Watch The Bond Market

What Bonds Are Saying About Inflation

The Ivory Hill RiskSIGNAL™ has remained green (since December 5th). Our short-term and mid-term volatility signals are firmly red.

The market has started to turn a little choppy, so increased volatility should be expected.

Potential Buying Opportunities

Inflation news has been persistent, but there are signs of easing. If this happens, expect a bond market rally and declining interest rates in anticipation of the Federal Reserve reducing rates.

The 20-year Treasuries are in a downward trend, but any indication of easing inflation will drive bonds higher. It's still early, but the bond market warrants close attention as it provides insights into inflation trends. If TLT sustains a breakout, I anticipate a FAST rally back to the $100 range.

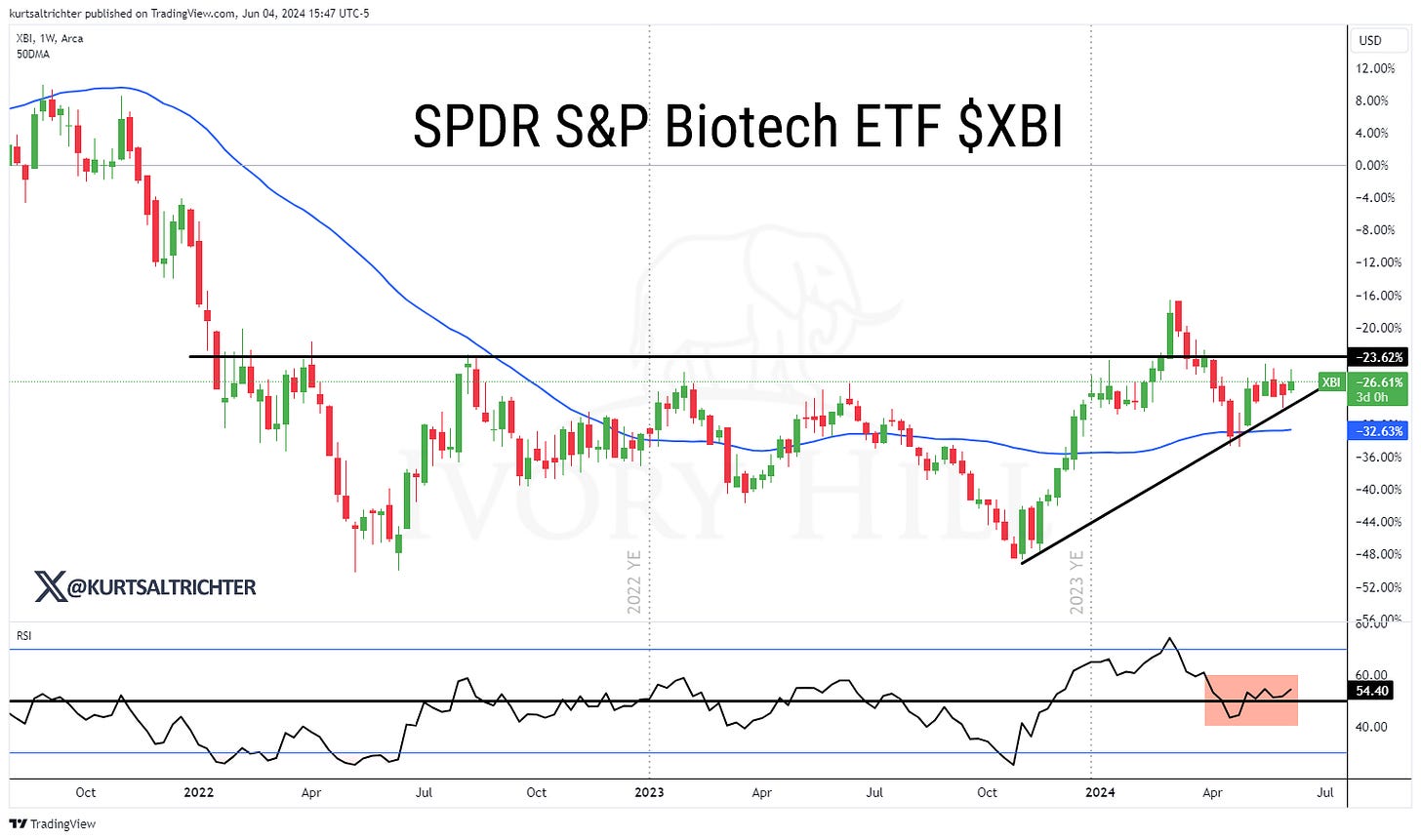

Biotech stocks have been showing improved performance, highlighted by XBI, the Biotech ETF, which recently crossed its 50-day moving average.

Three biotech stocks that I find attractive are Merck (MRK), Regeneron (REGN), and Moderna (MRNA). All three are well-positioned for upward movement. We added exposure to Biotech stocks today.

