RiskSIGNAL Flashed Green on December 5th

It might be short-lived

The way you create deflation is you create an asset bubble.

-Stanley Druckenmiller

The Ivory Hill RiskSIGNAL™ turned green on Tuesday (December 5th) and we are layering back into this market. Our short-term signal concluded this week green, while our mid-term signal ended the week in the red. However, it is anticipated that the mid-term signal will likely turn green next week.

Immediately following our October 11th sell signal, the market came down and touched its longer-term trend line and held strong, which is a positive sign to see. Yet even with the nice rally we have seen over the past month I still have some concerns.

First, was the October 11th red signal a false signal? Possibly. When we have a volatile market like this, the chances of a false signal rise more frequently - there is no way of avoiding this. More often than not, in these types of market conditions (high volatility, high uncertainty) the head fake actually comes on the subsequent green signal following the first red signal during a downturn.

This is one of the reasons why we do not go to 100% cash or completely reduce exposure to stocks as false signals do happen and should be expected from time to time.

If we look at a backtest of the signal during 2008, you can see two instances where the signal head fakes but in the end it does what we want it to do, which is sidestep 70-85% of the drawdown or major market crash allowing us to deploy capital into the market later to capture 70-85% of the uptrend.

It’s important to note that unlike our short-term and mid-term signals, the long-term RiskSIGNAL™ is reactive by design. The goal is not to call tops and bottoms, but instead to identify trends and opportunities through our quantitative signaling process.

False signals are virtually impossible to avoid if the market is not giving you the opportunity set.

The only person that I know who had a completely flawless indicator that perfectly timed every top and every bottom was Bernie Madoff, and we all know the outcome of that situation.

I think the sell signal on October 11th was accurate, and while Tuesday's buy signal might potentially be a false positive, it's important to remember that our approach is firmly rooted in a rules-based strategy using our quantitative signaling process. This method, grounded in mathematical analysis, is key to eliminating emotional biases in decision-making. I have put thousands of hours into this signaling process and I have learned to just follow the signal because its more right than it is wrong. When the signal is green, there is a 73% probability the market continues to rise and a 27% probability that the market will fall. I will take those odds any day of the week.

Should Tuesday's buy signal prove to be a false signal, we should find out rather quickly, thanks to the responsive nature of our signaling system, which is adept at tracking market movements and downward patterns. In the event of further market downturns, triggering another sell signal, we are well-prepared to quickly reduce equity exposure and increasing cash levels, a proactive measure to protect our clients' hard earned capital.

S&P 500: New All Time Highs Ahead?

This week, I renewed my focus on the Fibonacci retracement levels from the 2022 bear market. The chart features white circles highlighting key interactions with these Fibonacci levels throughout 2023. Notably, there was a period of hesitation at the 78.6% retracement level of 4,533, where the S&P 500 lingered for the better part of the last two weeks. However, a significant development occurred on Friday when the index broke higher, closing at a new high for 2023. This is a strongly bullish signal for the medium-term trend of the broader stock market, indicating that a move towards the early 2022 record highs is now the more likely scenario.

Taking into account the extent of the pullback in the second half of 2023, which was approximately 475 points, I have established a new measured move target for the S&P 500 at 5,061. Reaching this target would not only represent a significant recovery but also set new record highs for the S&P 500 Index.

VIX: Beachball Underwater

Last week, the CBOE Volatility Index (VIX) moved sideways, hovering around the low levels established earlier in 2023. This trend aligns with a bullish investor sentiment and a growing, somewhat worrisome, complacency in equity markets as December begins. The daily chart shows a lack of even a “lower high” to indicate a downtrend, as the drop in volatility throughout November was both rapid and systematic. Although the RSI indicator has seen a slight rebound from its recent lows, it remains in a deeply bearish territory, staying well below the 50 mark.

Looking forward, a near-term uptick in the VIX is anticipated, given that this options-based measure of volatility has plummeted by nearly 50% since reaching a six-month peak above 20 in mid-October. Initially, this early Q4 rise seemed to signal a more significant, potentially enduring bearish shift in the broader stock market. However, the recent lows in the VIX have, for the moment, put such concerns to rest.

In essence, the pronounced movement in the VIX over the past month indicates a capitulation among equity bears and a massively reduced demand for market hedges.

