February Market Expectations Report

A sharp pullback on real disappointment should be expected

The Ivory Hill RiskSIGNAL™ remains green since December 5th. Our short-and-mid-term volatility signals are also firmly green.

We are fully invested in this market and are favoring more risk and higher beta stocks as volatility remains suppressed (for now).

The February update for the Market Expectations Table sends a clear message: While the current factors driving stocks and bonds are positive, the market has priced in virtually no room for disappointment. In the event of negative news related to these drivers, a 10% correction is not only justified but highly probable.

After analyzing the changes in this month's table, one development of note is the formal acknowledgment of impending rate cuts by the Fed. This is a positive signal for the market, increasing the market multiple (ranging from 18.5X to 19.5X). Although there is a mild pushback from J-Powell regarding the March cuts, the timing (March vs. May) is not critical. What matters is THAT they cut, because the market is anticipating five or six-rate cuts in 2024.

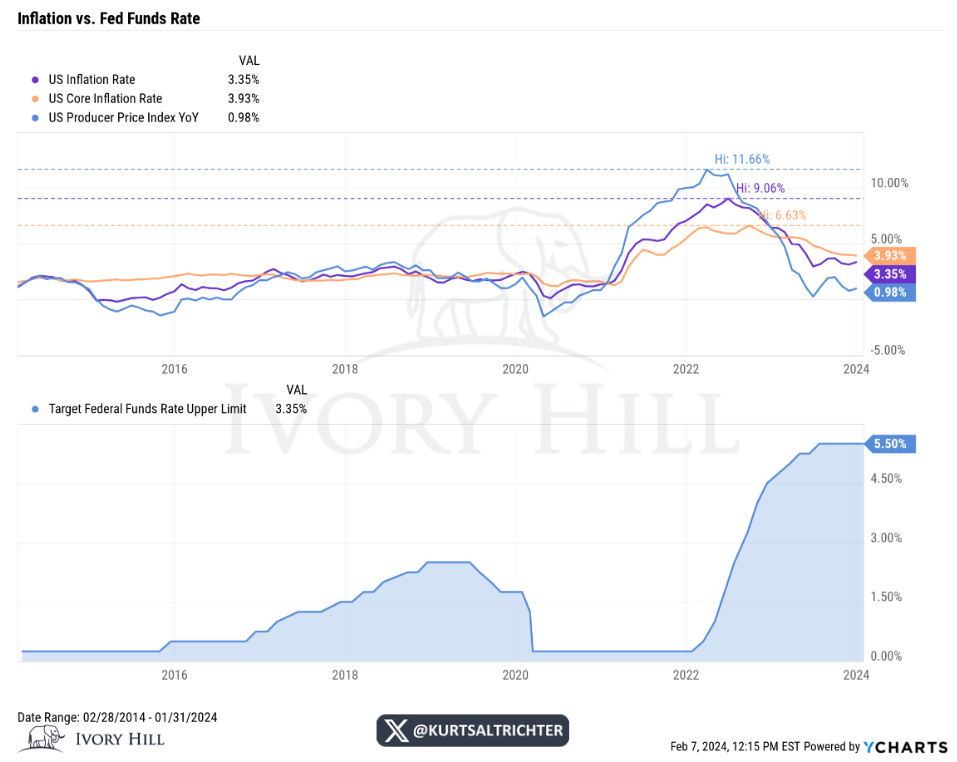

Economic data suggests momentum might be flattening out, yet there are no signs of a soft landing. Inflation data has generally declined, signaling that inflation is coming down to the Fed’s 2% target. But will the Fed risk it all at this point in the game?

The key takeaway from the Q4 earnings season was the S&P 500 earnings range for 2024, between $240 and $245, remains intact. However, there has been a slight deterioration, with consensus now hovering around $243, down from the previous estimate of $245.

Comparing market performance to the previous Market Multiple Table, it's evident that in January, the market priced in the “Conditions Get Better If” scenario last month, with the S&P 500 trading above that estimate. The challenge lies in the fact that while current market drivers are positive, they all have the potential to reverse.

The pricing of the "Conditions Get Better If" scenario is very aggressive and lacks support from fundamentals because none of these factors are guaranteed. However, momentum does lend some support to it; an overbought market that remains overbought is about as bullish as it gets. Nonetheless, I seek additional supporting factors beyond just momentum and technical indicators. Currently, the market is being supported by strong momentum and the narrative of anticipated rate cuts by the Fed, which the market is confident will happen 5-6 times this year. However, with breadth indicators showing significant weakness, this alone is insufficient for me to issue an all-clear signal.

