Earnings Acceleration and Policy Shift: Fuel for Small-Cap Momentum

Fed easing and small-cap earnings strength are setting the stage for a powerful end of year rally.

The Ivory Hill RiskSIGNAL™ remains green, which means the broader trend is still intact, and any pullback should be viewed as a buying opportunity.

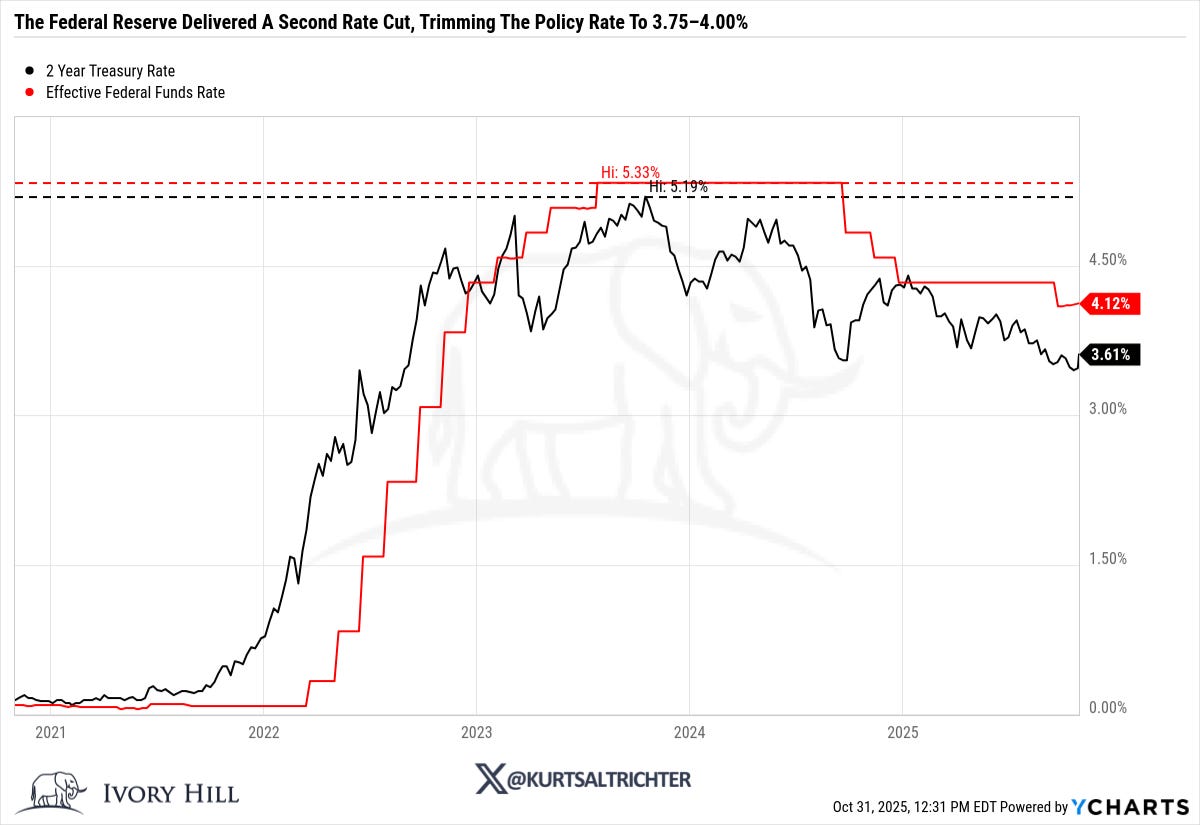

The Federal Reserve delivered a second consecutive rate cut, lowering the effective rate to 3.75%–4.00%. Jerome Powell signaled that a pause could follow at the next meeting, citing the federal data blackout caused by the government shutdown.

Chair Jerome Powell’s measured remarks, comparing policy to “driving in the fog,” signaled that the Fed will slow further easing until economic clarity improves. The 10 to 2 vote showed clear division within the committee, with one policymaker favoring a larger cut and another opposing any cut.

Markets rallied briefly before retreating as Powell tempered expectations for additional cuts this year. The S&P 500 finished flat near record levels, Treasury yields rose, and volatility ticked higher. The 2-year yield moved above 4.3%, while the 10-year held near 4.7%, modestly re-steepening the curve. With unemployment at 4.3% and core inflation at 2.7%, the Fed appears caught between doing too little and too much, resulting in a “hawkish cut” that leaves investors uncertain.

