The Bitcoin Drawdown That Finally Tests Strategy’s Flywheel

Strategy’s Flywheel, and Why I Shorted the Break Below 100,000

The Ivory Hill RiskSIGNAL has broken down but remains green. We have reduced high-beta exposure over the last couple of weeks, but remain long equities.

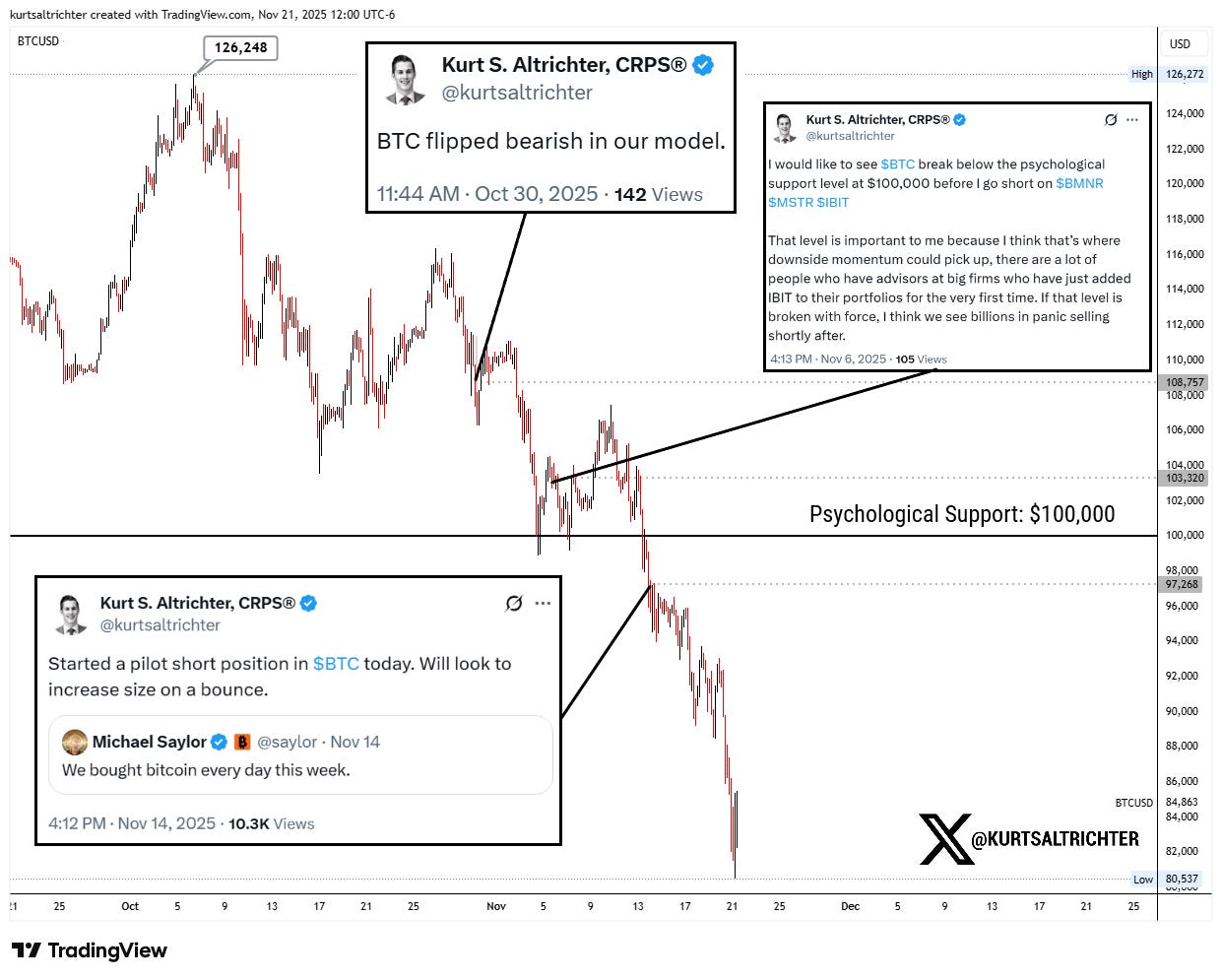

Bitcoin is sitting in the low 83k range as I write this, wrapping up its worst month since the FTX collapse in 2022. It is down more than 35% from the October peak above 126k. The move feels violent because it is, but it did not come out of nowhere. The setup was being built for weeks. If you were watching liquidity, positioning, ETF flows, and the psychology around 100k, none of this should feel surprising.

