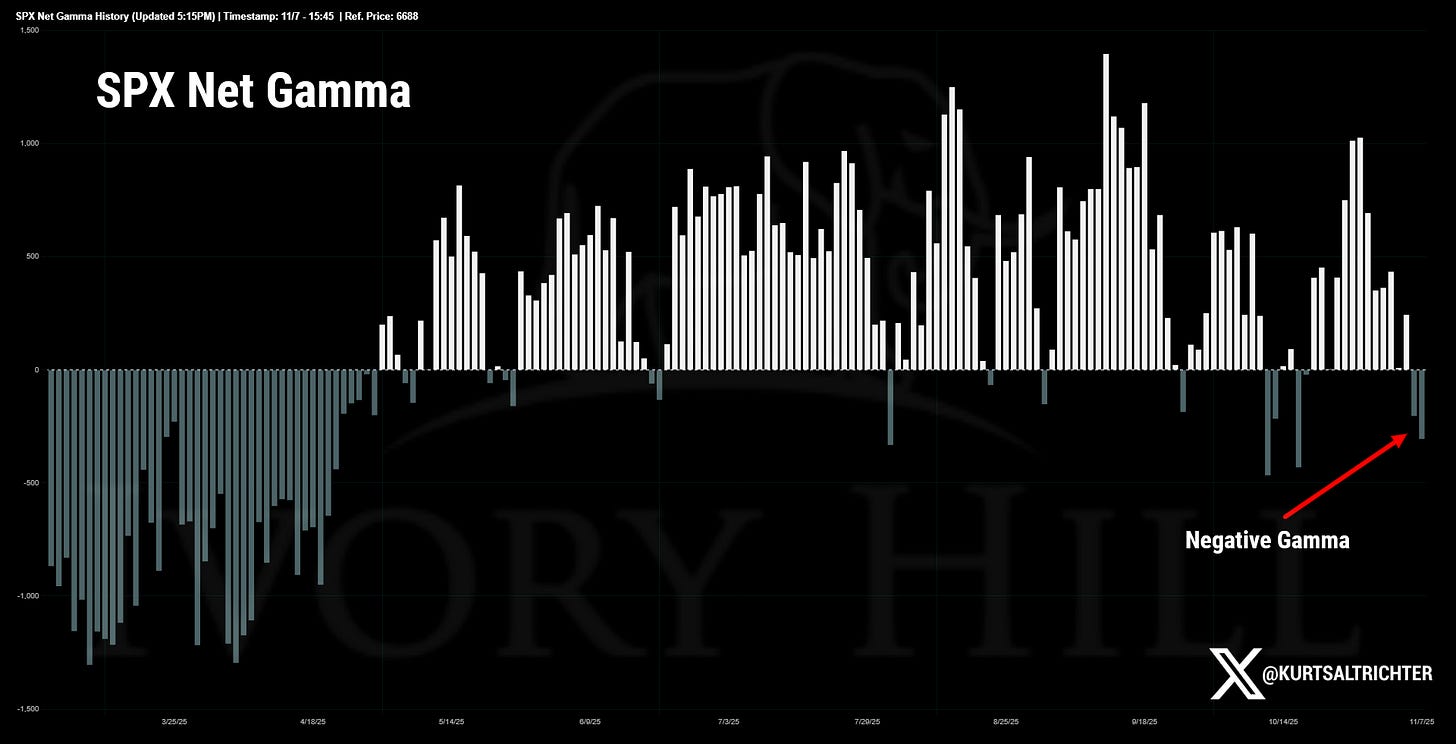

Dealer net gamma is negative, meaning we are in an environment where dealers sell into weakness and buy into strength, amplifying volatility on both the upside and the downside. That does not mean “sell everything”, it means volatility travels further both ways. When gamma is negative, markets move faster inside the current range, not structurally lower if the trend is still positive. For now, the trend is still positive.