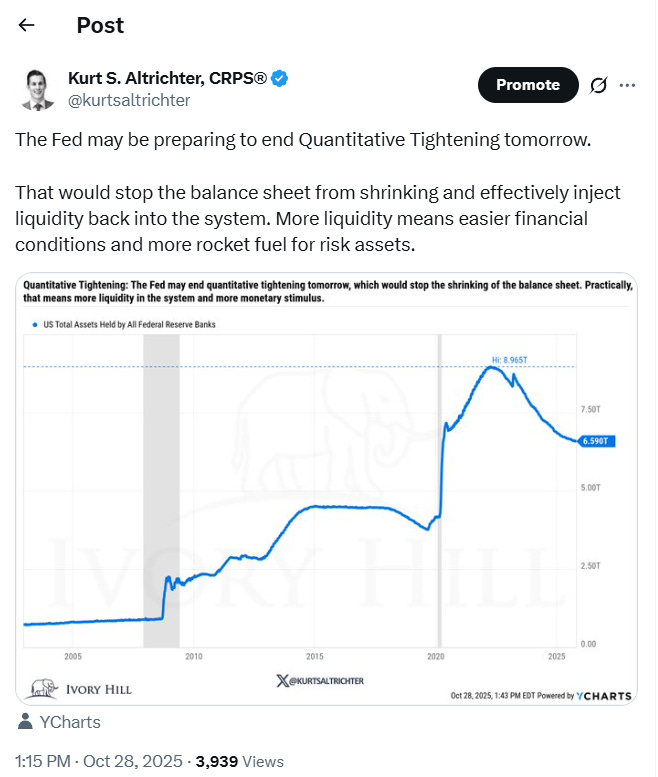

As I posted the day before the Fed meeting, the central bank confirmed it will end quantitative tightening on December 1, 2025, halting balance sheet runoff after reducing holdings by about $2.2 trillion since 2022. The decision followed signs of tightening in money markets, including rising short-term rates and heavier use of the Fed’s standing repo facility, suggesting that bank reserves have reached ample levels.

An end to QT is generally bullish for stocks in the short- to medium-term.

Liquidity Support: When QT stops, the Fed stops removing reserves from the banking system. More liquidity in money markets tends to support risk assets.

Lower Funding Stress: Reduced runoff eases pressure on short-term funding markets, which can help credit conditions and investor confidence.

Market Psychology: Ending QT signals a shift from tightening toward accommodation, often interpreted as supportive for asset prices.

Remember: the market cares more about WHY the Fed is doing what it does. In the longer term, this can be bearish if it signals that economic growth or bank liquidity is weakening. If the Fed ends QT because financial conditions are already strained, it can imply weakness beneath the surface.

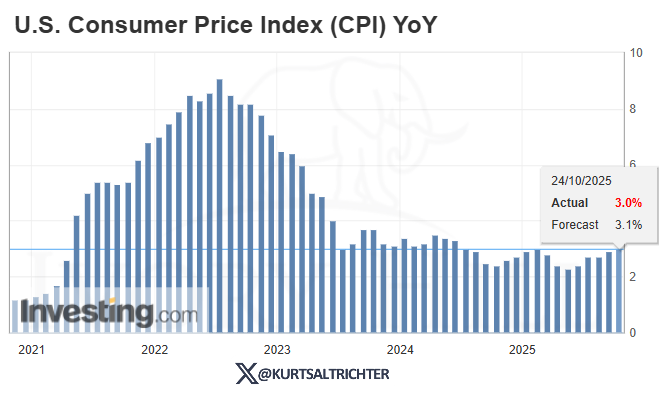

Powell noted that inflation “has moved up since earlier in the year and remains somewhat elevated,” though it is “not far from” the 2% target. He cited the Trump administration’s import tariffs as a key driver, saying they are “fueling inflation” and may cause a temporary rise in the coming months: “The base case is it will come and it probably will increase further, but it will be a one-time increase.”