My model flipped Bitcoin into a bearish regime at the end of October. That was the first sign the character of the tape had changed. A few days later, I warned that 100k was the line that mattered. Once that level broke, you would get forced selling, not dip-buyers. And when that break came, I stepped in on the short side. I did not chase the first move down. I waited for the inflection.

Everything that has unfolded since ties back to liquidity, positioning, and the unwind of the biggest retail and institutional flow in this cycle.

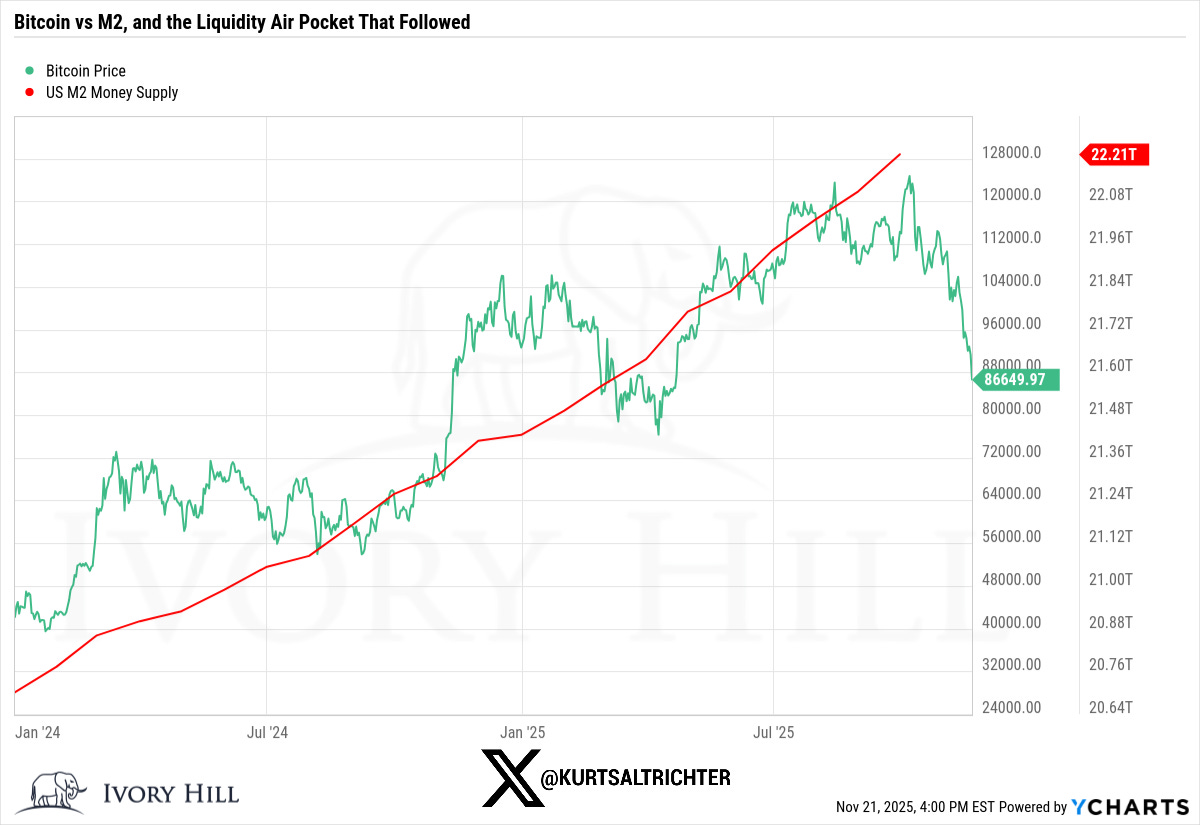

For nearly two years, Bitcoin acted like the purest expression of global liquidity. When liquidity was flowing, BTC outran everything. When liquidity tightened, BTC rolled first. That relationship held until late October when the odds of a December Fed cut collapsed almost overnight. The ten-year popped. The dollar accelerated. Tariff risk re-emerged.

Institutions did what they always do when conditions tighten: they hit the outer edges of the risk curve first. Bitcoin was the first casualty. AI was next.

