Welcome back to the Dealer Gamma Report. Five weeks in, and this report continues to evolve faster than most realize. The more we track this in real time, the more we see how the structure of flows and the shape of dealer positioning drives the tape far more than headlines ever do.

The job is not to guess. The job is to measure the regime and position accordingly. Professionals look to the left side of the equal sign. This is the only part we can control.

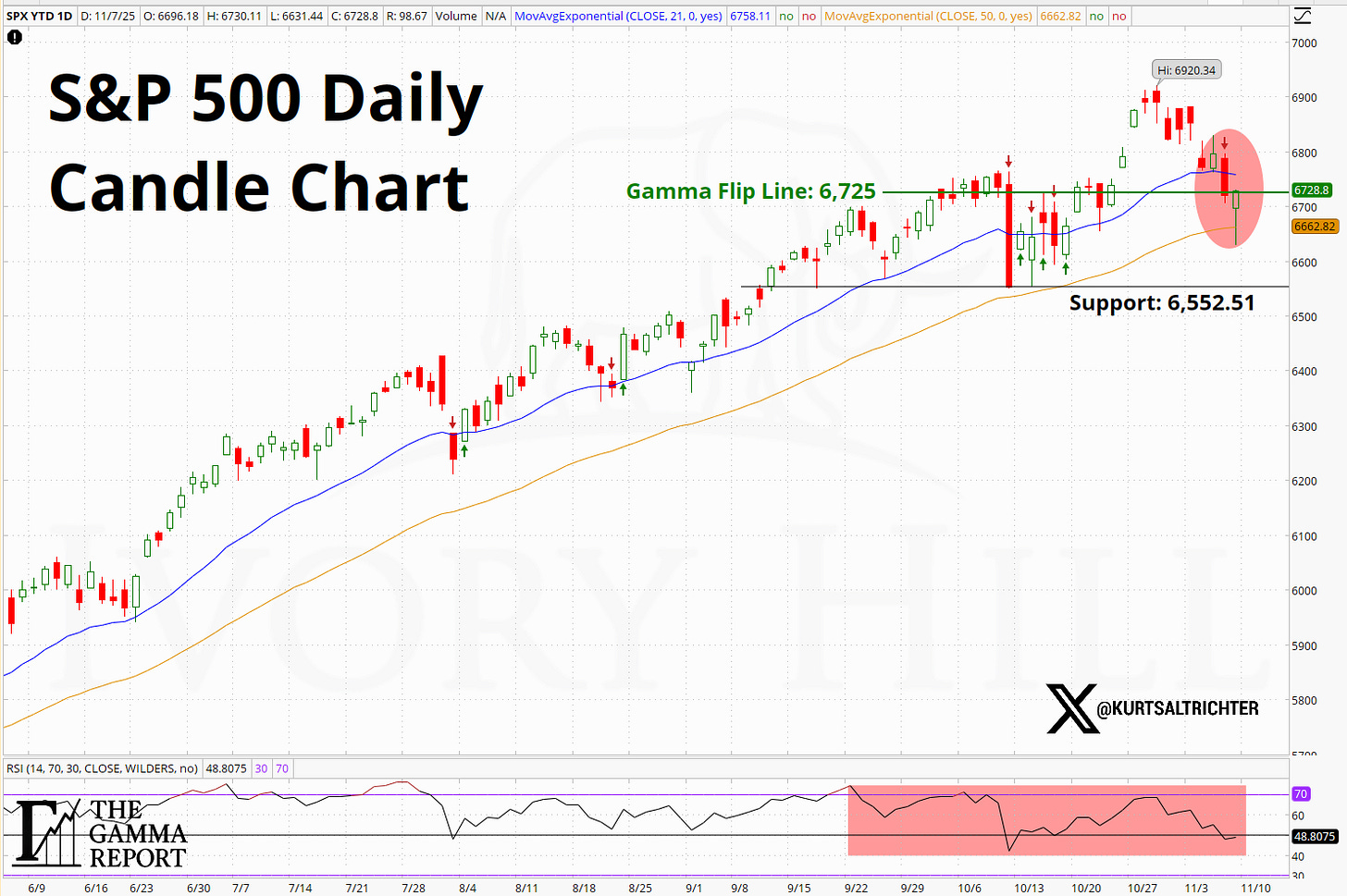