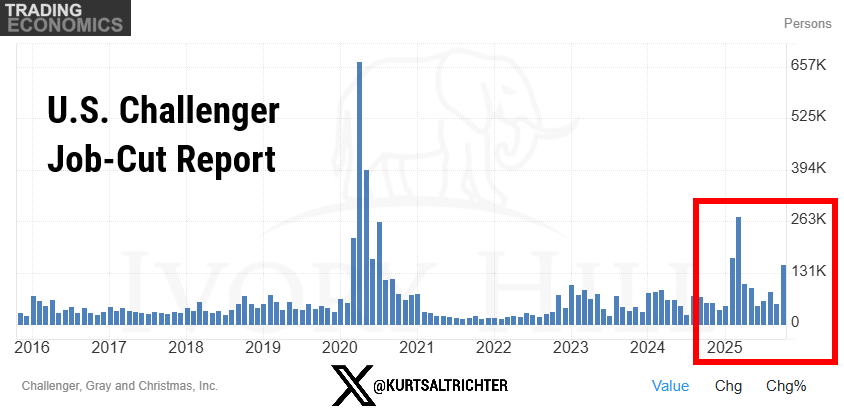

Challenger job cuts are flashing stress right beneath the surface. That is the feedback loop you actually want during corrective phases, because stress is the accelerant. Labor and credit stress tend to spike into major pivots, not after them, because markets front-run the liquidity response long before policymakers finally react.

