New Market Extremes Demand Respect

High-Risk With Limited-Reward

The Ivory Hill RiskSIGNAL™ has remained green (since December 5th). Our short-term and mid-term volatility signals are green but are teetering on flipping red.

We are seeing a little bit of a sell-off this week, and as long as our long-term signal is green while the VIX is below 20, we will view this as a buying opportunity.

First, despite alarming headlines, the economy and market are currently stable. Since October, four key factors have driven the market: solid growth, falling inflation, expectations of Federal Reserve rate cuts, and the strength of tech stocks. These factors remain intact, so there’s no need to worry about a significant market decline unless this changes.

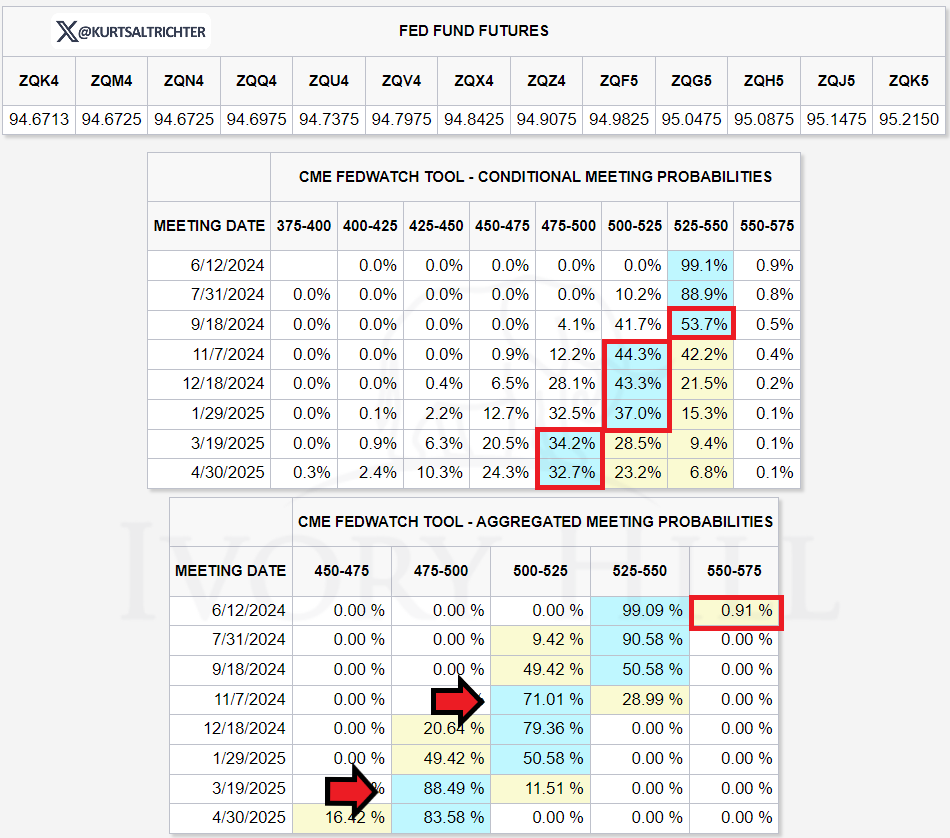

Second, expect some short-term volatility. Markets don’t rise every day, and short-term fluctuations are normal. The primary cause of recent volatility has been investors’ expectations regarding Fed rate cuts. In April, stocks dropped because the market feared the Fed might not cut rates in 2024. However, markets have since rebounded, anticipating two rate cuts in 2024, with the first possibly in September. These shifting expectations will cause short-term volatility, but we focus on the medium and long term. Whether the Fed cuts rates in September or December is less important than the market knowing a cut is coming. If the market drops in the coming weeks over rate cut concerns, it will be a good opportunity to increase exposure, as it’s not a long-term negative.

Looking at the long term, economic growth is our primary concern. Growth is strong now, but we must remain alert for any signs of a significant downturn, as that could end this bull market. High rates are less of a concern. If rates remain high and growth is solid, markets can continue to perform well (remember, the rally from October to now happened with rates near 5.5%). The key risk is an economic slowdown, and that’s what we’re monitoring closely.

Practically, this means that sticking to your strategy is now more crucial than ever. Short-term volatility will happen, but unless there’s a significant change, it will present buying opportunities. Given the risk of slowing growth and the recent market rally, reducing volatility in your holdings is prudent. This strategy has shown some outperformance recently, and I expect it to continue over the summer. Regarding elections and politics, the debate at the end of June will generate headlines. However, the market’s focus on the election won’t intensify until after Labor Day, with many uncertainties, including Trump’s court cases, which are still to be resolved.

The bottom line is that the medium—and long-term outlook remains positive. Don’t be overly concerned about scary headlines about rates and rate cuts. Rates aren’t likely to end this bull market, but a slowing economy could. That’s the main risk we’re watching now.

