The Algos Are Waking Up

The machines aren’t chasing yet, but they’re close—and positioning says it won’t take much.

You may have noticed I’ve been quiet the past few weeks—unfortunately, I’ve been sidelined by a nasty skin infection on my index finger. Not exactly the macro catalyst I expected, but it’s made typing a challenge. I'm back now, healing up, and ready to dig into the data again.

The Ivory Hill RiskSIGNAL™ turned red on Friday, March 7, and we are still sitting on a significant amount of cash. Our short-term volatility signals are green while our mid-term volatility signal remains red.

Price Action Technicals – S&P 500 Futures

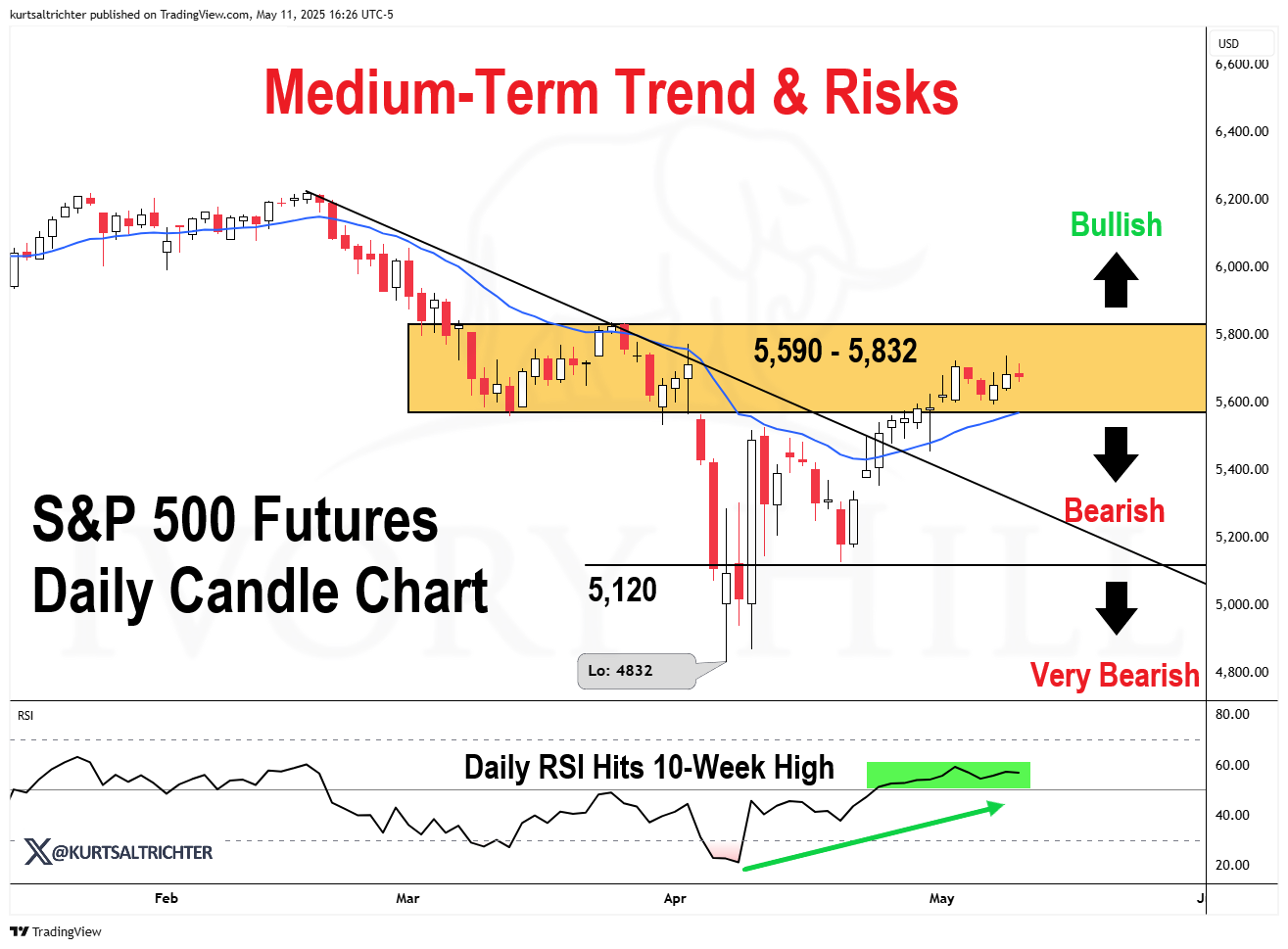

SPX futures remain trapped in the critical resistance zone of 5,590–5,832, where bulls have repeatedly stalled.