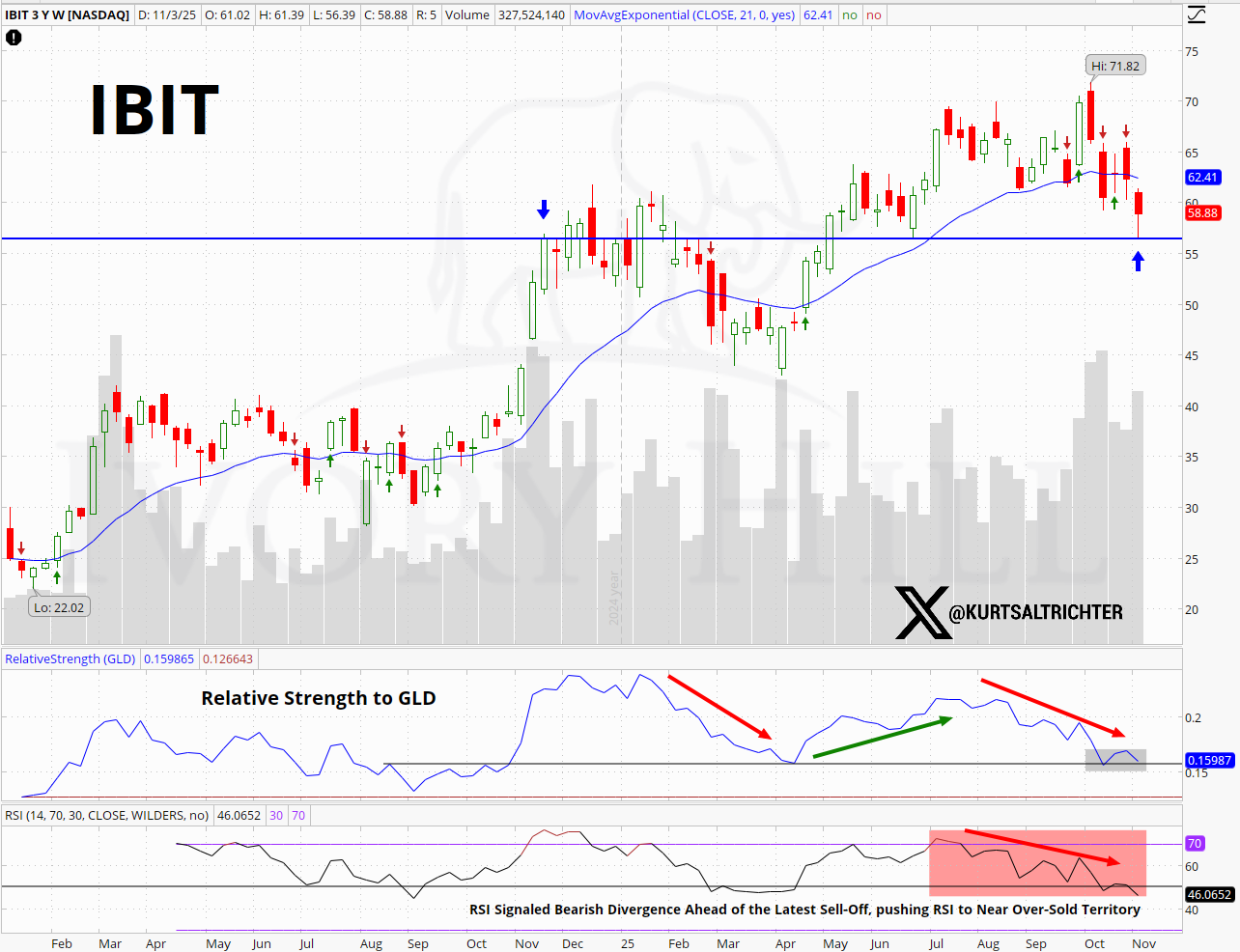

Bitcoin washout is buyable for long-term investors. While our Bitcoin Trend Tracking Model has been bearish on Bitcoin since the end of October, if you are building a multi-year allocation in IBIT, this is a reasonable zone to incrementally scale into.