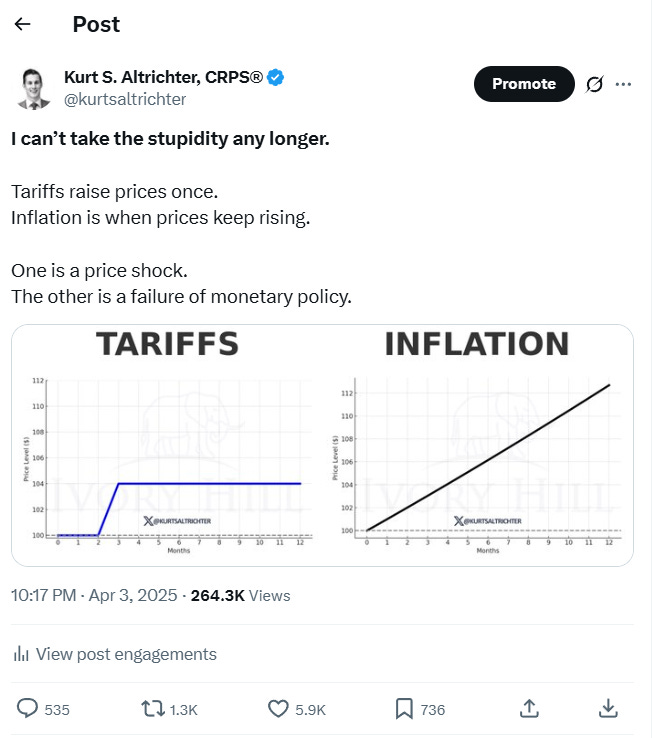

That last phrase is interesting to me. For the past year, both market gurus and the Fed have described tariffs as a persistent driver of inflation. Now the language has shifted. Powell acknowledged that CPI could spike temporarily but emphasized it would not last. The reason is simple: tariffs cause a one-time jump in prices, not ongoing, month-over-month inflation like we saw over the last 5 years. Because CPI measures the rate of change, not the price level itself, a one-time price shock fades mathematically over time, pushing inflation back down once prices stabilize.

Based on the data in front of me, I completely disagree with the Fed Chair’s outlook that inflation will rise on the November 13th CPI report. My models point to a reading below 3%. The next FOMC meeting is scheduled for December 9. If CPI prints below 3% on November 13, as I expect, that would put a December rate cut back on the table just in time to fuel a year-end Santa Claus rally.

Buy Bonds

The MOVE Index, often called the “VIX for bonds,” tracks expected volatility in Treasury yields using options pricing. Since April, it has dropped by 50%, signaling a major positive shift for bonds. Lower volatility means less uncertainty about interest rates. Because bond prices move inversely to yields, stable or falling yields generally support higher bond prices. When the MOVE Index rises, it reflects unpredictable rate swings that make bonds riskier. When it falls, it indicates expectations for steadier or lower yields, improving the risk-reward profile and drawing investors back into fixed income.

Earnings

As Q3 2025 earnings season progresses, large-cap stocks in the S&P 500 continue to outperform their small-cap counterparts in the Russell 2000, and forward EPS growth projections further highlight this divergence. So far, 222 S&P 500 companies (roughly 44% of the index) have reported, with an impressive 84.2% beating analyst earnings estimates. That figure stands well above the four-quarter average of 77% and stems from strong contributions in technology, consumer discretionary, and AI-driven sectors amid favorable macro conditions. This momentum supports robust forward EPS growth of 11.0% for full-year 2025, up slightly from prior estimates. Consensus forecasts show acceleration to 7.4% in Q4 2025, 11.9% in Q1 2026, and 12.8% in Q2 2026, underpinned by AI tailwinds, resilient consumer spending, and anticipated rate cuts.

