Missile Strikes, Port Strikes, and Hurricanes—Oh My!

Global Disruptions and Their Impact on Markets: What You Need to Know

I've received several client calls about the ongoing turbulence in the U.S. and globally. In my experience, if one client has a question, many others likely share the same concerns. So, I wanted to take a moment to provide a brief update on what this uncertainty means for the markets and your hard-earned capital.

Understanding the Impact of Iran's Missile Strike on Markets

On Tuesday, Iran launched a significant missile strike against Israel, causing a temporary drop in stock prices—a typical "panic" reaction. While this certainly heightens geopolitical concerns, it doesn’t appear to have a lasting impact on the market rally. Before diving into why that’s the case, let's break down what happened in simple terms.

What Happened?

Since Israel's response to the Hamas attack last October, the nation has been actively targeting Iranian-backed factions in the region. This includes Hezbollah in Lebanon and the Houthis in Yemen, who have retaliated with attacks of their own, including Hezbollah’s rockets and the Houthis’ assaults on shipping routes. Recently, Israel escalated its actions with significant strikes against these groups, including an attack that reportedly killed Hezbollah's leader. In response, Iran launched hundreds of missiles toward Israel, though most were intercepted by Israel’s Iron Dome defense system, minimizing damage.

Why Isn’t This a Bearish Gamechanger?