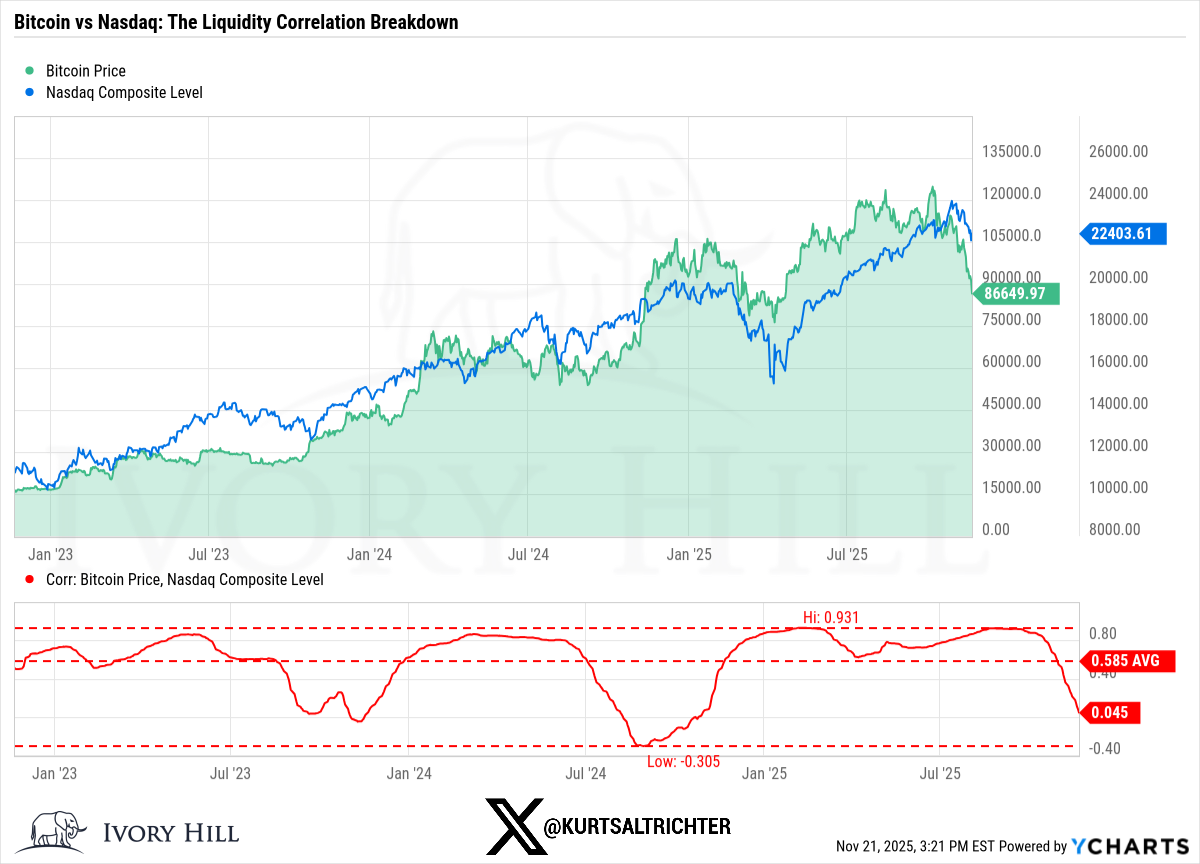

This is where the Bitcoin–Nasdaq relationship started to matter in a way most people were not watching closely enough.

For most of 2023 through 2025, Bitcoin and the Nasdaq moved like two sides of the same trade. The correlation regularly sat in the 0.6 to 0.9 range, which made BTC function like a levered tech stock.

That broke during this drawdown.

Bitcoin fell apart while the Nasdaq softened but held up materially better. That divergence is a message: the market is no longer de-risking broadly. It is de-risking at the edges. Bitcoin has become the preferred pressure valve.

A correlation unwinding from 0.93 toward zero does not happen in healthy liquidity conditions. It happens when the tape is repositioning into tighter financial conditions, and the speculators get hit first.

This matters for Bitcoin, but it matters even more for Strategy (formerly MicroStrategy), because their entire model sits at the intersection of Bitcoin’s volatility and the Nasdaq’s liquidity.