The RSI has broken out to a 10-week high, signaling renewed momentum, but price must break decisively above 5,832 to confirm the next leg higher.

A drop below 5,590 would suggest a failed breakout attempt; beneath 5,120, the structure turns outright bearish.

Trendline resistance from the March peak has been cleanly broken, adding to the bullish tilt we have been seeing.

Bottom Line: Momentum is building, but bulls must clear the top of this range with force. Until then, the risk of chop or reversal remains high within this zone.

It’s important to understand the market you're actually trading in. Today, automated trading accounts for an estimated 80–90% of daily market volume, driven by high-frequency traders, quant funds, and algorithmic strategies. These systems don’t think—they react with no feelings. They respond to volatility signals, price momentum, and order book dynamics at machine-level speed, often moving in synchronized waves. This herding behavior can accelerate both rallies and selloffs, creating feedback loops that distort traditional market signals. If you're trying to compete in this environment using fundamental reasoning alone, you're likely trading against a machine that already moved two steps ahead.

S&P 500 Options Dealer Gamma Exposure:

Market makers are currently slightly long gamma, which typically signals a period of reduced volatility. In a positive gamma regime, dealers hedge by buying into weakness and selling into strength, creating a suppression effect on price swings and helping to stabilize short-term moves. In contrast, when dealers are short gamma, they hedge in the same direction as the market—selling as prices fall and buying as they rise—which amplifies volatility and fuels more erratic price action.

Since February, the S&P 500 has spent most of its time in negative gamma territory, fueling sharper intraday moves. Now, it’s transitioning back into positive gamma—a shift that usually brings lower realized volatility. That said, the current exposure looks more neutral than decisively positive, meaning the suppressive effect on volatility may be limited for now.

Bottom Line: A sustained breakout above 5,832, paired with a continued build in positive gamma, would reinforce the short- to medium-term bullish case for the S&P 500 by aligning dealer flows with upward price momentum.

The Nasdaq-100 (NDX) flipped to positive gamma on April 23, ahead of the broader S&P 500. Tech-heavy components are benefiting from dealer hedging flows, helping to reinforce short-term upside stability. While gamma exposure remains modestly positive, this setup favors volatility suppression, though it remains vulnerable to sudden shocks.

Bottom Line: The NDX continues to lead in gamma stability, making it the most structurally supported index for reduced short-term volatility. A decisive breakout above 18,300, coupled with a deeper move into positive gamma territory, would strengthen the bullish case and signal more durable upside.

Small-caps (IWM) by no surprise are firmly in negative gamma since December 12, 2024. No meaningful dealer support in small caps - liquidity remains poor, and price action remains highly reactive. Asymmetric risk of vulnerable to macro surprises or liquidity shocks.

Bottom Line: IWM remains a volatility engine—approach with caution, particularly in thinly traded names. A meaningful breakout above key technical resistance, paired with aggressive deregulation under the Trump administration and lower rates, could revive small-cap momentum. But until small-caps pushes to new all-time highs, it's hard to argue we're in a broadening bull market.

S&P 500 CTA Positioning – Systematic Flow Analysis

CTA trend funds remain net short SPX, with positioning unwound aggressively since late February.

We are now observing a modest recovery in positioning — a potential shift in the systematic tide.

Should SPX continue to rally, CTAs will likely be mechanical buyers, fueling more upside through forced re-leveraging.

Bottom Line: CTA positioning is a coiled spring — further gains could ignite systematic buying, but downside reversals would remain sharp due to fragile exposure.

S&P 500 Volatility Control Fund Positioning

Vol control funds have sharply increased exposure after hitting their lowest point at the end of April.

This quick re-leveraging signals a potential feedback loop — lower volatility drives more buying, further dampening volatility.

If vol remains low, this trend continues — making a short-term pullback less likely without a macro catalyst.

Bottom Line: The vol-control bid is back. Systematic re-risking adds another layer of stability and upside fuel to the current rally.

Heading into the week, the focus is on whether SPX and NDX can maintain their positive gamma regimes. A continued build would likely keep volatility suppressed and reinforce dip-buying behavior, especially as volatility-control funds re-leverage. A VIX trending below 20 would serve as further confirmation that the market is in buy-the-dip mode. However, a reversal back into negative gamma—especially on the heels of a macro shock—could quickly reignite instability. Technically, a clean breakout above 5,832 on SPX futures would confirm the next bullish leg, while a break below 5,590 risks dragging the market back into chop.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Email: kurt@ivoryhill.com | ivoryhill.com

Great analysis. Could def keep on going up Sry about your finger.