Salesforce (CRM) experienced a notable drop last week after releasing a fiscal first-quarter report that fell short of Wall Street expectations for the first time since 2006. The company also provided guidance that was below projections. The stock is likely to retest recent lows around $216, which could be a favorable buying opportunity. With its steady monthly subscription revenue and strong potential in AI development, Salesforce shows promising long-term growth. However, I would prefer to see the price stabilize before buying. If you bought this stock today, you'd be happy with it in five years, but given the current market conditions, patience is crucial.

We added to our Bitcoin position last week. The primary trend in Bitcoin remains bullish, as the uptrend from the late 2023 lows was defended for a second time in late April and early May. However, recent consolidation and a loss of upward momentum have been evident, with futures falling to multi-month lows in early May and encountering resistance at previous record highs. This compressing pattern isn't particularly bullish but is near-term neutral, putting technical focus on the uptrend line from the October lows. A break below this trendline would be a significant bearish signal for Bitcoin futures, bringing support at the Q2 lows ($57,670) into play. Another key indicator to watch is the daily RSI dropping below the 50 threshold, which would signal deteriorating price action. Otherwise, the uptrend is expected to continue, potentially retesting the all-time highs set in March.

From a macro perspective, Bitcoin has been a leading indicator for stocks, especially over the past year, as it peaked before stocks last summer and bottomed out before stocks in October. The recent divergence of Bitcoin from equities is noteworthy, and the absence of new record highs in Q2 adds to the list of reasons to be cautious about the latest attempts to reach new all-time highs in the S&P 500 and Nasdaq Composite Indexes.

I'm becoming more optimistic about the industrial sector. As the US enters a prolonged period of reflation with mixed macroeconomic growth forecasts, we should anticipate a reflation/stagflation environment that typically favors outperformance in industrial stocks.

The relative strength of XLI to SPY (blue line) is falling back towards the 2024 lows and has been a reliable indicator of manufacturing activity in 2024, showing strength earlier this year but now breaking down at an accelerated pace. Such conditions often set the stage for cyclical relative rallies.

Notable Economic Developments

Despite Friday’s rally and a less-hawkish tone in money flows at the end of May, last week brought more evidence of stagflation in the economy. Q1 GDP growth was sharply revised downward to a seven-quarter low, contrasting with the more optimistic preliminary release.

Traders seemed to take the 2.8% annual Core PCE print for April in stride, as it met expectations. However, the chart below clearly shows that the disinflation trend is stalling, with core inflation readings remaining well above the Fed’s 2% target. This situation could lead to either 1) a prolonged higher interest rate policy by the Fed or 2) a rate hike if inflation starts to rise again. Neither scenario is good for stocks.

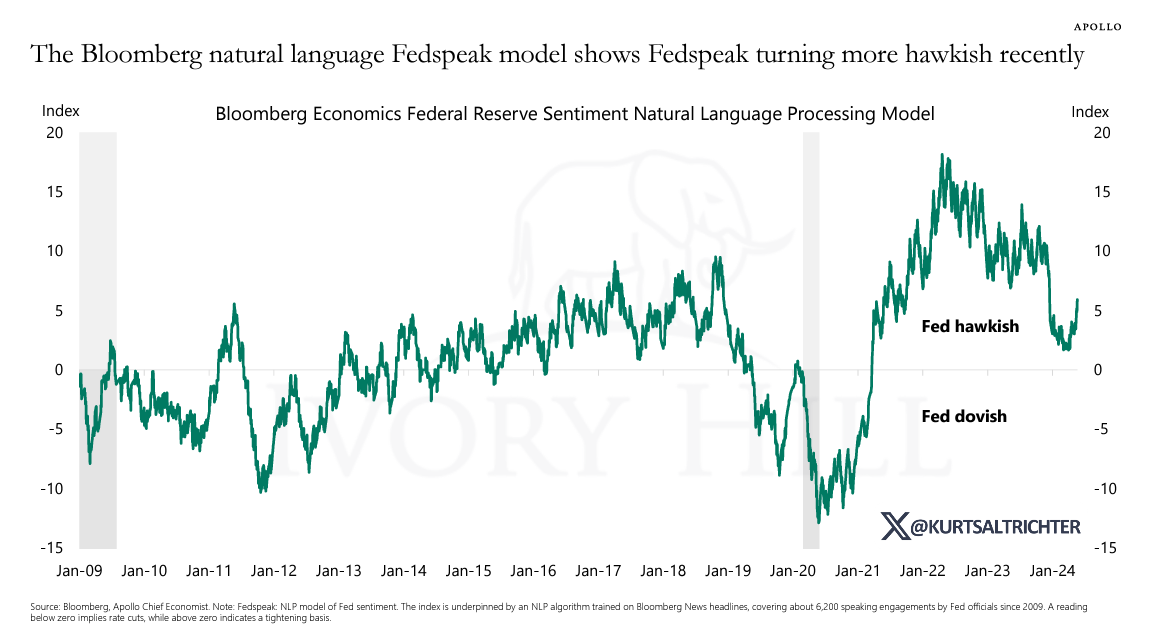

Apollo recently highlighted an intriguing visual that caught my attention. The chart below comes from Bloomberg’s Federal Reserve Sentiment Natural Language Processing Model, which evaluates Fed commentary to generate a numerical index indicating whether Fed officials are hawkish, dovish, or neutral. According to Apollo, the model has reflected varying degrees of hawkishness since early 2021, and no rate cuts have been priced in for 2024 so far. The most recent movement in the index has been sharply upward, even though it started from a multi-year low. This increasingly hawkish Fed policy outlook is concerning for stocks and other risk assets, especially as inflation appears to be stabilizing around 3% and growth has slowed to a seven-quarter low.