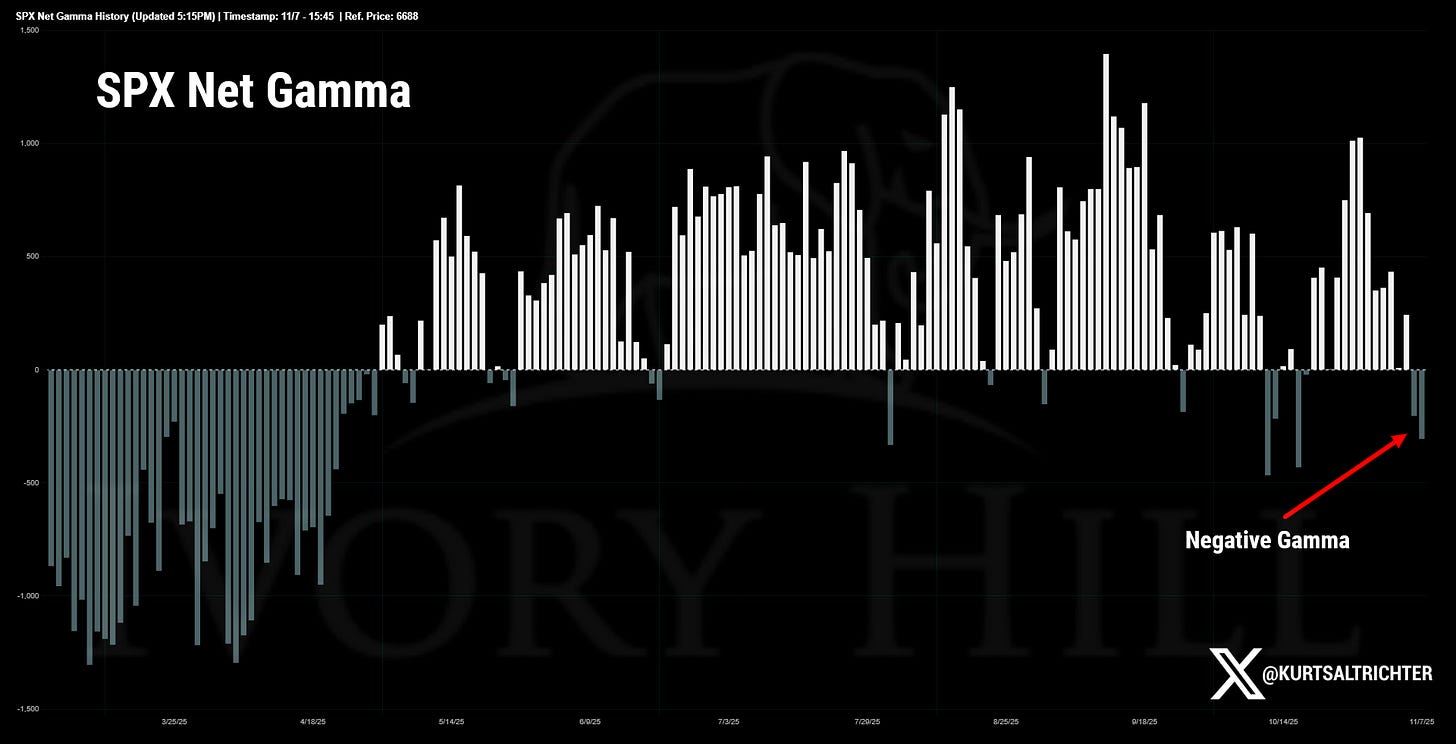

Gamma Signal

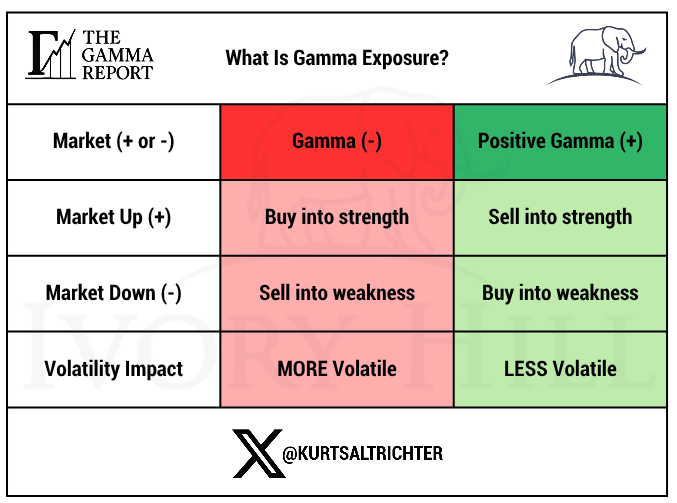

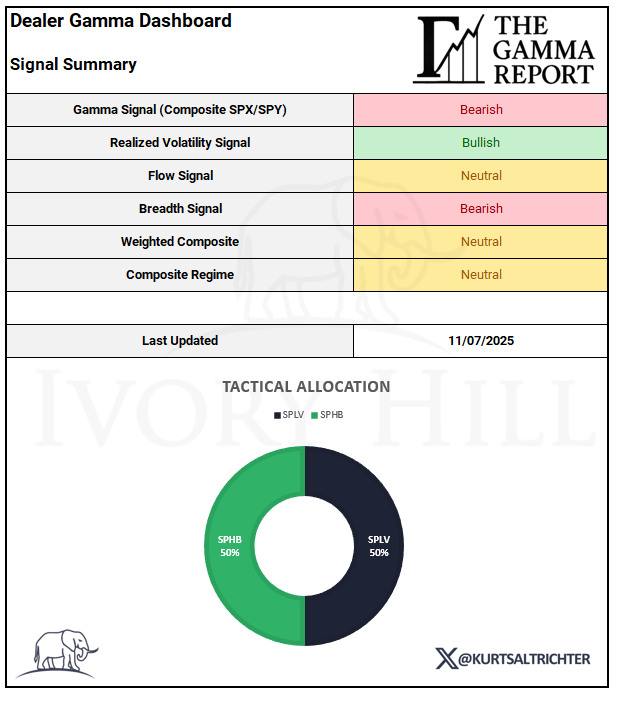

Dealers moved into negative gamma last week. This move matters because it is a regime change. Now that dealers are short gamma relative to spot, they must hedge in the direction of price. When the market trades lower, they sell into weakness. When it trades higher, they have to buy into strength. Flows are more erratic in this environment. Price gets amplified, not suppressed.

Now that dealers are short gamma relative to spot, they must hedge in the direction of price.

SPX remains below the flip line, confirming the negative gamma environment. Until spot pushes back above that level, the tape will remain structurally weak and more sensitive to order flow. This is not about calling direction. It is about understanding liquidity. In a negative gamma, it takes less to move the index. Moves stretch. Reversals snap. And intraday volatility tends to expand even in the absence of a headline catalyst.