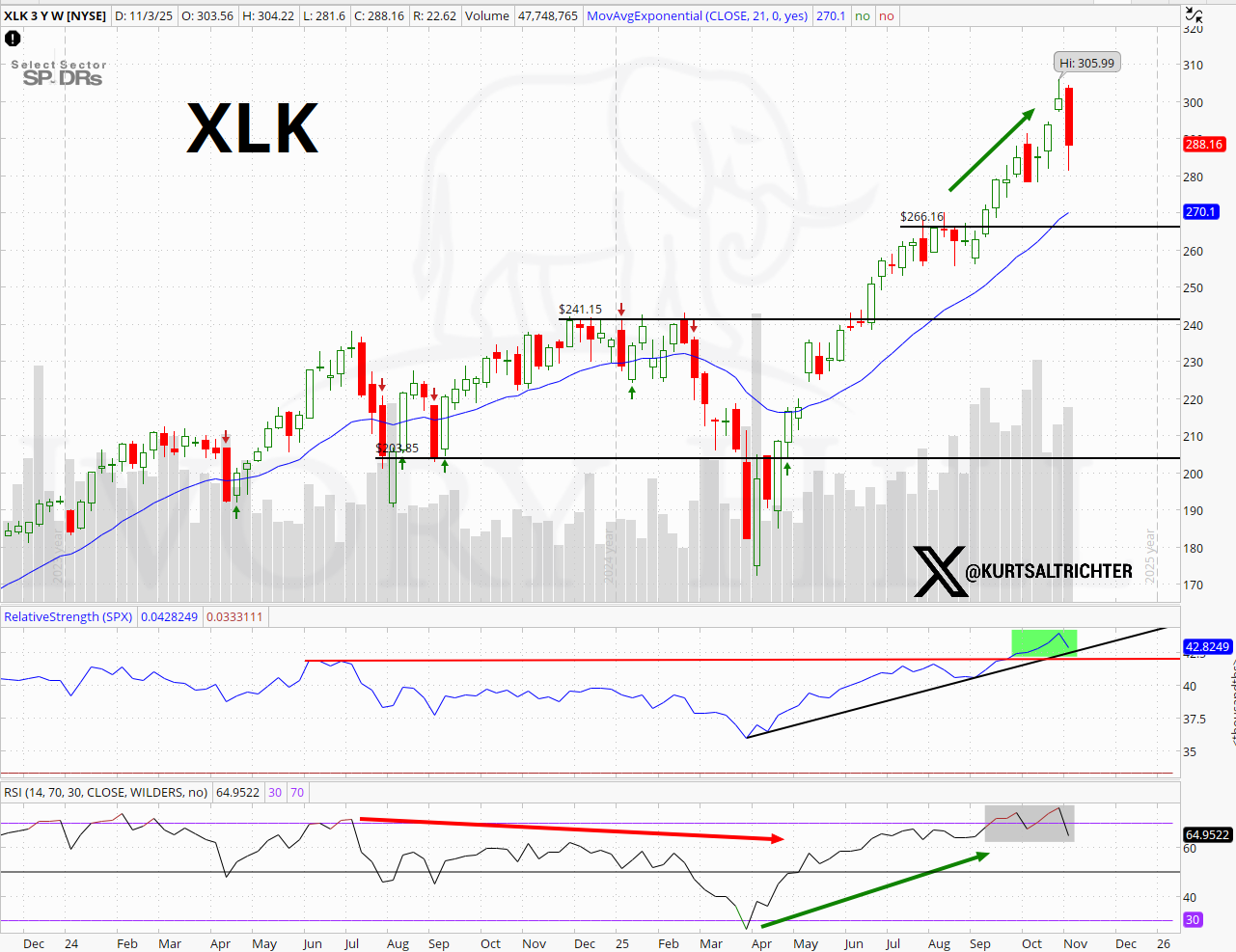

XLK remains one of the cleanest pure expressions of capex rotational leadership, and trend structure remains bullish. If the trend is up, and the pullback is into defined support, the rule is simple: you add, not reduce.

Now we shift from “shopping list” to risk mechanics

The first level that matters is gamma. Gamma sets the rink’s width, not the scoreboard.