Current Situation:

The Federal Reserve has delayed rate cuts in March, but they are still planning on a rate cut in May (I’m skeptical of this).

Market expectations suggest that there may be five or six rate cuts in 2024.

Economic growth is currently positive but not excessively hot.

Inflation is trending lower, closer to the Federal Reserve's 2% target.

There is anticipation of a rate cut, possibly in May, due to the declining inflation trend.

Overall, the current situation is characterized by positive factors supporting stock market gains throughout the year.

Conditions Improve If:

The Fed confirms a May rate cut.

Economic data stays Goldilocks.

Inflation continues to drop towards the Fed’s 2% target. Supporting the May rate cut narrative.

This would be a very positive macro environment for stocks and bonds and would likely push the S&P 500 to a valuation beyond 4,900.

This scenario aligns with “perfect” conditions for stocks, including imminent rate cuts (leading to a higher market multiple), robust but not excessively hot growth, and a downward trend in inflation.

Despite valuation concerns, driven by momentum, a surge in the S&P 500 towards 5,000 would be considered reasonable in this environment.

Conditions Deteriorate If:

The Fed pushes back on rate cuts in May and the expectation for five or six cuts this year.

Economic growth suddenly rolls over or materially accelerates.

Inflation metrics (CPI/Core PCE Price Index) rebound.

The situation described could significantly challenge the foundations that have fueled the Q4 and January market upswing. Given the current overextended state of the markets, the likely consequence would be significant stock market declines, with the possibility of erasing a substantial portion of the gains witnessed from October to January. Although this might seem impossible right now, such an outcome cannot be entirely dismissed.

We are still in a weak bull market

This year, the rate cut narrative driving the S&P 500 to new nominal all-time highs did not carry the less capitalized Russell 2000 stocks. Small-caps have lost momentum and failed to break out, in line with my ongoing analysis.

It's essential to recognize that a broadening bull market cannot only rely on the leadership of overinflated bubble-cap tech. To ensure the market's broad health, it's crucial that the smaller, less capitalized indexes, establish and maintain a sustained upward trend. So far that has not happened.

I will hold this opinion until small-caps have a sustainable uptrend for weeks, months, and quarters. Until that happens, I still believe we are not in a healthy bull market, as small-caps have been in a full cycle crash since late 2021 and have gone nowhere in two years.

Small-Cap Russell 2000 Index Technical Update

Small-cap stocks had a terrible performance last week, plummeting by -0.78% at Friday's close.

However, the RSI is still above 50, indicating that the bulls remain in control despite the range-bound price action in the small-cap index.

Nevertheless, the Russell 2000 index, in relative strength to the S&P 500, continued to underperform and is dangerously close to breaking below the late 2023 lows. A move below those lows could signal further underperformance in the coming weeks or months, which is a significant concern.

On the weekly chart, the Russell 2000 is trading within a tight range between support at the pivot area of the early 2024 lows at around 1,935 and resistance at the pivot point from the failed breakout into the end of 2023 at 2,040 - 2,050. The situation demands close attention as a breach of either level could indicate a significant shift in market sentiment.

5-Yr “Real Yields” (TIPS) - WATCH THIS!

One data point that many investors are neglecting is real interest rates. Real interest rates have significant ramifications for the economy and various asset classes. Broadly speaking, rising real rates tend to constrain growth, whereas lower real rates tend to support economic expansion and coincide with stock market strength.

Last week, real interest rates plummeted towards the year's lowest levels, with the 5-Year Treasury Inflation-Protected Securities (TIPS) yield reaching 1.63%—just slightly above the 2024 low of 1.62%. However, a substantial upward reversal occurred into the weekend, pushing the benchmark real yield to 1.80% by Friday's close. This represented a 2 basis point increase for the week, stopping just short of the 2024 high of 1.83%.

In the upcoming weeks, you should closely monitor the pivotal level of 1.83% in the 5-year TIPS yield. A breach above this threshold could signal a potential move beyond 2% in the near term. Historically, crossing the 2% mark in real rates coincided with risk asset downturns over the past two years and throughout most post-WWII economic cycles.

In summary, keep a close eye on the 1.83% level in the 5-year TIPS yield from early 2024. Any upward movement beyond this mark would likely exert negative pressure on stocks.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President