This is evident as those opposing the popular “short vol” trade among financial institutions appear to have conceded defeat. However, an overly complacent market is often prone to volatility spikes, a risk that is building up with the VIX's new lows last week and today. Investors have a is a serious lack of interest in downside protection right now.

If you're considering buying a VIX ETF or ETN, such as VXX, VIXY, VIXM, or VXZ, I would highly advise against it. To achieve profitability with these ETFs, your market timing must be exceptionally precise. Instead, a more strategic approach to capitalizing on the VIX at this time would be to invest in TLT.

Tech: The Magnificent 7 might be losing its footing

Last week, the Technology Sector, represented by XLK, experienced a modest rally, gaining 0.63%. The RSI (Relative Strength Index) corroborated this upward movement, maintaining its position in bullish territory. However, it's important to note that the RSI has started to move sideways, which suggests a potential loss of momentum in the sector.

In terms of relative strength compared to the S&P 500, the Technology Sector continues to adhere to the bullish uptrend line established in 2023. This ongoing trend supports the maintenance of an 'Outperform' rating for the sector, indicating that it is still performing well relative to the broader market. We are bullish on bubble-cap tech.

Panic Index = Broken

Recession Risks

Examining the present market environment, portfolio risks are at their highest level since the period preceding the Great Recession in the mid-2000s.

This statement isn't intended to be dramatic but is grounded in factual data. Since 1976, the yield curve has inverted on seven occasions, as indicated by the red boxes in the accompanying chart, which shows the spread between the 10-Year and 3-Month Treasury yields.

In six out of the seven instances where the yield curve inverted, an economic recession and a bear market in equities ensued, with the only exception being the latest inversion, which remains unresolved. Notably, the current inversion is the most pronounced in the last 50 years, dropping well below -100 basis points.

Despite the yield curve's flawless record in forecasting recessions, most investors often believe that "this time it's different." A prime example of this is the recent trend of investors jumping back onto the "soft landing" theory, reminiscent of their behavior in 2000 and 2006.