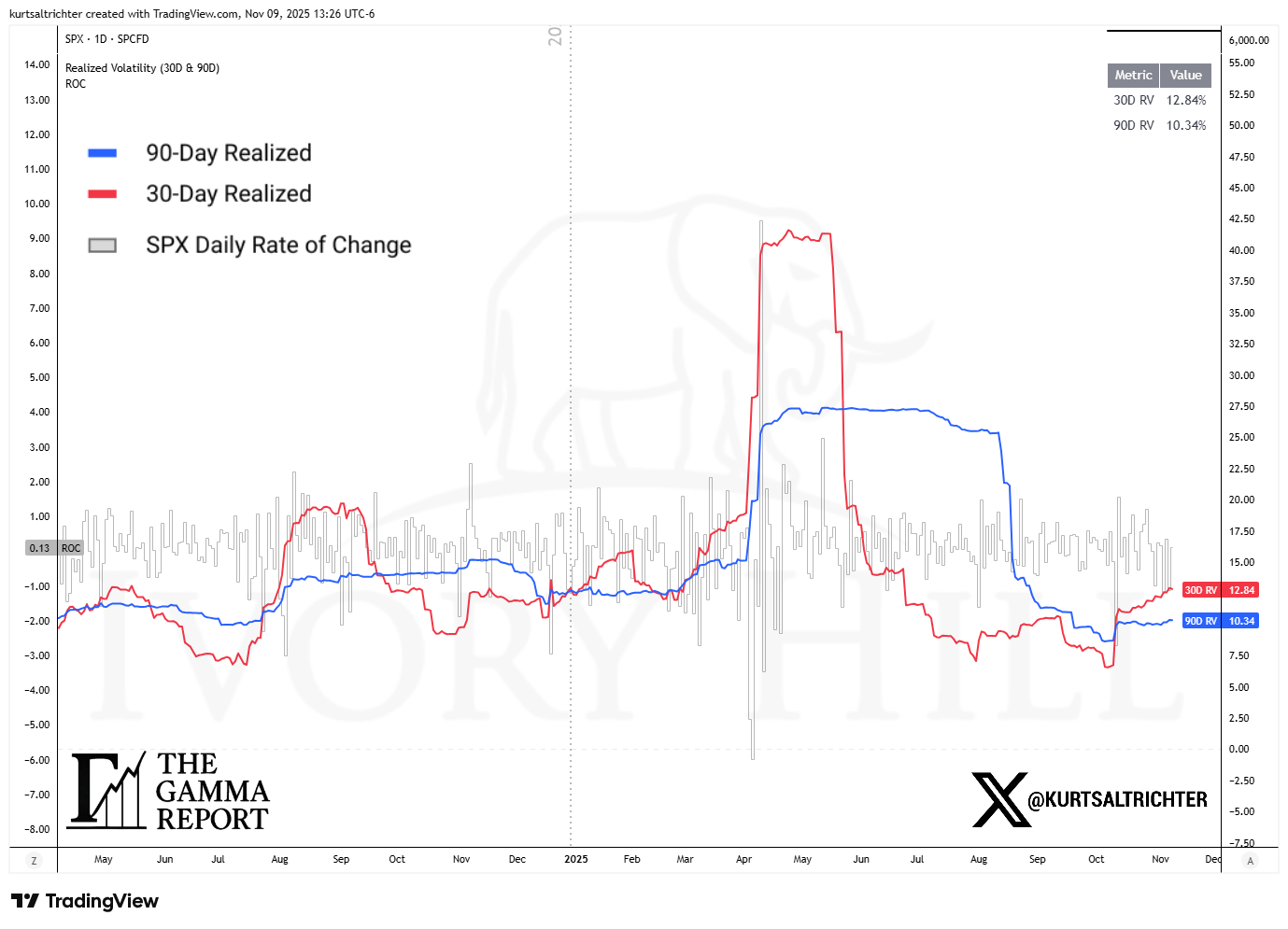

Realized Volatility Signal

30-day realized volatility finished this week at 12.84, up from 12.22 last week. 90-day finished at 10.34 versus 10.03 last week. Both readings increased from last week.

Higher realized volatility means the market actually moved more last week than it did the prior week. However, these levels are still not high enough to force VolControl models to reduce exposure. They only cut when realized volatility jumps sharply. That hasn’t happened yet.