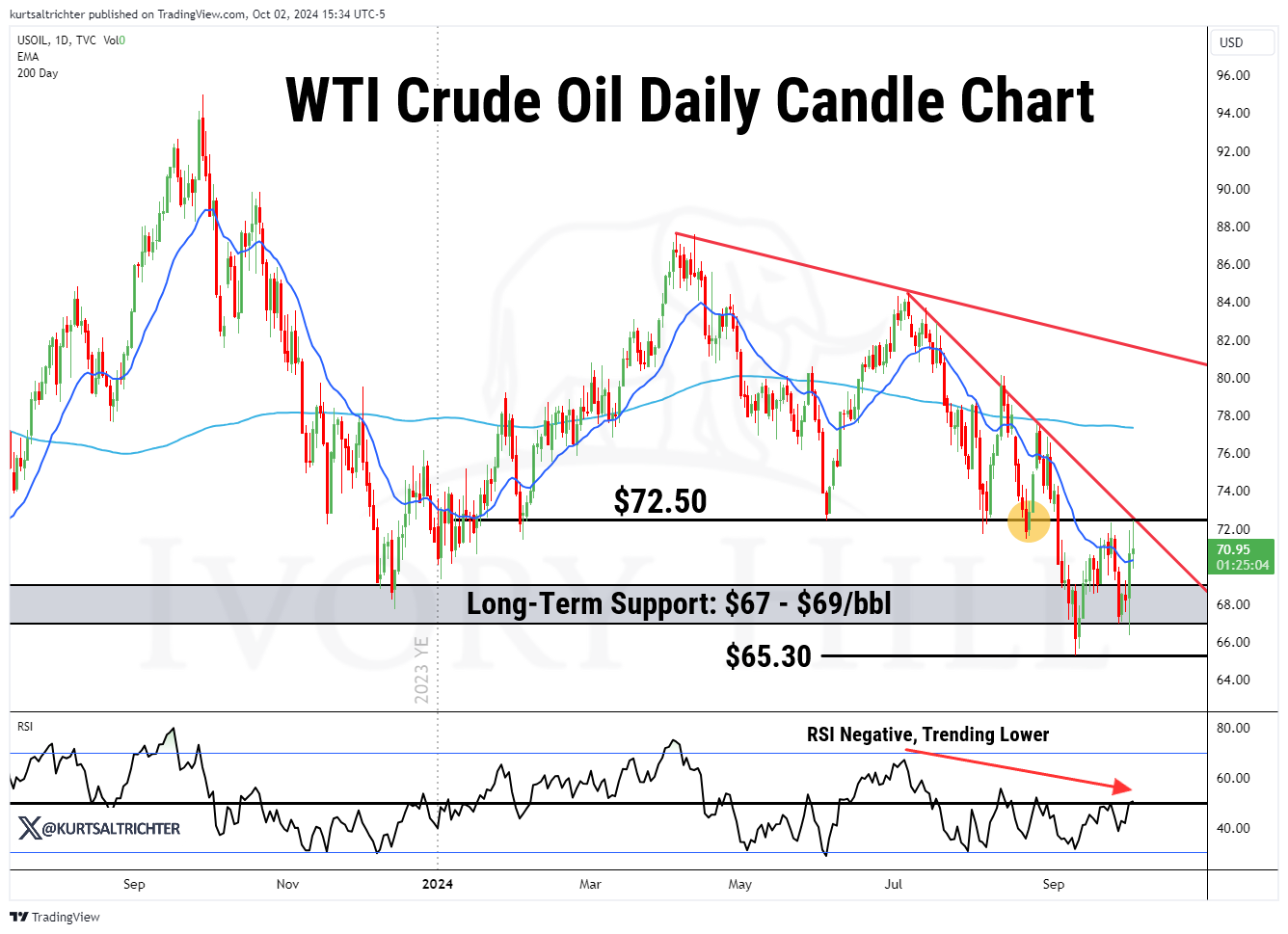

Despite the worrying headlines, several factors suggest this won’t lead to a bearish market shift. First, similar exchanges between Israel and Iran, like the one in April, didn’t lead to a wider conflict. While this recent strike was more aggressive, it hasn’t escalated beyond what analysts predicted. Most importantly, from a market perspective, oil remains the key factor in assessing geopolitical risks. While oil prices did rise 3% after the news, it’s a relatively muted reaction, especially considering the potential impacts of a full-blown war.

Even if Israel were to launch a larger offensive in Lebanon, the market is likely to overlook it, as Lebanon is not a major oil producer. As long as oil prices don’t spike dramatically, the broader market is expected to remain stable.

Ultimately, oil prices serve as the key indicator for how markets interpret geopolitical events. Although tensions in the region are elevated, with oil currently priced around $70 per barrel, it’s not signaling any immediate cause for concern.

When Does This Become a Bearish Scenario?

The situation could shift if the conflict disrupts major oil producers, particularly Saudi Arabia. Should the regional conflict spread, pulling in other nations and affecting oil supply, we could see significant market repercussions. If oil were to jump above $80-90 per barrel, this could signal deeper economic risks and strain the current market rally.

What’s Next?

Israel’s response will be critical in determining the next steps. If it launches retaliatory strikes on Iran, we could either see the situation de-escalate or intensify. Any Israeli ground operations in Lebanon would also heighten tensions. However, unless the conflict impacts major oil production, it's unlikely to derail the 2024 market rally.

In conclusion, while the situation in the Middle East is undoubtedly tense, unless it triggers a disruption in oil supplies or a broader conflict, markets are likely to weather the storm.

Will the Port Strike Increase Hard Landing Chances?

A dock worker strike that spans from Maine to Texas began this Tuesday, and you are surely seeing some alarming headlines about its potential impact on the U.S. economy. While this is undoubtedly a significant event, I don’t believe it will dramatically increase the chances of a hard landing. However, it could affect specific sectors and the broader economic outlook in the long run. Here’s why.

What’s Happening?

The International Longshoremen’s Association (ILA) and the U.S. Maritime Association (representing port operators) have failed to reach a new labor agreement. As a result, a large-scale dockworker strike covering major ports from Maine to Texas has begun. This means cargo ships may remain unloaded, disrupting supply chains and reducing economic activity in the U.S. It’s the first coast-wide strike of this magnitude since the 1970s.

Will This Impact the Market Rally?

On the surface, this could be seen as a serious threat to the U.S. economy, especially since it’s already showing signs of slowing, and the Fed has recently started cutting rates. A strike affecting all major East and Gulf Coast ports could 1) deepen the economic slowdown and 2) create supply chain issues that might lead to inflationary pressures, potentially complicating further rate cuts.

However, I believe these concerns are overstated for several reasons. First, strikes are temporary by nature, and policymakers, including the Fed, generally look beyond such disruptions when making decisions. For example, if the October and November economic data are weaker than expected due to the strike, economists will likely view it as “strike-skewed” and discount its significance. Similarly, while a temporary supply disruption might cause a brief rise in prices, the Fed is unlikely to adjust its policy based on these short-term fluctuations.

Second, there are alternatives to port closures that can mitigate the impact. While a strike on the East Coast would disrupt some retailers and importers, it wouldn’t be catastrophic. The West Coast remains more critical for retail imports (particularly from Asia), and companies can rely on existing inventory, air freight, or trucking from Canada and Mexico to manage their supply chains. Though these alternatives may be more expensive, they ensure goods continue flowing.