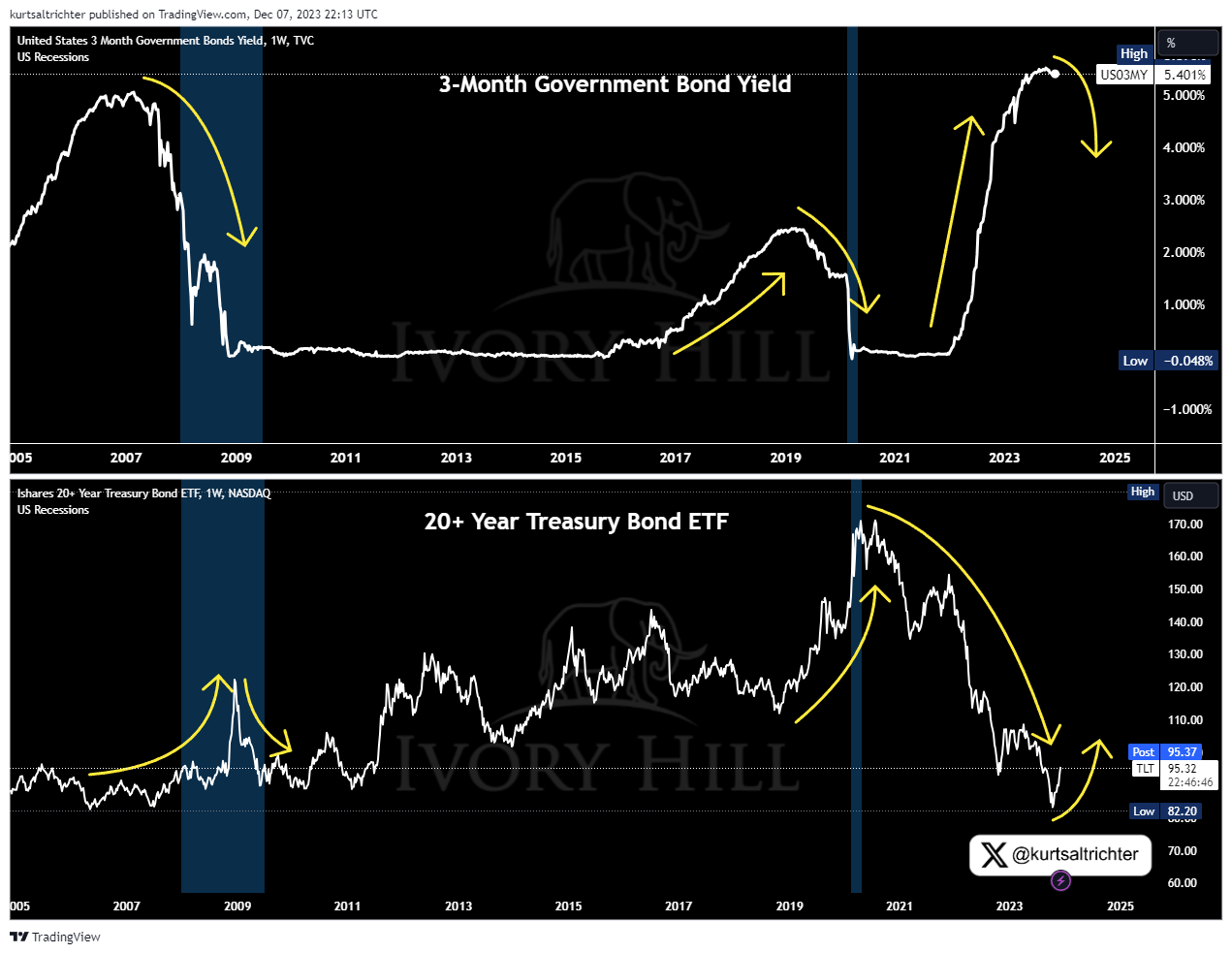

Interest Rates and the Bond Market

The attractiveness of a bond is significantly influenced by its coupon rate, which is closely tied to the level of interest rates. In times of rising inflation and rising rates, bond prices go down. Conversely, in a climate of controlled inflation and falling rates, bonds become more attractive due to their perceived safety and income potential, leading to increased buying activity. This creates an inverse relationship between interest rate trends and the bond market.

This inverse relationship is shown in the chart below, which shows the correlation between the bond market and rates, using the 3-month Treasury bond rate as a reference. This rate is a good proxy for the Federal Funds rate but exhibits less volatility.

We are seeing this happen right before our eyes as the Fed went on the most aggressive rate hiking cycle in history that has resulted in Treasuries crashing by over 50%. We are now seeing what looks like to be the start of a sustained uptrend (not confirmed).

This is important because: First bonds crash, then stocks crash.

A rise in interest rates triggers a bond market sell off, which often comes before a stock market crash. However, the key question is how the bond market predicts changes in interest rates?

Interest rates are mostly influenced by Fed policy. A tight policy is adopted to combat inflation, while a more accommodating policy is used to stimulate growth.

Understanding the direction of interest rates involves predicting future inflation trends.

Commodity and raw material prices provide early signals of where inflation is going. If commodities are rising then inflation is also rising.

Increased demand for industrial and agricultural commodities are an early warning that the economy is overheating, leading to higher inflation.

A surge in commodity prices comes before an increase in interest rates.

For the bond market to effectively anticipate rate hikes, it monitors commodities.

Among these, crude oil prices are particularly influential. As energy is a fundamental component of nearly all economic activities.

Crude Oil Prices and the Bond Market

The movement in oil prices significantly influence the cost structures across all sectors of the economy, making it a critical asset to track for inflation forecasts.

Changes in crude oil prices directly affect the pricing of all end products. Everything that you buy from any store was likely delivered to that store by truck so the price of diesel fuel will directly impact your grocery bill. Starting to make sense?

When oil prices rises, the Fed responds by tightening monetary policy, leading to higher interest rates and, historically, subsequent recessions. These recessions typically result in reduced consumption and market crashes because the Fed is always too late to raise rates and always too late to cut rates.

When oil prices rise, that is inflationary leading the Fed to raise rates.

The interplay between bonds and oil prices is crucial as it influences interest rate trends, affects sectors sensitive to interest rates, and impacts the overall equity market.

The chart below demonstrates the relationship between crude oil and Treasuries, highlighting their tendency to move in opposite directions. As crude oil prices rise, bonds typically drop, and the reverse is also true.