High-Risk With Limited-Reward

Last week, both the S&P 500 and Nasdaq Composite indices surged to new record highs, driven by concentrated strength in mega-cap tech and growth stocks. This occurred despite generally deteriorating market dynamics within equities and across other asset classes. It's crucial to respect new market extremes, and the 2024 rally to fresh all-time highs in the S&P 500 is no exception. However, conviction behind a trend is vital. Since late in the first quarter, our evidence-based conviction behind the latest run into record territory has weakened due to rising risks and diminishing reward prospects this year. Here’s why:

The new highs in the S&P 500 lacked confirmation from the Relative Strength Index (RSI) on the weekly chart, a dynamic that occurred in 2018, 2020, and 2022 prior to 20%+ market drawdowns.

Growth stocks (VUG) led to the upside last week but failed to hit all-time highs relative to the S&P 500, which we would expect in a sustainable move.

The two sectors entirely responsible for the S&P 500’s advance, technology (XLK) and communication services (XLC), are both below their respective all-time highs in relative strength to the S&P 500. In fact, none of the 11 sector ETFs made new records in relative strength terms to the S&P 500 last week.

Measures of market breadth were mixed, but the number of stocks trading above their 50, 100, and 200-day moving averages within the S&P 500 all declined despite the new highs in the index.

Treasury yields continued to rise with bear-flattening yield curve spreads, which do not support a soft landing.

Fed policy expectations became less dovish, with fewer rate cuts priced in over the next 12 months. The consensus for the first rate cut has been delayed from September to November, though the chances of a September cut remain roughly 50-50. The Fed will not raise rates anytime soon.

Real rates rebounded towards 2024 highs. The 2024 high of 2.29% from late April will be a crucial level to monitor this week. A continued push higher will present a strengthening headwind for stocks and other risk assets.

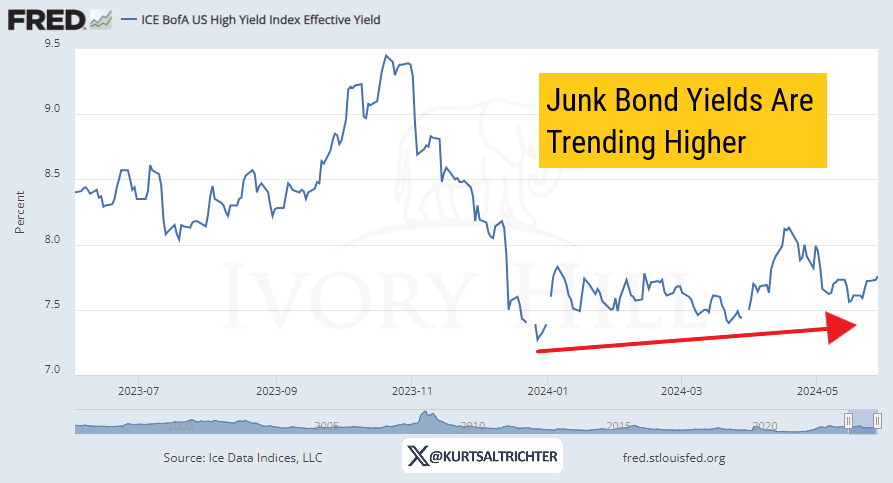

Credit spreads failed to fall to new cycle lows with the latest advance in stocks as junk-rated corporate yields have been trending higher all year. Despite tight credit spreads and a renewed rally to all-time highs in the equity markets, a divergence persists, highlighting the risks of imminent volatility and a potential pullback or correction in stock prices in the weeks ahead. Within corporate bonds, the spread between junk-rated and investment-grade yields remains well off the 2024 lows, indicating a deterioration in risk appetites among bond traders.

