Steepening Yield Curve: Top Sectors to Watch in the Next Fed Rate Cut Cycle

Banks, small caps, and bond proxies could see major upside as the 2-Year signals easier policy ahead

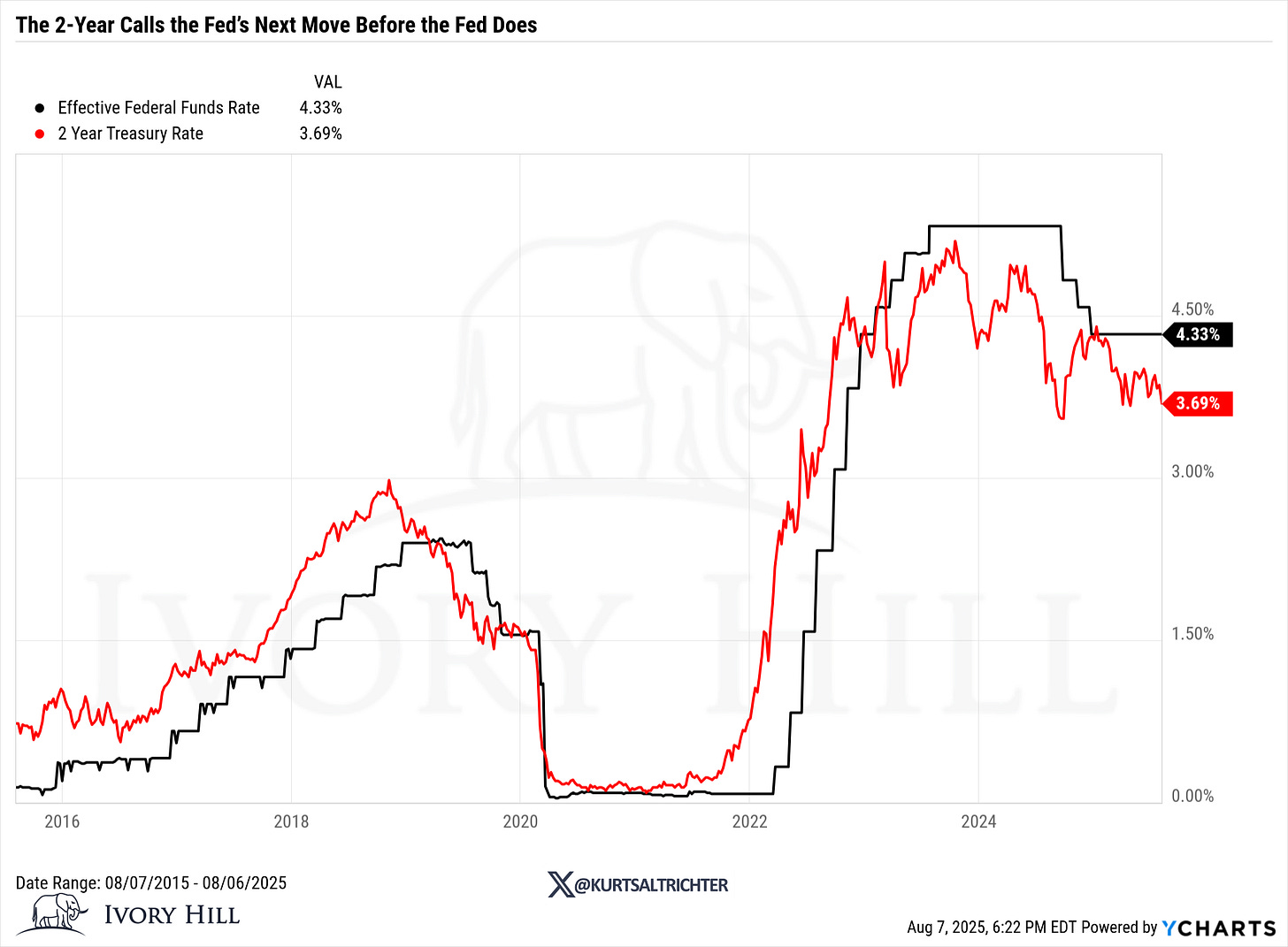

Despite the choppiness in stocks and bonds this year, one trend has been running steadily in the background: the yield curve has been steepening.

Since mid-2023, the 10’s-2’s spread has moved decisively higher, starting 2025 at 29 basis points and now pushing above 50 bps, the steepest slope since early 2022. The driver has been almost entirely on the short end, with the 2-Year yield falling from 4.40% in January to around 3.70% today. That drop has been fueled by expectations of Fed rate cuts, generally stable inflation, and lingering growth concerns that point to a soft landing rather than a recession.

In markets dominated by noise, I’ve always believed there’s a bull market somewhere, and right now, the yield curve is quietly creating tailwinds for certain sectors.

1. Banks

Banks profit from the spread between what they pay to borrow in the short term and what they earn lending in the long term. As short-term yields fall and are likely to keep falling, net interest margins expand. Large money center banks dominate the Invesco KBW Bank ETF (KBWB), while the SPDR S&P Regional Banking ETF (KRE) offers broader exposure to smaller institutions. With policy easing likely and a supportive political backdrop, banks stand to gain if growth remains steady. The caveat: credit quality must hold up.

2. Small Caps

Small-cap companies rely heavily on borrowing, often through credit lines tied to short-term rates. When the short end of the curve drops faster, their financing costs fall disproportionately, giving them an immediate boost. If the Fed delivers the aggressive rate cuts the market expects in 2026, this advantage could persist for multiple quarters. The Russell 2000 has been flat this year, but a continued steepening led by the short end would be a strong catalyst. This would be good for profitless tech, so we are also long ARKK.

3. Utilities & REITs

These bond proxy sectors become more attractive when short-term yields decline and the curve steepens. For utilities, that’s an added tailwind on top of booming electricity demand from AI-related infrastructure, the Utilities Select Sector SPDR Fund (XLU) recently hit all-time highs. For REITs, the easing in both long-term yields and inflation concerns removes a major headwind. If the 2-Year keeps leading rates lower, both sectors stand to benefit from improved relative yield appeal.

Bottom Line

If rate cuts play out as the market anticipates through 2025 and into 2026, the 2-Year should keep falling, the curve should continue steepening, and these sectors could be prime beneficiaries. But if growth breaks down and long rates drop faster than short rates, that steepening tailwind flips to a headwind, with economic worries taking center stage.

And remember - The one fact pertaining to all conditions is that they will change.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President