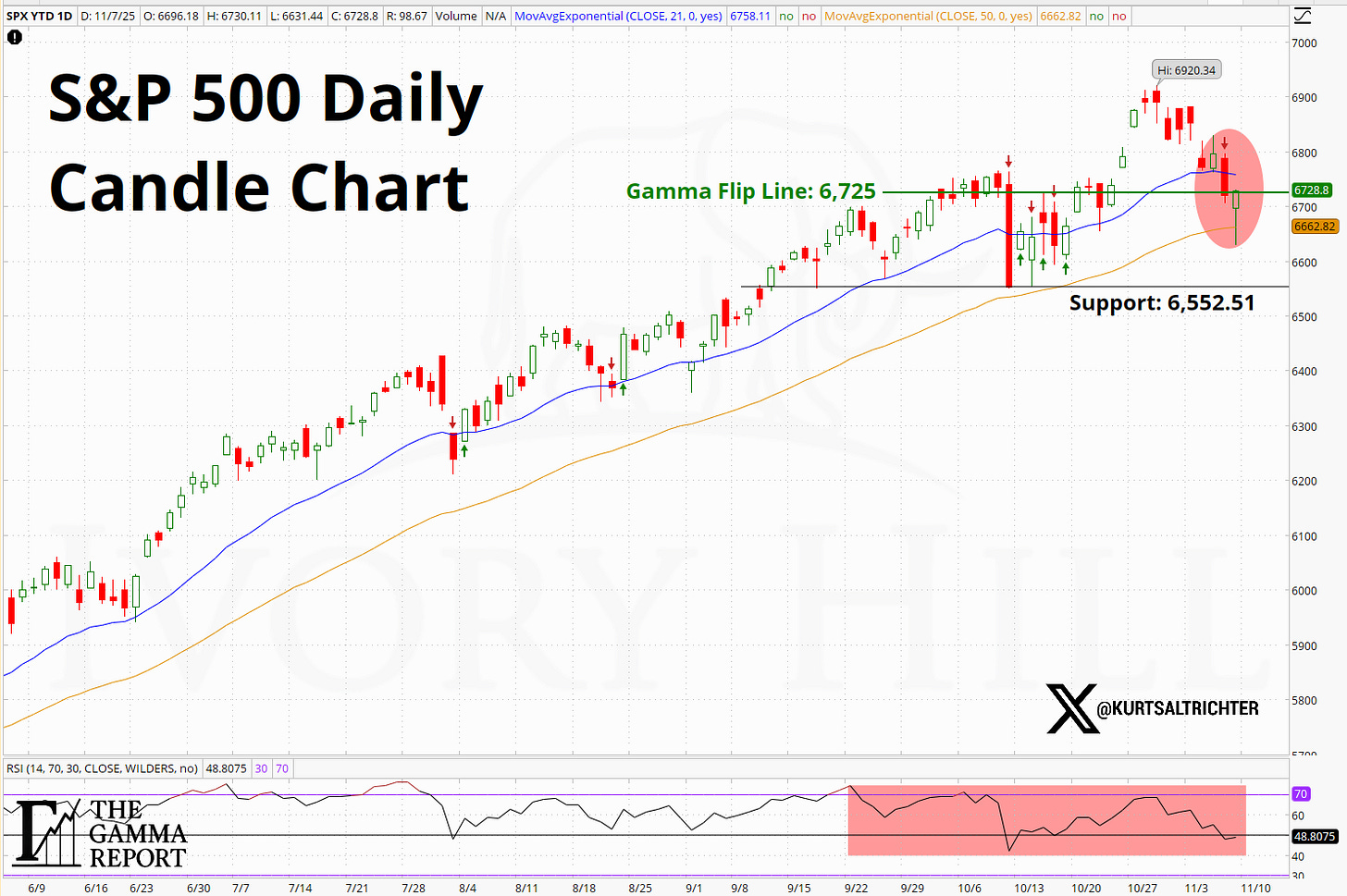

The S&P 500 is sitting just under the Gamma Flip region near 6,725. Above that line, dealer hedging suppresses volatility, and we slip back into a boring drift-up tape. Below it, volatility expands mechanically. That is the pivot that defines the volatility regime.

Level 1 – 21-day EMA: violated

This confirms the pullback is real, not a cosmetic pause.

Level 3 – Gamma Flip Line

This is the transition zone where price behavior changes, not the trend direction itself.

Level 3 – 50-day EMA: intact

This is the level institutions respect and where they begin scaling into weakness.

Level 4 – Key Support (October closing low)

If this gives way on a closing basis, you activate a measured move lower. If it holds, this remains a corrective reset in a larger uptrend.