Fidelity's market cycle chart below indicates that we are in the early part of the final stage of economic expansion. However, it would be more plausible that we are approaching the end of this late-stage phase and could be on the verge of a recession in 2024. Only time will tell.

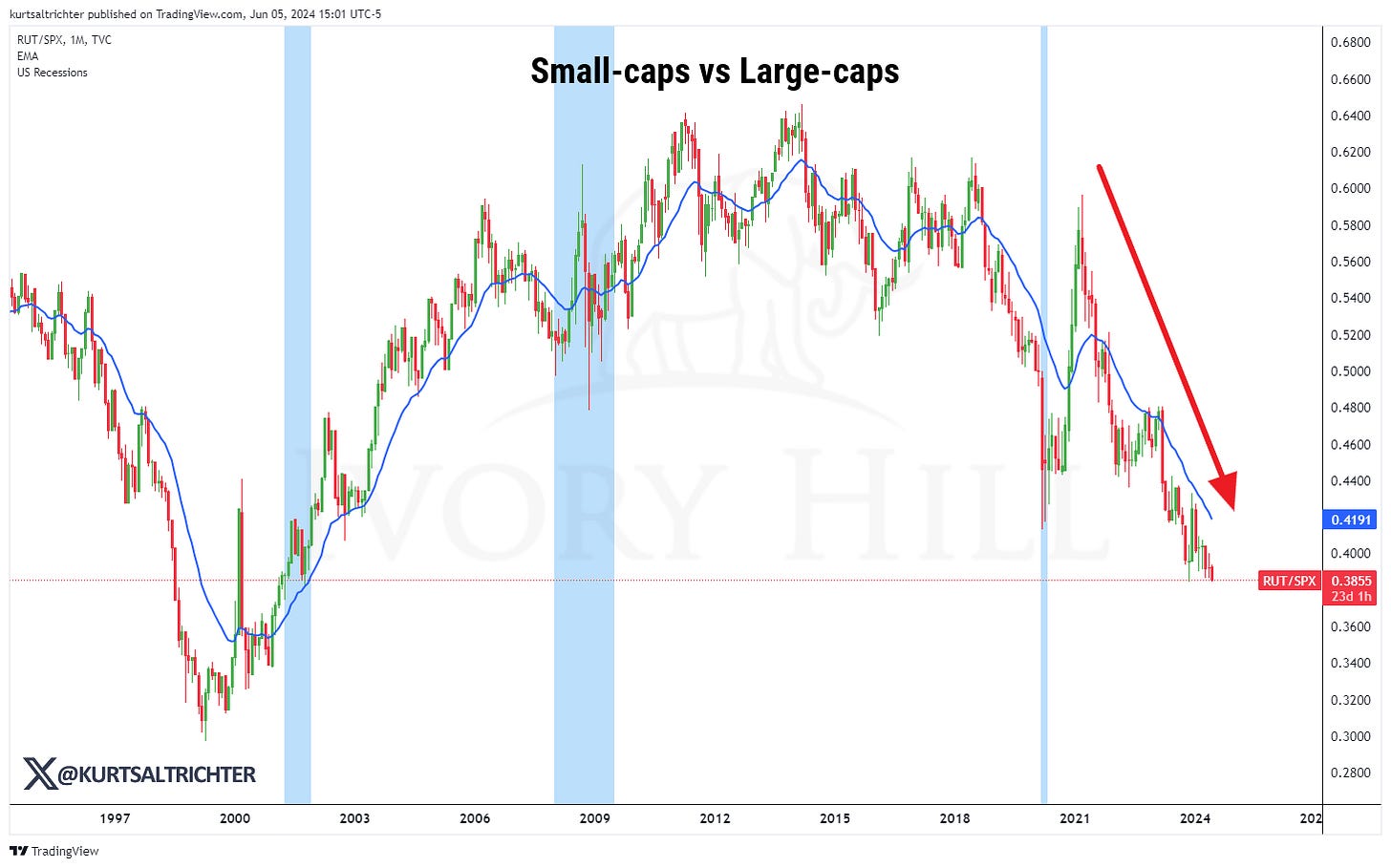

I know I’ve been sounding like a broken record on this for almost three years now, but small-caps' performance is very important. Small-cap stocks are more reliant on debt than larger firms and are continuing to decline even as rates have been falling. This does not indicate strength. Until small-caps can sustain an uptrend over the coming months and quarters, I don't believe we are in a broadening bull market.

Looking ahead, I expect this market to become increasingly difficult to read as the election approaches.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Direct: 952.828.5336

Email: kurt@ivoryhill.com | ivoryhill.com