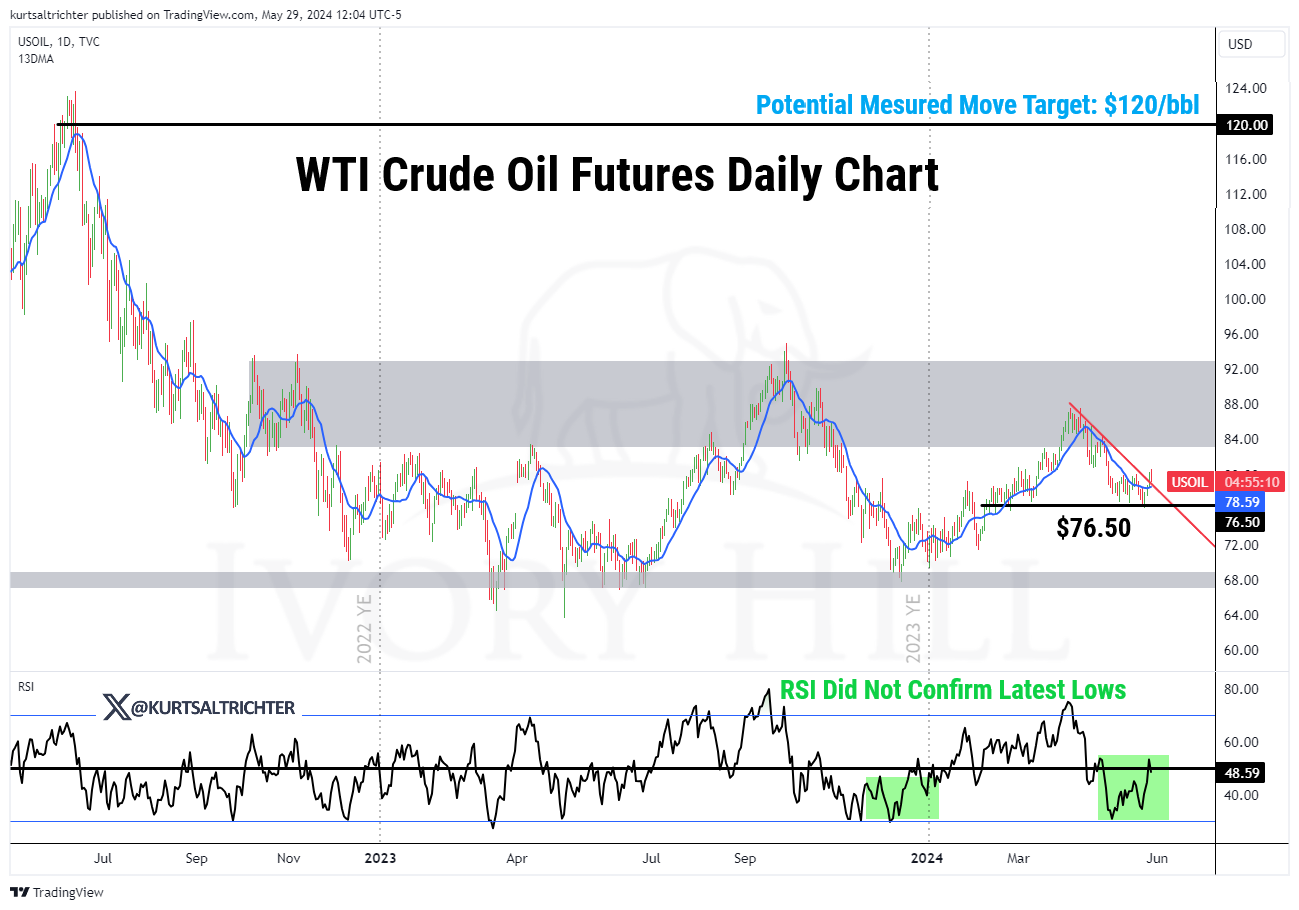

Oil prices are set to rebound, meaning inflation is accelerating.

The dollar index is in a broad uptrend channel so far in 2024. The bottom line is that a break below either of those two uptrend support levels this week would significantly undermine the bull case for the greenback. This could lead to higher commodity prices and increased inflationary pressures.

On the weekly chart, the VIX's RSI indicator has made a series of higher highs and higher lows in recent months, indicating a warning of increased volatility. Remember: if our long-term signal is green and the VIX is below 20, we view any dip as a buying opportunity.

The SKEW spiked to 155, coinciding with three instances of volatility in recent years. From here, new highs would suggest that smart money is actively chasing the latest leg higher in the S&P 500. Conversely, a reversal to the downside would indicate increasing risks of a significant downturn in stocks, similar to the last three instances when this SKEW dynamic occurred.

The Put/Call Ratio is potentially bottoming, suggesting that the rise in out-of-the-money options demand is for downside put protection and not hedge fund chasing.

The two sectors currently rated by analysts to outperform, energy and financials, indicate that the market is positioned for higher oil prices, which would exert broad upward pressure on inflation, and higher-for-longer Fed policy rates, which will likely choke off economic growth.

The bottom line is that the question "Where does the market go from here?" cannot be answered with certainty. Based on the majority of trends and indicators I track (in addition to our signaling process), the risk-reward dynamics of adding to the 2024 equity market rally have significantly deteriorated since the start of Q2, despite new highs in the S&P 500 and Nasdaq Composite Indexes last week. In the longer term, the risk of a cyclical economic downturn (and risk assets) is as high as it has been since 2007. Investors waiting for 5-10% pullbacks to add exposure should ensure they can quickly shift their investment objectives from optimizing returns to preserving capital as we navigate through an uncertain 2024.

I am bullish now and bearish on the macro picture.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President