No Fear in New Highs: Why We’re Staying Long

Earnings are accelerating, flows have done their job, and the breakout is backed by data, not hype. The path forward demands rotation, not retreat.

All of our signals are green, and we are fully invested.

The S&P 500 continues to push into record territory, an undeniably strong signal for markets. Still, I keep hearing skeptics argue that new highs are something to be feared, or worse, that they’re a warning sign.

Let’s be clear: progress in the market REQUIRES new highs. This is absurd because new highs are what every investor wants to see. The S&P 500 is going to double someday, and in order for it to reach 12,800 from today’s 6,400, it has no choice but to keep setting new records along the way. That’s how compounding works.

New highs aren’t something to shy away from. They’re a feature, not a flaw.

We are still in the early innings of earnings season, and it’s off to a good start. As of July 25, 34% of S&P 500 companies have reported, with 80% beating EPS estimates and 80% topping revenue forecasts. The blended earnings growth rate for Q2 2025 is tracking at 6.4%, up from 4.9% at quarter-end, with standout contributions from Communication Services (+34%) and Financials (+10%). While the pace of growth is slower than recent quarters, this marks the eighth straight quarter of earnings expansion. The market is rewarding beats aggressively, with positive EPS surprises leading to outsized price gains versus historical norms.

So let’s not fear strength, let’s embrace it.

S&P 500 futures closed the day just below all-time highs at 6,425, continuing to consolidate in a tight range after breaking the April-to-June uptrend line earlier this month. Despite that breakdown, price remains firmly above the 21-day EMA and continues to hold the prior resistance zone between 6,095 and 6,260, which is now acting as support.

While the series of higher highs remains structurally bullish, the momentum picture has turned more cautious. A prolonged RSI divergence has persisted since late June, with RSI unable to push beyond the low 70s even as prices climb. This flattening in momentum suggests the rally is losing steam, and further upside may require a reset.

The 6,241 level, marked by last Wednesday’s swing low, remains a critical downside trigger. A break below that would likely confirm a shift in trend character and invite increased selling pressure.

Until then, the market holds a constructive but fragile posture, resilient in price, but flashing subtle internal warnings.

We're still bullish on the S&P 500 and ready to put money to work on any meaningful dip.

The Russell 2000 is trending higher, indicating technical progress, but momentum is waning. With RSI diverging and relative performance stalling, the path forward likely involves some consolidation before another leg up.

We remain long small-cap stocks.

Further on that note, small-caps appear to be showing a bottoming here relative to the S&P 500. The combination of renewed momentum behind the Trump-era tax cuts and the growing likelihood of Fed rate cuts later this year (or next year) is reviving the investment case for US small-caps, especially those more sensitive to interest rate and tax policy.

At the same time, this could reflect a growing hesitation to keep chasing the mega-cap trade. With stretched valuations and mounting concerns around an economic slowdown, investors may be rebalancing towards parts of the market that still offer relative value (like small-and mid-caps).

Our ARKK position has decisively cleared key resistance at $68.03, breaking out of a multi-year base and confirming upside momentum. The ETF is now trading near $75.80, with a measured move target pointing toward $101.86, a level not seen since 2022.

Momentum is supportive, with RSI holding in bullish territory and price well above the rising 50-day moving average. Relative strength vs. the S&P 500 has also started to improve, marking a potential inflection in ARKK’s longer-term underperformance.

Bottom line: As long as ARKK holds above $68, the path of least resistance remains higher. The breakout in profitless tech is real, and the risk/reward favors trend continuation toward the $100 zone.