Why It’s Not a Major Economic Threat

We can look at the past for perspective. From June 2014 to February 2015, West Coast ports experienced various forms of work stoppage. While this impacted some retailers, the broader economy remained largely unaffected, and West Coast ports are more critical than East Coast ones for retail and consumer goods.

What Are the Risks?

While I don’t foresee the strike significantly affecting the overall economy, it could still impact certain sectors. Retailers and commodity importers, in particular, could face higher transportation costs as they seek alternative methods of bringing goods to market. This may put pressure on their margins and profits, particularly if the strike drags on. It wouldn’t be surprising to see some downward pressure on the VanEck Retail ETF (RTH) and the Energy Select Sector ETF (XLE) if the port strike persists for an extended period. Both sectors could experience increased costs and disruptions, potentially impacting their performance.

Additionally, there is one key macroeconomic risk to consider: a potential Fed misstep. The market has priced in a soft landing, but that doesn’t mean a hard landing is off the table. For the Fed to execute a soft landing successfully, it needs reliable economic data. A port strike could distort this data, making it more challenging for the Fed to make accurate policy decisions. While this won’t affect markets in the short term, it could have medium- to long-term implications, particularly in early 2025.

Bottom Line:

The headlines about the dockworkers strike may seem concerning, but history suggests it’s unlikely to significantly alter the near-term economic outlook or inflation trends. However, it could create headwinds for retailers and commodity importers and complicate the Fed’s efforts to achieve a soft landing, increasing the chances of a hard landing in the future.

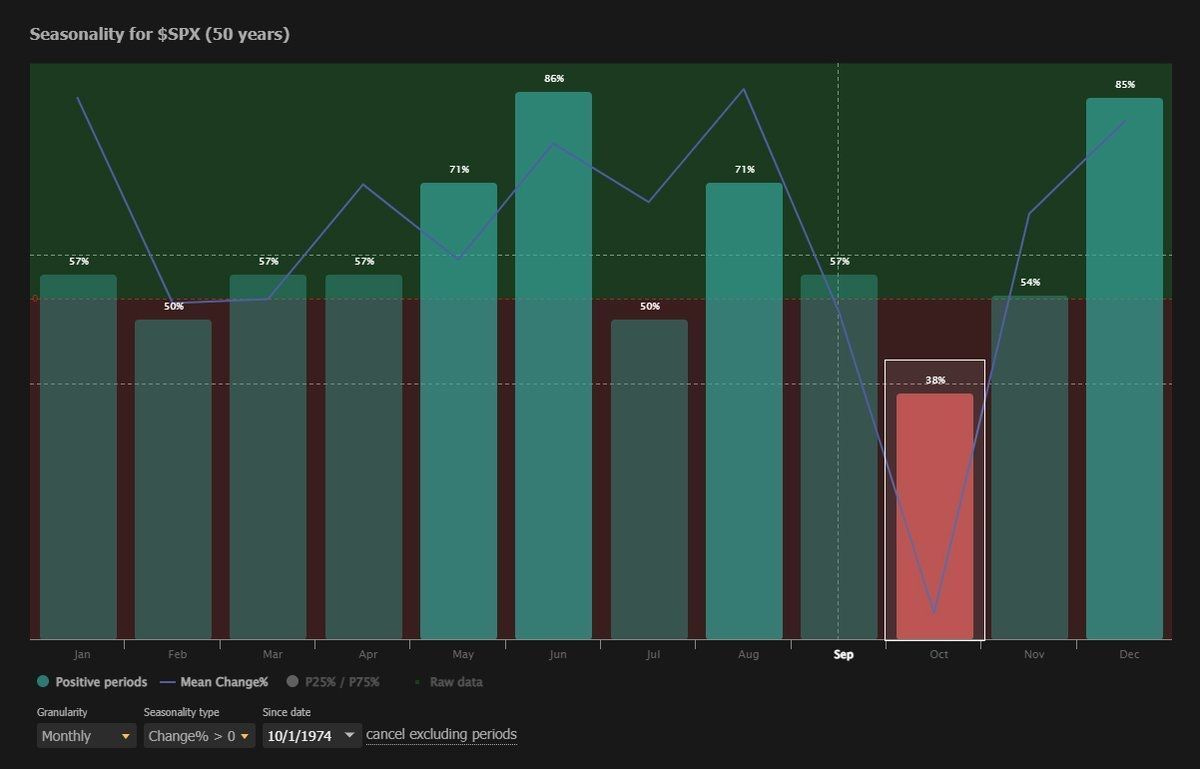

We are far from out of the woods yet. In the last 50 years, October has been the worst month for the S&P 500 in election years, being down 62% of the time with an average decline of -3.05%.