For example, when crude oil prices dramatically dropped by 70% in 2008, bonds rallied over 40%. Following the bond rally, stocks crashed over 50%.

To summarize the intermarket dynamics since 2020:

Federal Reserve's Response to the Pandemic: In response to the economic panic caused by the pandemic, the Federal Reserve implemented a massive monetary stimulus, printing trillions of dollars. Additionally, Congress issued stimulus checks, many of which went to individuals who may not have been in dire financial need.

Consumer Behavior: Flush with cash, consumers either spent heavily at large retail stores or invested their money into various assets, driving up asset prices.

Inflation and Money Supply: The increase in money supply served as an early indicator that consumer spending and asset prices would rise, subsequently leading to a significant increase in demand for commodities.

Oil Prices and Inflation: The rally in oil prices was an early sign that inflation was set to increase. This, in turn, was a precursor to the Federal Reserve's decision to start raising interest rates.

Rising Rates and Treasuries: The increase in interest rates led to a substantial decline in Treasury prices, crashing over 50% over the last couple years.

Economic Slowdown and Oil Prices: As the rate hikes began to impact economic growth, oil prices have started to fall, indicating a reduction in inflationary pressures.

Treasury Bonds Becoming Attractive Again: With the drop in inflation, Treasury rates became more appealing, leading to the current rally in Treasury bonds.

Flight to Safety and Market Impact: This situation is likely to result in a 'flight to safety' trade, where investors move their assets to safer investments like Treasuries. This shift, coupled with a significant slowdown in earnings, will likely lead to a crash in the stock market.

This is how I see this cycle playing out.

The stakes are getting higher and risk is becoming more and more expensive. That’s not to say the market still can’t make all time highs into year end as markets can stay overbought for long periods of time.

Bubble-Cap Tech

Bubble-cap tech is bullish trend so we own MSFT, AMZN, META, GOOGL, and NVDA in our macro portfolios. We also added DKNG back to the mix.

Quick note on DraftKings (DKNG) is set for further expansion following the announcement by Kindred Group to discontinue its U.S. operations, including the Unibet brand, by the end of Q2 2024. This decision indicates a trend towards consolidation in the online sports betting market, which could work in DraftKings' favor. As a leading entity with a substantial market presence, DraftKings is well-positioned to capture customers looking for alternatives to Unibet.

In Ohio, DraftKings faced a minor hurdle with the increase in gaming taxes. Nonetheless, there is a mounting pushback against this tax increase, which could lead to a reversal, potentially enhancing DraftKings' operations in the region. Considering these factors, DKNG continues to be a strong Long investment.