Where Strategy Actually Sits Today

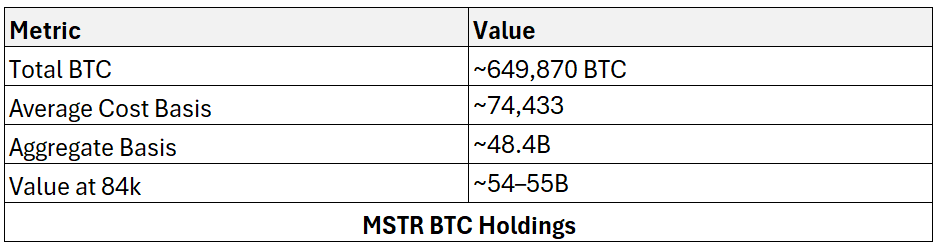

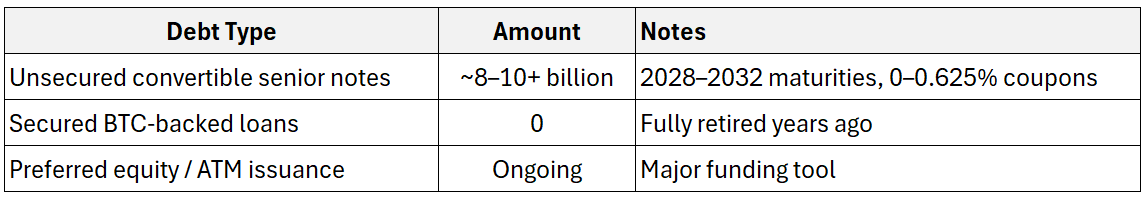

There is a lot of noise online about “Saylor margin calls” and leveraged BTC liquidation. Almost all of that is outdated and incorrect. Here is the actual capital structure as of November 21, 2025.

No collateral is pledged. There are no secured BTC loans. The old Silvergate loan from years ago is long gone.

There is no lender on earth who can force Strategy to liquidate BTC at a specific price. The meltdown scenario crypto social media is still obsessing over simply does not exist anymore.

The real pressure comes from something very different.

The True Risk: The Funding Flywheel Is Losing Lift

Strategy’s entire model depends on a simple reflexive loop:

The stock trades at a premium to the value of its BTC pile

They issue equity through At-The-Market (ATM) or convertible deals

They use the cash to buy more BTC

BTC rises, the premium widens, the cycle strengthens

That loop works only under specific conditions:

The mNAV premium must stay elevated

Index providers must keep Strategy inside major benchmarks

Credit markets must remain friendly

Bitcoin must not melt faster than the company can fund itself

Those conditions are now deteriorating.

The mNAV Premium Has Collapsed to ~1.1x

That is the lowest premium since 2020.

At parity (1.0x), every equity raise becomes openly destructive.

MSCI Is Reviewing Digital Asset Exposure Rules

A January 2026 ruling could remove Strategy from key indexes.

That would trigger 2–9B in passive outflows.

This is real. Not theoretical.

BTC/Nasdaq Correlation Remains High on Paper, but Asymmetry Is Back

That asymmetry is deadly for Strategy:

BTC drops faster than tech on risk-off days

BTC lags tech on risk-on days

The last time we saw this pattern was late 2022 at the bottom of the bear market.

This dynamic squeezes Strategy from both sides: its asset value falls while its valuation multiple compresses.

