From Stimulus to Tariff-ied

Decades of bad decisions are coming do—and tariffs might be the least of our worries

ANNOUNCEMENTS

Clients: Please schedule your quarterly review by clicking HERE

The Ivory Hill RiskSIGNAL™ turned red on Friday, March 7, and we are still sitting in roughly 40% short-term Treasuries and 20% long-term Treasuries. All of our signals are red at this time, meaning we can expect increased volatility for the foreseeable future.

Today, the Trump administration is expected to roll out its latest tariff proposal. Will markets rally or retreat? No one knows for sure. But one thing is certain—it’s going to be volatile.

The first quarter is officially in the books, and it wasn’t pretty. We just experienced the fifth-fastest 10% market correction in 75 years. Tech stocks have been pummeled, down 17% from highs. Tariff headlines are everywhere. The kind of market chaos we’re seeing might feel like an economic apocalypse is coming. But this is what modern markets look like. With more than 85% of trades entered daily being executed by automated and computerized trading systems, volatility is no longer a bug in the system—it is the system. If you are not set up to compete with the herd of computerized trading, you will be left in the dust. Especially with the advancements in AI, volatility is only going to get more vicious as time goes on.

What Triggered the Selloff?

Tariffs are the clear catalyst. And no, I’m not upset about it. In fact, I welcome it. Because if we don’t start addressing the runaway debt problem now, this first quarter will feel tame compared to what’s coming. A genuine debt crisis could trigger a 50–60% market drawdown, fast. Don’t believe me? Look at what happened in 2008. We need to confront this head-on—with spending cuts and increased revenue—not fantasy accounting or more easy money.

Here’s the hard truth: debt does matter. And raising taxes has never reduced government appetite for spending. In fact, every single time our elected officials have raised taxes in this country, they have used this to justify even more spending.

Want to shrink the deficit? You’ve got two options: cut spending or grow revenue. That’s it.

Let’s Play the “What If” Game

If the US is paying a 25% tariff to a foreign entity and we start charging them 25%, what if we both drop the tariffs? That would redirect that 25% value to U.S. businesses, boosting earnings per share. What if we lowered capital gains taxes from 20% to 15%, maybe even 10%, and still paid down the debt? Any of these scenarios could trigger a massive upside move.

But let’s not ignore the downside risks—inflation, recession, or stagflation are all in play. No one can say how it all ends. What I do know is this: the policies of the last two decades aren’t working. The national debt is exploding.

So How Did We Get Here?

Let’s pick up mid-timeline to save space and focus on what matters: the government shut down the global economy, then panic-printed trillions. Here’s the math:

U.S. Fiscal Stimulus (2020–2022):

CARES Act: $2.2T

PPP & Healthcare Enhancement: $484B

Consolidated Appropriations: $900B

American Rescue Plan: $1.9T

Infrastructure Investment & Jobs Act: $1.2T

Inflation Reduction Act: $750B

Total: ≈ $7.43 trillion

Federal Reserve Balance Sheet Expansion:

Feb 2020: ~$4.2T

Peak in early 2022: ~$8.9T

Increase: ≈ $4.7 trillion

Total Combined Stimulus:

$7.43T (fiscal) + $4.7T (monetary) = $12.13 trillion

All that cash hit the system at once—direct payments to consumers, most of whom didn’t need it. What happened next? They spent it. On what? Big-box goods, stocks, crypto, and real estate. Asset prices exploded—and then everyone acted surprised when inflation popped out on the other side.

What’s the only thing that causes inflation? Government money printing. It’s not supply chains, labor shortages, wage pressures, commodity shocks, corporate greed, or even tariffs. None of those can create new dollars out of thin air. Only the government can do that. Everything else the pundits blame is anecdotal noise at best—distracting symptoms, not the root cause.

Think about it this way: Since 2020, nearly 40% of the total U.S. money supply in circulation today was created out of thin air during the last 5 years.