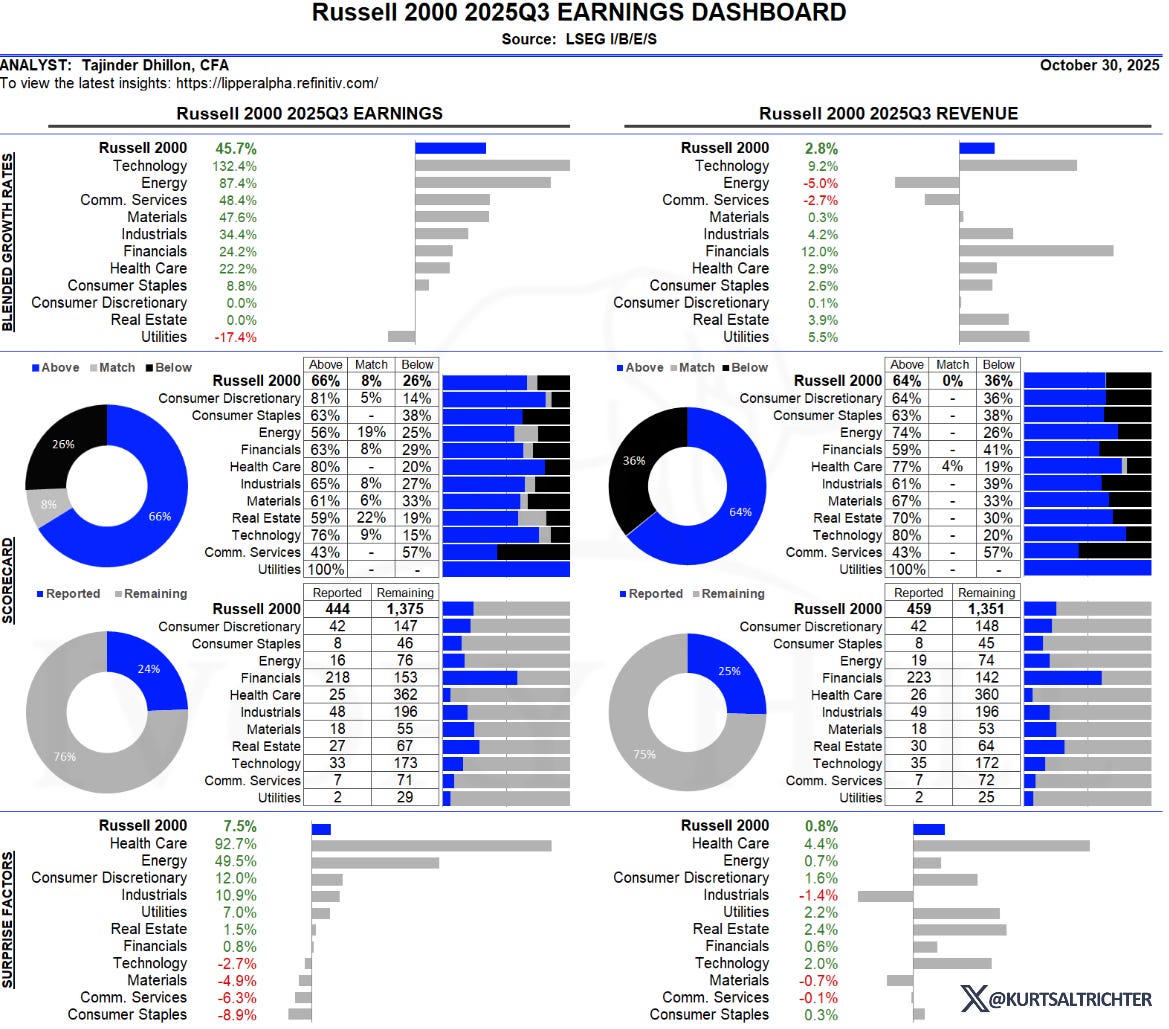

Small caps are showing real signs of life. Refinitiv’s latest data puts Russell 2000 earnings up +45.7% year-over-year, with 66% of companies beating estimates. That kind of acceleration hasn’t been seen since the post-pandemic rebound and signals a genuine profit recovery underway beneath the surface. Revenue growth of +2.8% means margins are expanding again, a sign of operating leverage returning to smaller businesses. For investors, this shift matters: earnings momentum drives valuation resets, and when small-cap EPS growth runs this strong, it often precedes a sustained period of outperformance versus large caps.

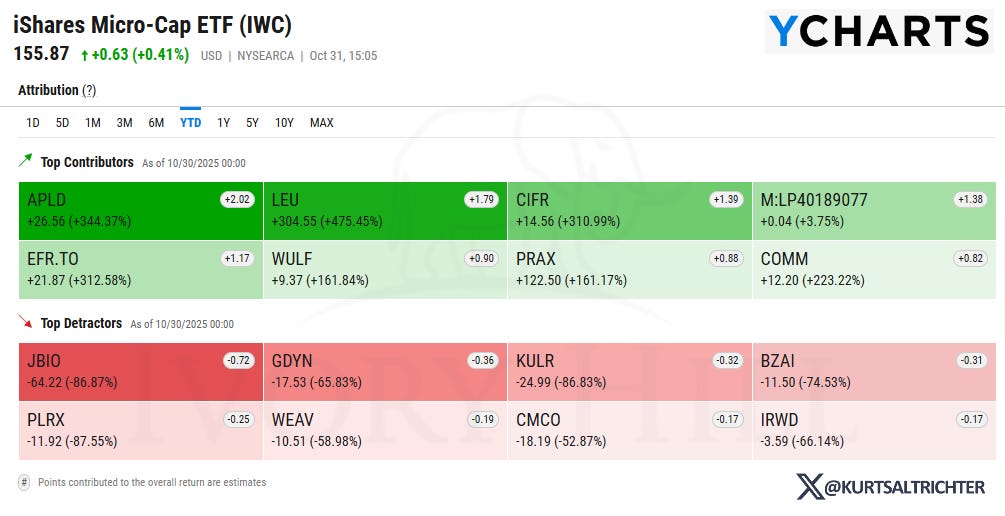

I continue to see small and mid-caps as the most attractive area heading into Q1 2026. We’ve been increasing exposure to ARKK, IWM, and TNA, and recently added micro-caps through IWC.

Overall, conditions are still bullish for stocks until proven otherwise.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The RiskSignal Report is published by Ivory Hil, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.