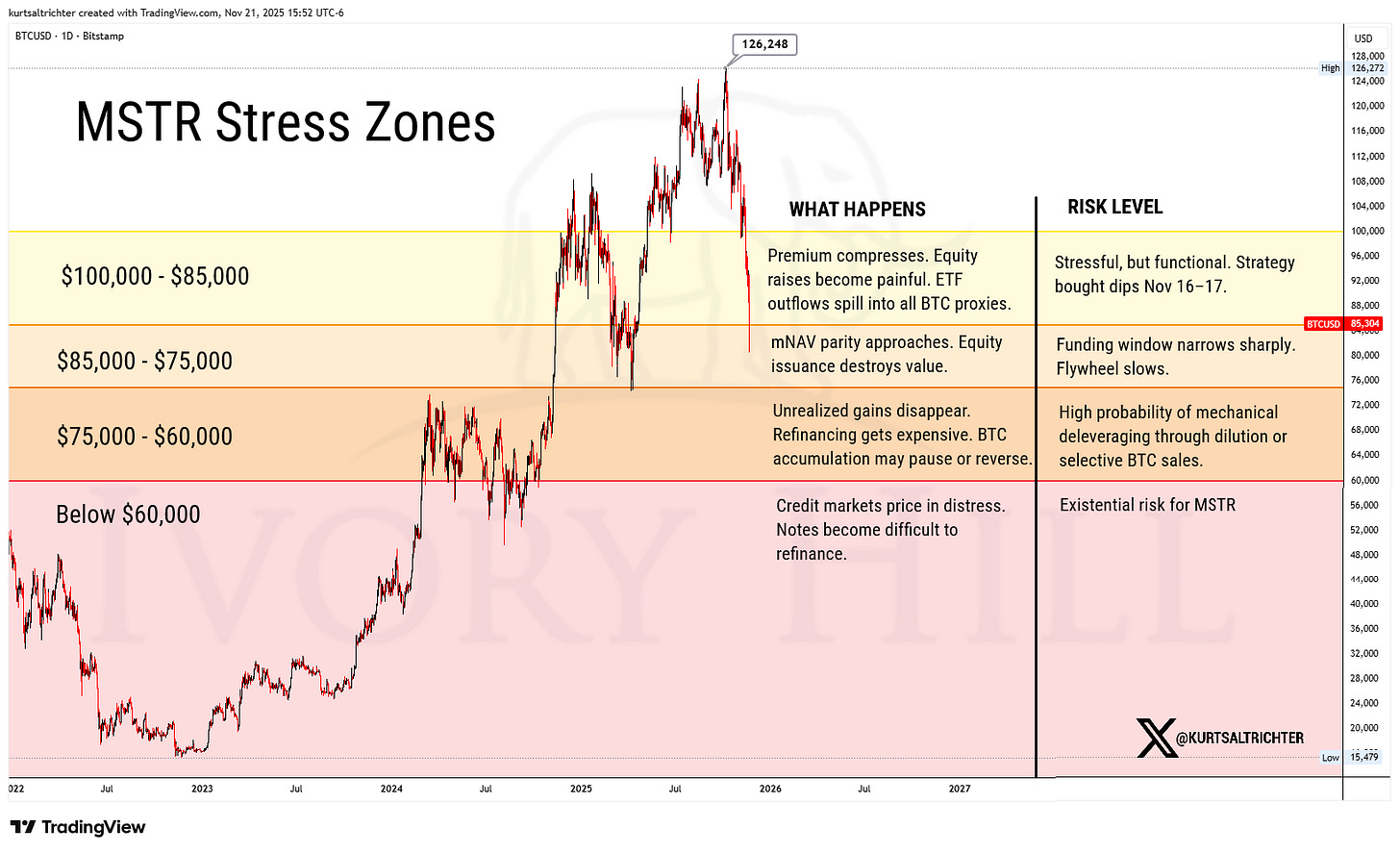

Where Pressure Actually Builds: The Realistic Timeline

Here is the truth nobody wants to spell out clearly. There are no BTC price liquidation triggers for MSTR. Everything is driven by how quickly the premium collapses, how expensive credit becomes, and whether passive flows remain intact.

This is not fearmongering. It is how capital structures behave when premiums collapse.

Is the Bull Cycle Dead?

No. This is a violent reset inside a longer cycle.

Every Bitcoin bull run has featured multiple 30–50% drawdowns.

Nothing about this move violates long-term structure.

What makes this cycle different is the size of the leverage built on top: ETF flows, corporate treasuries, and Strategy’s massive BTC book.

This downturn impacts more than just price. It pressures the whole structure of how Bitcoin has been financialized since 2022.

If this move has you panicking, your position size is too big. Bitcoin is volatile by nature (so this is not a surprise at this point), and the only way to handle that volatility is to size it correctly. For most long-term investors, that usually means keeping it in the one to three percent range. Our own models can take BTC up to twenty percent when conditions support it, but the chart above shows that we do not simply buy and hold in our active framework. We manage the position through signals, not emotion.

If you’re a long-term investor, you should actually welcome drawdowns like this. Five years from now, you’re not going to look back at an 83k entry and beat yourself up. But if you’re going to step in, don’t fire off a lump-sum buy. Start small, add on down days, and let the market come to you.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The RiskSignal Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.

Great work, Kurt! Very informative! Hope you have a great Thanksgiving!