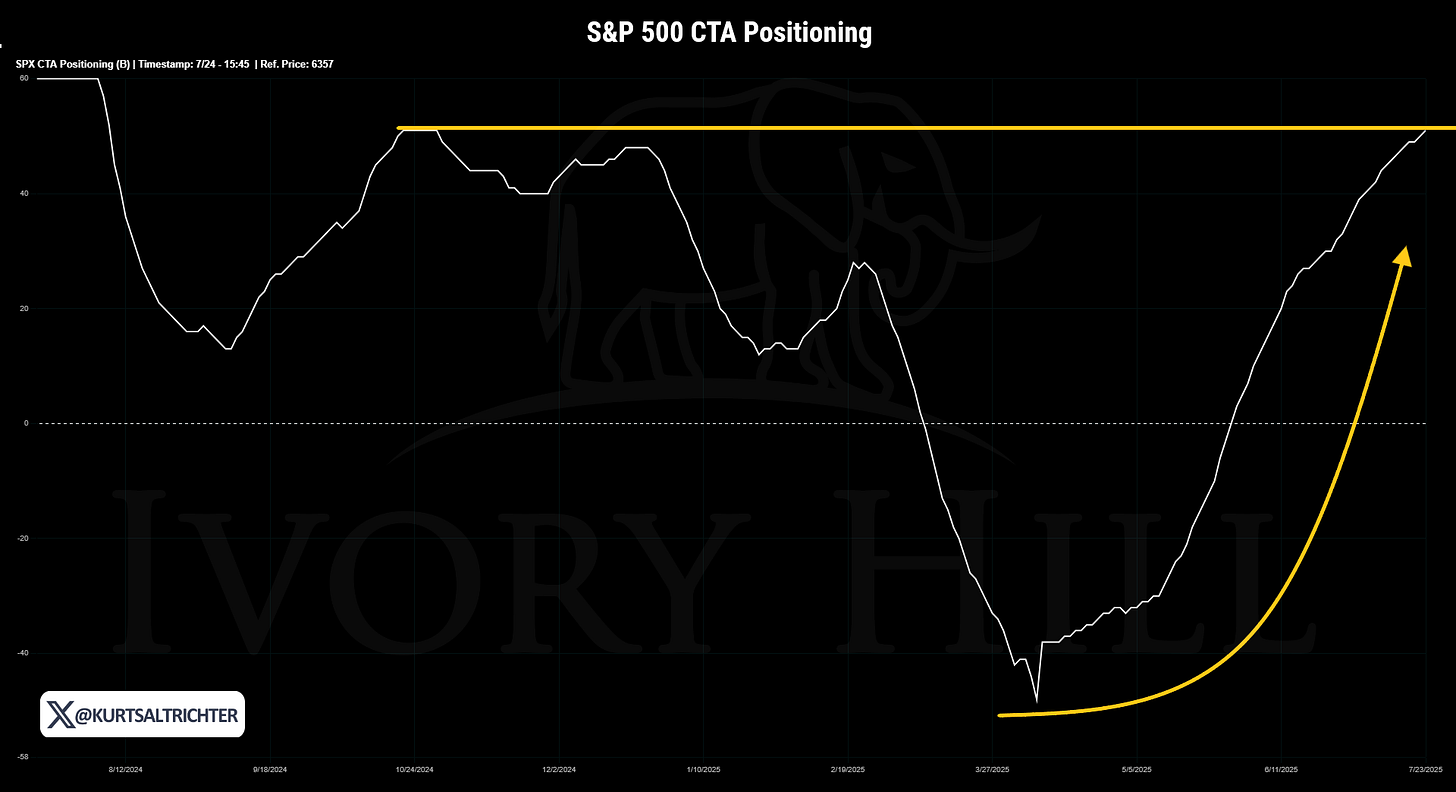

Flows and Dealer Gamma

Positioning tailwinds have done their job. CTAs and VolControl funds have aggressively re-levered as volatility collapsed, providing a reflexive bid that’s helped drive the S&P 500 to all-time highs. Now, with both models (CTA and VolControl) near full allocation and the market sitting in a positive gamma regime, we’re in a zone of stability, low realized vol, tight intraday ranges, and orderly price action. That doesn’t mean a crash is imminent. In fact, these conditions often support grind-up markets. But it does mean new upside may require fresh catalysts, because the mechanical buyers have largely done their buying.

The setup is still bullish, but it's now more dependent on rotation, earnings follow-through, or macro confirmation to keep the tape moving higher. The risk isn’t in being long, it’s in assuming the same flows will keep doing the heavy lifting from here.

Macro Play

We are entering a macroeconomic regime that will emphasize rising growth and disinflation. While I think the August 12th CPI will be colder than anticipated ~2.6%, this won’t change the narrative. This environment is favorable to high-beta and innovation names like ARKK and BTC (we are long both).

Please do not confuse disinflation with deflation. Disinflation means prices are still rising, but at a slower pace than before. Deflation means that overall price levels are falling year-over-year.

Despite its limited trading history following its IPO last month, Circle Internet Group, Inc. stands to benefit from this macro regime, an environment that historically favors emerging growth stocks, particularly those in disruptive finance and digital asset ecosystems. CRCL’s positioning in this evolving space gives it thematic upside as capital rotates back toward innovation sectors.

After rocketing over 300% since its IPO, it has been pulling back, creating a potential accumulation zone within the broader bullish trend. This kind of near-term weakness is the context of accelerating growth, which is often a high-probability entry point.

CRCL stands out as a fundamentally supported growth play in a macro regime built to reward exactly this profile. While the stock is young, its accelerating strength, thematic alignment, and institutional backing all argue in favor of upside. In short, CRCL is a strategic allocation into the right stock at potentially the right time.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board by scheduling a portfolio review meeting with me by clicking below.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Some fear comes during drawdowns, but if the system is proven and working, is just about waiting for the new trend to come