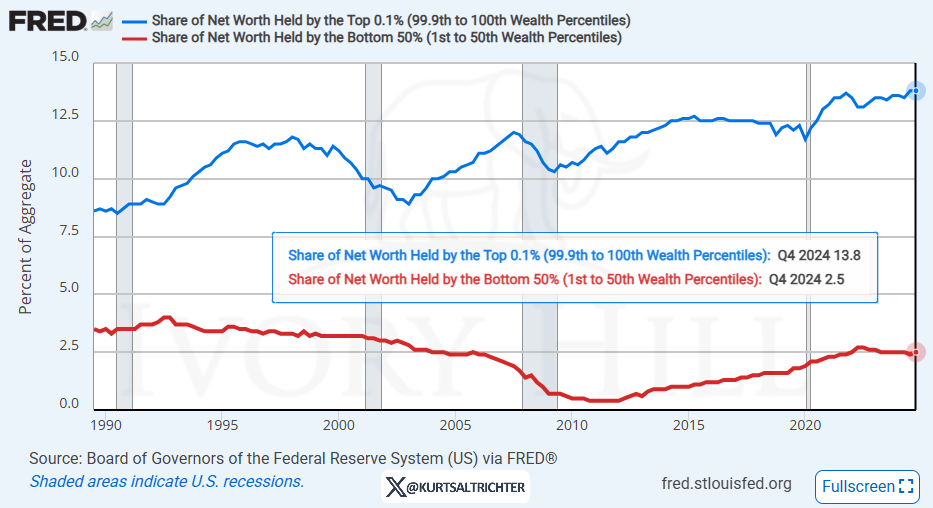

This flood of money triggered one of the greatest wealth transfers in history. The top 10%—who own the majority of assets—watched their wealth multiply. Meanwhile, middle- and working-class Americans spent their stimulus checks (and now have less money in their pocket) and got hit with the hidden tax of cost-push inflation. Their wages didn’t rise to match inflation. Their cost of living did. And now, if the government allows the $7 trillion in maturing debt to roll over at today’s interest rates, the annual interest payment—already nearing $1 trillion—could nearly double. What does that mean? It means higher taxes for the middle and working class to cover the rising cost of servicing this new mountain of debt.

Let’s be clear: If you’re outraged by the wealth gap but still demanding more government handouts, you’re missing the root cause. It’s those very handouts that continue to widen the divide.

Since 2020, our government has added $12 trillion to the national debt. That’s the fastest debt expansion in U.S. history.

If you think that doesn’t matter, ask yourself: why are we still paying taxes if debt doesn’t matter? Because someone has to pay to service it—and that someone is you, the taxpayer.

In 2024 alone:

The government spent: $6.8 trillion

It collected: ~$5 trillion

The deficit: $1.8 trillion

We’ve run budget deficits every single year since 2002—22 years straight. And the interest on our debt alone is now over $1 trillion per year—more than our defense budget. We literally don’t bring in enough tax revenue to cover just the interest and entitlements, never mind the rest of the government. This is not a political point of view; this is math.

So how do we make those interest payments?

Raise taxes

Cut spending

That’s it.

And yet, every time spending cuts are on the table, our elected officials (on both sides) manufacture a new crisis to justify more spending. Their “solution”? More IRS agents. More audits. More taxes.

How much of your paycheck are you willing to hand over—40%? 50%? If you’re comfortable giving up nearly half your income for the government to decide how it’s spent, you might want to ask someone who lives in Belgium, Germany, or Austria—countries with the highest overall tax burden at all income levels, where effective rates range from 43% to 50%. This is where we are headed if something doesn’t change.

It’s absurd. And it’s not sustainable.

The “Tax the Rich” Fallacy

The ultra-wealthy already don’t pay much in taxes. And if you try to hit them with taxes on unrealized gains, they’ll just relocate to Puerto Rico or some other tax haven.

Even if the government outright stole all $5.7 trillion of U.S. billionaire wealth, it would only fund federal spending for about 10 months, based on the 2024 spending rate of $6.75 trillion.

Then what?

You’d have to go after the middle class. Do you see the problem?

This isn’t about Republicans or Democrats. This didn’t start in 2020—it’s been building for decades. From the Iraq War to Medicare Part D, from TARP to quantitative easing, both parties have done a horrid job of managing the finances of this country for decades. The Iraq War cost trillions with no clear outcome. Medicare Part D created a massive unfunded entitlement. TARP rescued Wall Street while Main Street paid the price. Quantitative easing injected trillions into financial markets, inflating asset prices and widening the wealth gap.

These weren’t isolated decisions—they were links in a chain. Crisis after crisis, the answer has always been the same: more spending, more debt, more intervention. It’s a loop we can’t seem to escape.

That’s how we got here. And that’s how we got DOGE.

If you’re wondering why DOGE of all things—it’s the chemotherapy of a broken monetary system. Painful, chaotic, irrational... but maybe, just maybe, it’s the shock needed to break the cycle.

So Where Do Markets Go From Here?

Eventually, this storm will pass. I still believe the S&P 500 will finish the year above 6700. And when it does, no one will be talking about Q1 anymore.

But if we don’t change course soon, history won’t remember this decade for what went right—only for how long we ignored what was wrong.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Email: kurt@ivoryhill.com | ivoryhill.com

Spot on. Excellent analysis.

Informative as always.