Special Update: The Ivory Hill RiskSIGNAL™ Has Turned Red

What's Really Pressuring Stocks

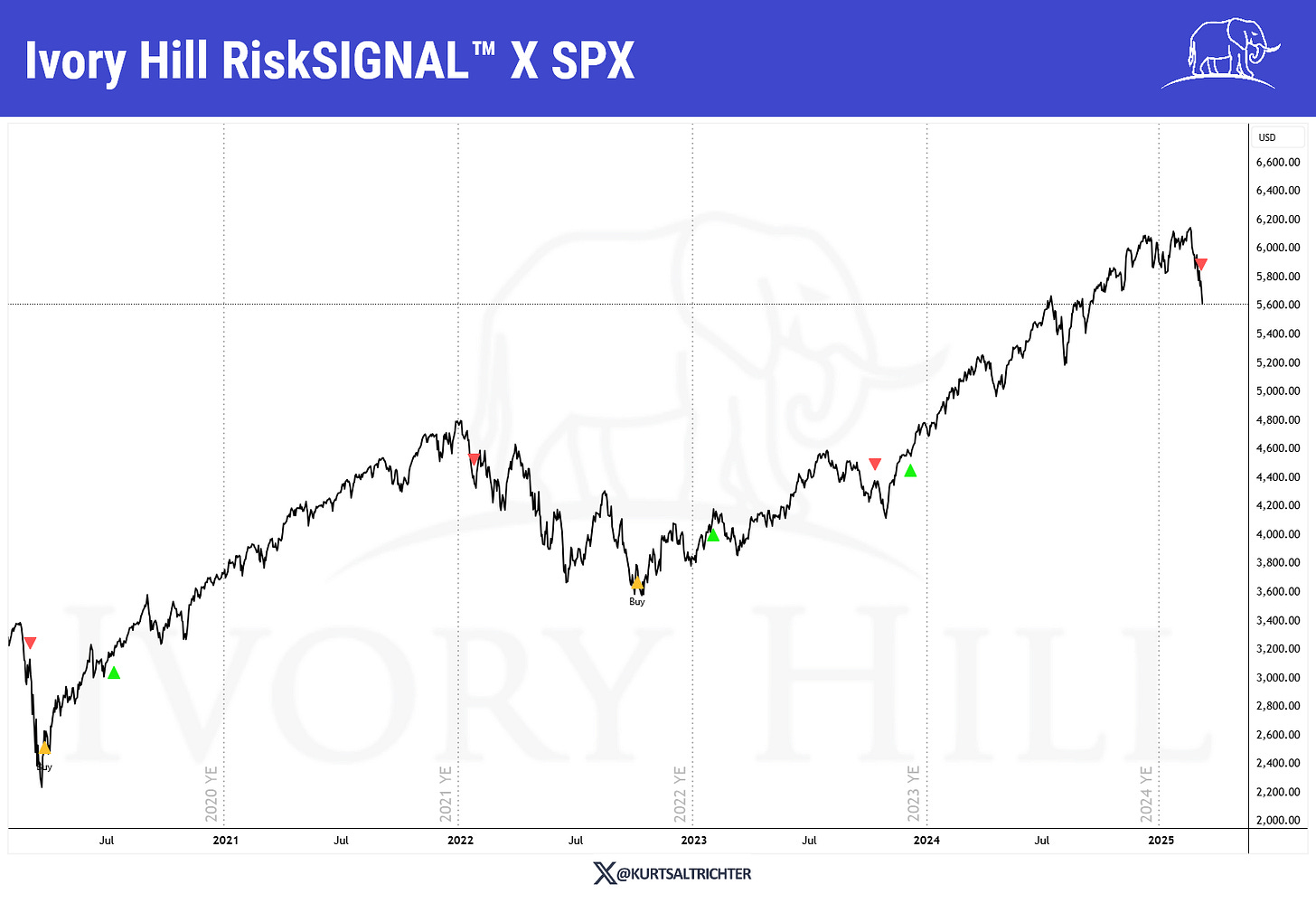

The Ivory Hill RiskSIGNAL™ turned red on Friday, March 7, for the first time since October 2023. In response, on Friday, we reduced equity exposure and now hold roughly 36% in cash and bonds. While an oversold market should spark a trader’s rally, any rally when the RiskSIGNAL™ is red should be seen as an opportunity to reduce risk, not add exposure.

This is not 2022 all over again. This pullback should be short-lived, and markets are set for solid gains by year-end.

With inflation cooling, bonds are set for a comeback. We increased exposure on Friday, and I expect March and April CPI to come in cold—setting up long bonds for a strong move. If stocks sell off hard, TLT could see a massive rally if the flight to safety trade gains momentum.

Why Are Stocks Selling Off?

Stocks continued to slide last week, driven by concerns over tariffs (Trump Tape Bombs), underwhelming tech earnings, and a constant stream of unsettling headlines. Sentiment remains deeply negative, with calls for further declines becoming more frequent. In the short term, the market outlook has clearly worsened. Before tariff-related uncertainty took center stage in early February, stocks thrived in an environment of steady economic growth, Federal Reserve rate cuts, AI-driven optimism, and expectations for fiscal stimulus.

That setup has been been broken. However, given the overwhelming noise in financial media, it’s essential to clarify exactly why stocks are struggling.

At its core, the market is reacting to a sharp rise in uncertainty—and the fear that this uncertainty could lead to several negative outcomes. The current market logic suggests that tariff-related turmoil will persist for at least another month, with further policy instability expected in three key areas:

Government Shutdown Avoidance – The ongoing uncertainty over whether Congress can agree on a budget deal without another last-minute scramble.

Debt Ceiling Extensions – Continued back-and-forth over raising the debt limit, which adds another layer of unpredictability.

Tax Policy Extensions – Uncertainty surrounding potential tax cut extensions, creating hesitation among businesses and investors.

This policy chaos could cause consumers and businesses to pull back on spending and investment, leading to an economic slowdown and weaker corporate earnings. With the S&P 500 still trading above 21 times earnings, the index remains vulnerable to at least a 10% decline before reaching more stable valuation levels.

Adding to the challenge, the Federal Reserve cannot counteract the dysfunction in Washington. Even if the Fed implements another rate cut, it won’t resolve the uncertainty stemming from erratic policy decisions.

If these risks fully materialize, the market could see a pullback of 10% or more. Until there is movement toward a more stable policy environment, the most likely scenario is a choppy market, with the S&P 500 fluctuating between 5,700 and 6,000.

That said, while these concerns are valid, fear—not actual economic deterioration—is the primary driver of recent market weakness.

Separating Fear from Fundamentals

Despite the volatility, the underlying economic data remains stable. Federal Reserve Chair Jerome Powell recently stated that the economy is still on solid footing, even if there are signs of slowing momentum. Corporate earnings have also held up, and there have been no widespread downward revisions to earnings estimates.

Furthermore, while trade tensions continue to make headlines, the real impact of tariffs has been more muted than feared. Exemptions under the USMCA agreement significantly reduce the direct economic impact of Canadian and Mexican tariffs.

Tactical Strategy: Managing Risk Without Overreacting

Given the uncertainty, a cautious approach is warranted. However, the negative scenario many fear is not inevitable. Economic and earnings data are still holding up, making a balanced strategy the most prudent course of action.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Email: kurt@ivoryhill.com | ivoryhill.com