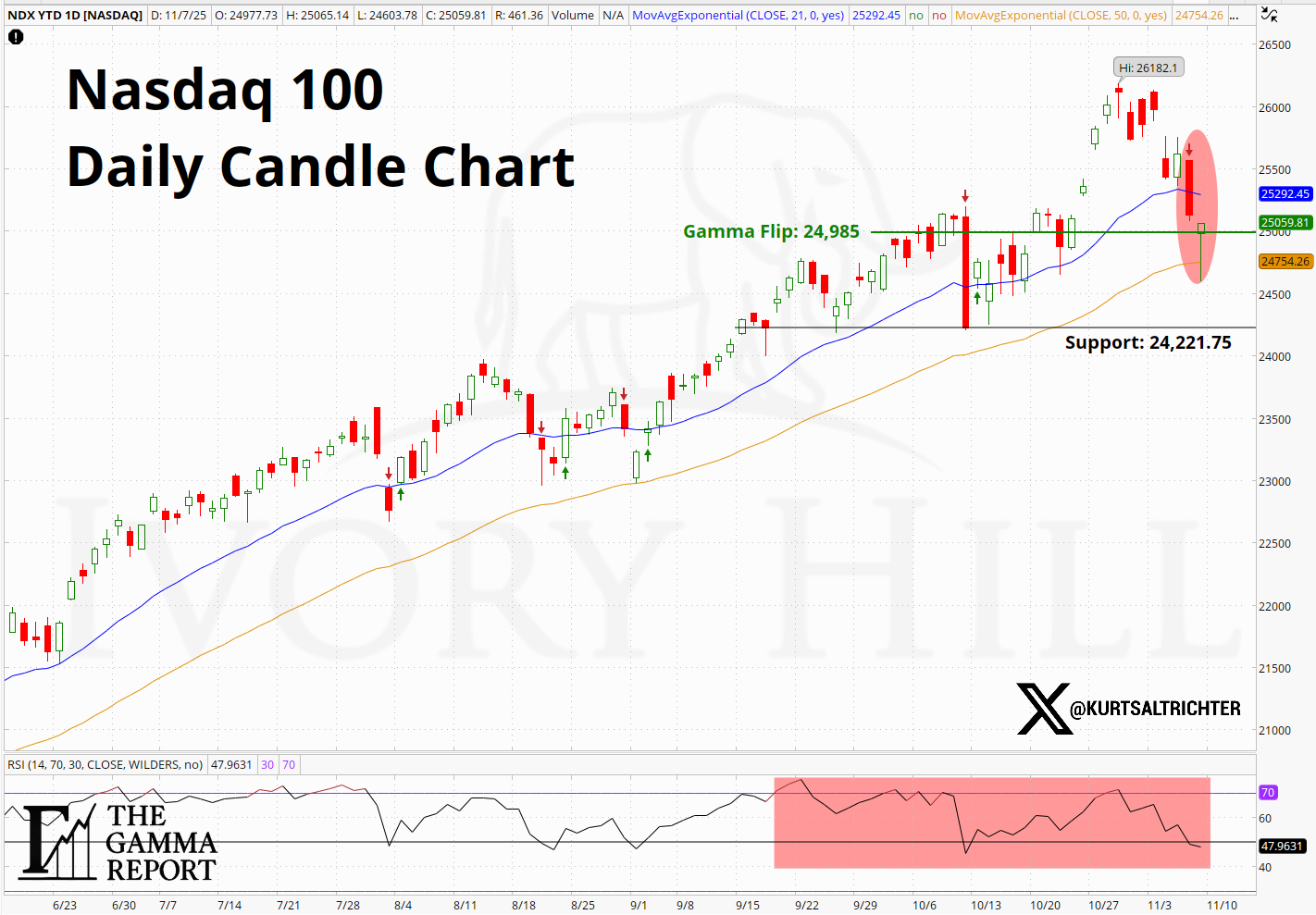

Nasdaq 100 has the same structure.

Level 1 – 21-day EMA: violated

Fast-money trend support broke, confirming this pullback is not just noise.

Level 3 – Gamma Flip Line

This is where the tape’s character shifts. Above it, volatility collapses into mean-reversion. Below it, price discovery widens and swings travel further.

Level 4 – 50-day EMA: intact

This is the level real money allocators defend, and it is still holding.

Level 4 – Key Support (October closing low)

If this level fails on a closing basis, you unlock measured-move downside targets. If it holds, this is just another shakeout within a still-rising trend.

The factor stack is still trending positive. Trend still up. Pullback still inside the core range. The trend does not reverse until support breaks.

Now, to VIX.

VIX is grinding along its rising trend line. That is not bearish by itself. That is a rising floor of implied volatility during an uptrend in spot. When gamma is negative and VIX is grinding, it is a volatility “expansion window”, not a top.

Level 1 – Monday’s low near 17: intact

This is the volatility floor. If VIX breaks back below here, the panic bid evaporates.

Level 2 – Tuesday’s high near 20.50: intact

This is the ceiling. A breakout above this level confirms a volatility expansion.

Vol Regime Context

VIX is grinding higher, but not blowing out. That is what a negative-gamma environment looks like: volatility firms while the trend in spot stays up.

Which brings us to the VIX futures calendar spread

This spread collapsing back toward zero tells you exactly what the vol desks are doing. When Nov-Dec compresses toward zero, that is usually an unwind of stress, not the beginning of new stress. In other words, this is the unwind of the panic, and likely not the start of panic. When this turns back higher again through the zero bound, that is the green light into year-end.

That aligns perfectly with VolControl starting to re-add.

This is when you buy pullbacks.

This is when you execute.

This is where you trust the signal until it tells you otherwise.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The RiskSignal Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.