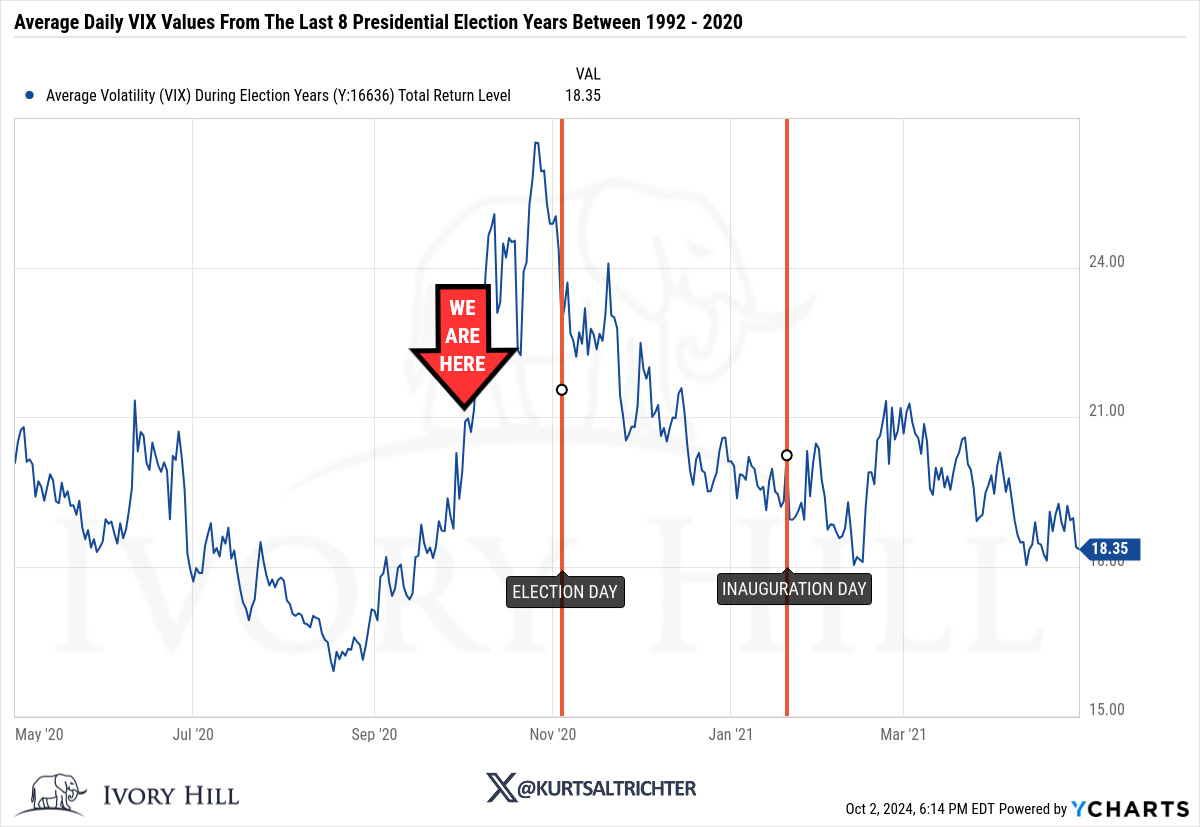

And I still expect volatility to rise significantly over the next four weeks as we approach election day. It is very important that we do not allow the noise and volatility to impact our investment decision making.

If you're feeling stressed about what’s going on, it’s likely because you're glued to the financial fear-mongering machine. Do yourself a favor and turn off the financial pornography news network. These so-called 'news' organizations are really entertainment networks, and they aren’t here to inform you—they're here to manipulate you, driving views and engagement so they can sell more advertising. Don’t let them pull you into their panic-fueled trap. Trust me, you're better off ignoring the noise entirely. It’s important to stay positive, as I’ve never met a wealthy individual who wasn’t an optimist.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Email: kurt@ivoryhill.com | ivoryhill.com