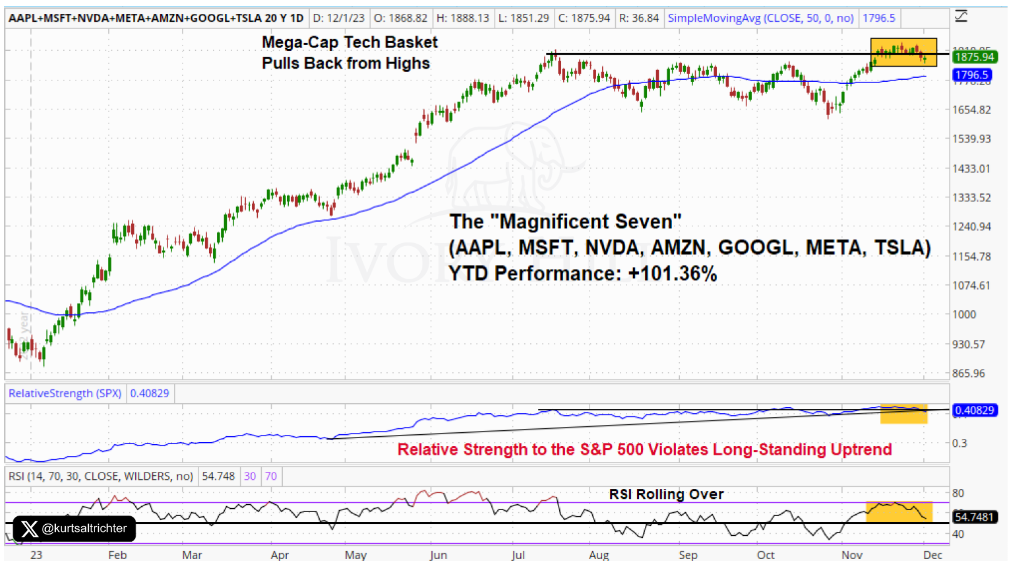

The Magnificent Seven (M7), comprising the largest stocks in the S&P 500 by market cap - AAPL, MSFT, NVDA, AMZN, GOOGL, META, and TSLA - were key drivers of the S&P 500's substantial gains up to the summer highs. However, last week saw these tech giants relinquish some of their YTD outperformance as market breadth showed significant improvement in November.

Despite gains in most major indexes, bubble-cap tech stocks experienced a decline over the week. This drop was mirrored in the RSI, which fell to its lowest level since early November, a period when the group's valuation was much lower than Friday’s close.

The relative uptrend of the M7 against the S&P 500, dating back to the first half of 2023, was breached last week. While this doesn't necessarily spell a bearish outlook for bubble-cap tech, it does indicate that other sectors and styles may be better positioned for short-term outperformance.

As long as the RiskSIGNAL™ is green, we will look to add to these positions on down days unless they break trend.

The daily chart for 2023 illustrates a classic uptrend pattern, progressing from the bottom left to the top right, and this trend is still intact.

However, there's a noticeable decline in momentum among the M7. Recent weeks have seen a significant broadening of market breadth and a trend of profit-taking in bubble-cap tech stocks, signaling a shift away from the focused leadership that was prevalent in the first half of 2023.

In the current market scenario, maintaining these stocks is crucial since they have driven all the gains in the S&P 500 this year.

We've made a modest move into small-cap stocks via IWM. If the market breadth continues its upward trend, small-caps are likely to outperform. We are maintaining a small short position in our macro strategy as small-caps are still experiencing a bear market.

Furthermore, Cathie Wood's ARKK ETF that famously rallied 350% from the COVID lows to the 2021 highs has recently confirmed an uptrend. In light of this development, we are planning to initiate a position in ARKK sometime in the coming week.

Treasuries

We currently have a 10% allocation in 20-Year Treasuries and, for certain clients, we're also investing in a leveraged 20-Year Treasuries ETF (TMF). This strategy is based on the belief that Treasuries present significantly lower downside risk compared to stocks, and the potential for substantial upside gains is also higher than stocks, despite how crowded this trade is becoming. If the market cycle unfolds as I anticipate it will, it's crucial to invest in TLT and TMF now. The opportunity for profit lies in catching the upward turn early, rather than waiting for the trend to be fully established. We're still in the early stages of movement in TLT, and I do expect a correction to occur over the coming weeks but we need to dig our heels in on this trade.

Should the 30-Year Bond Yield reach 4.62%ish, we plan to increase our investment in TLT, barring any changes in the current market conditions.

Gold

Gold sprinted to new all time highs last week. From a technical and macro perspective, the outlook for metals like Gold, Silver, Platinum, has improved substantially over the last week and I think we get more outperformance from gold in the months ahead.

From a signaling prospective, seeing gold continue to rise is bearish for stocks.

Bitcoin

Bitcoin has been a successful trade for us so far. We initiated our position in Bitcoin via the BITO ETF in the last week of October, followed by an investment in GBTC in mid-November. Additionally, we added exposure to Ethereum via ETHE at the start of this month.

Our decision to invest in Bitcoin and Ethereum is driven by the current economic climate characterized by slowing growth and high inflation. Historically, in similar conditions of decelerating growth and rising inflation, Bitcoin has shown to yield quarterly returns of over 160% about 53% of the time. I will expand more on the investment thesis for Bitcoin in another report.

However, it's important to highlight that we maintain relatively small positions in cryptocurrencies, typically ranging from 0.50% to 4.0%. This risk management approach is due to the extreme volatility of this asset class and its susceptibility to influences from social media and news headlines.

As recent developments have heightened the likelihood of a significant market downturn and recession, it's more important than ever to remain disciplined and not let personal sentiments interfere with your long-term investment goals. We will continue to add to positions that exhibit bullish trends, adhering closely to our RiskSIGNAL™ until it tells us to raise cash levels.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President