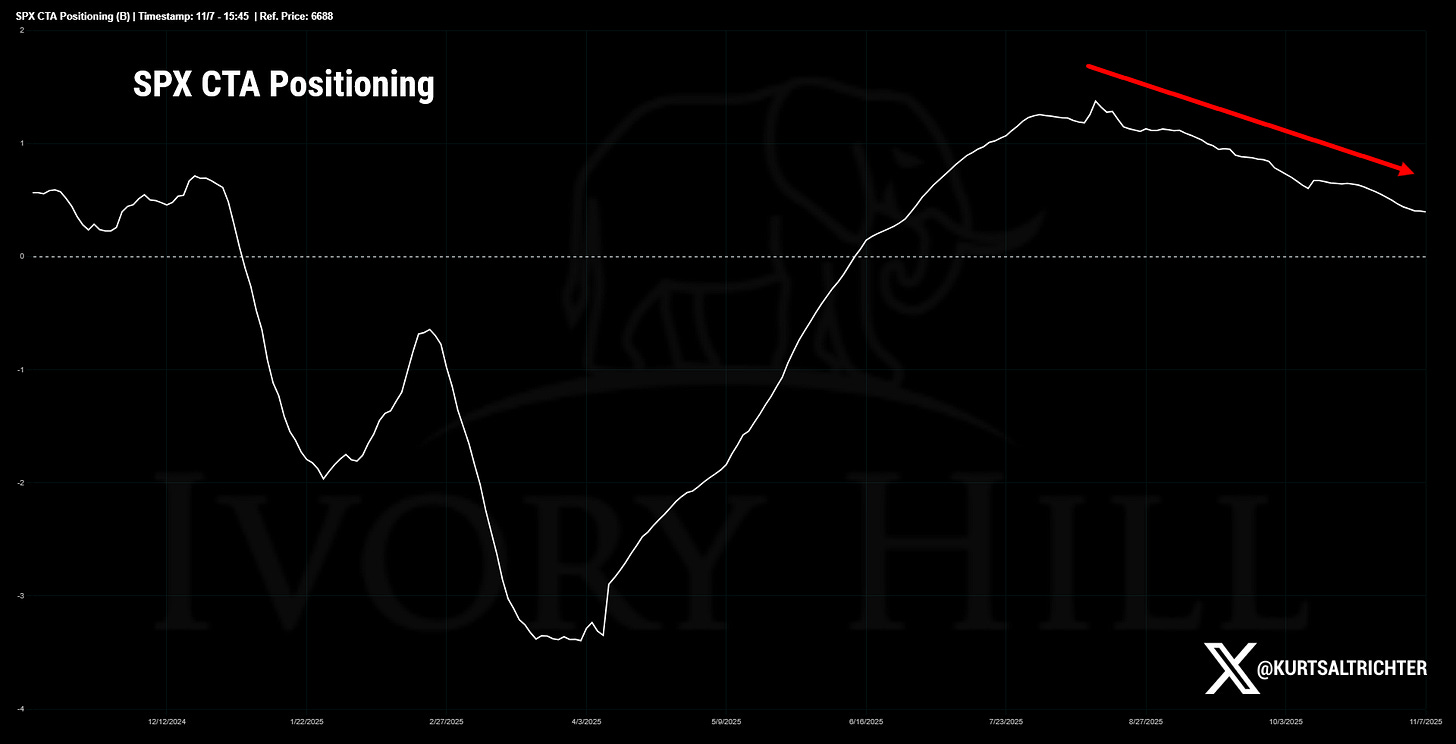

CTA positioning stepped down again because trend momentum weakened. CTAs follow the trend. VolControl follows realized volatility.

So, compared to last week, realized volatility increased, but not enough to trigger mechanical selling from volatility targeting models.

Flow Signal

CTA exposure moved lower this week, indicating that trend strength is fading. VolControl exposure increased off the recent lows because realized volatility has not expanded enough to force those models to cut exposure. CTAs react first to trend changes. Vol Control confirms or rejects that move based on realized volatility. Right now, we have trend deterioration without a volatility blowout. That means flows are not applying downside pressure. They are also not adding any meaningful upside support either.

Breadth Signal

Breadth weakened further. The percent of stocks above their 200-day moving average declined again and remains below the “yellow zone” that historically creates a durable trend foundation.

Composite Regime

The weighted composite moved to neutral on Friday. The gamma signal is bearish. The realized vol signal is slightly bullish. Flow is neutral. Breadth is bearish. When you blend those four components, the model neutralizes and pulls us back into risk control posture. There is no statistical advantage to pressing leverage here until we see either breadth improve or gamma flip back to positive.

Tactical Allocation

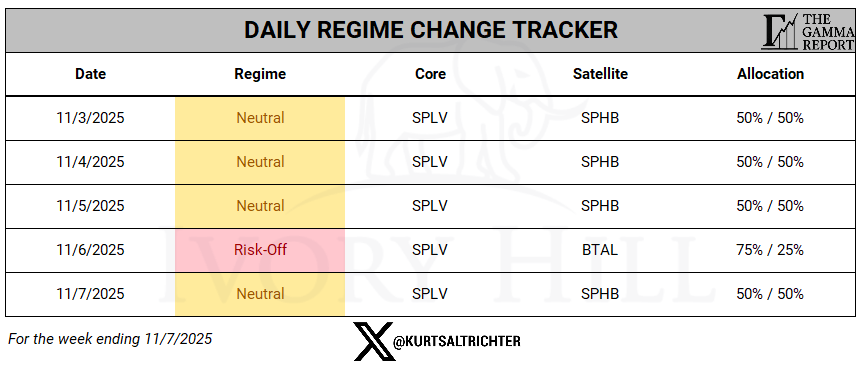

The daily model finished the week neutral at 50% SPLV and 50%SPHB. The weekly model, which trades only on Fridays, also remains neutral with the same 50% SPLV and 50% SPHB mix.

Weekly Model Performance

The weekly model entered last week in a Risk-On mode, with 75% SPHB and 25% SPXL, and held that allocation through Thursday. The adjustment only happened at the Friday close when the model moved back to Neutral.

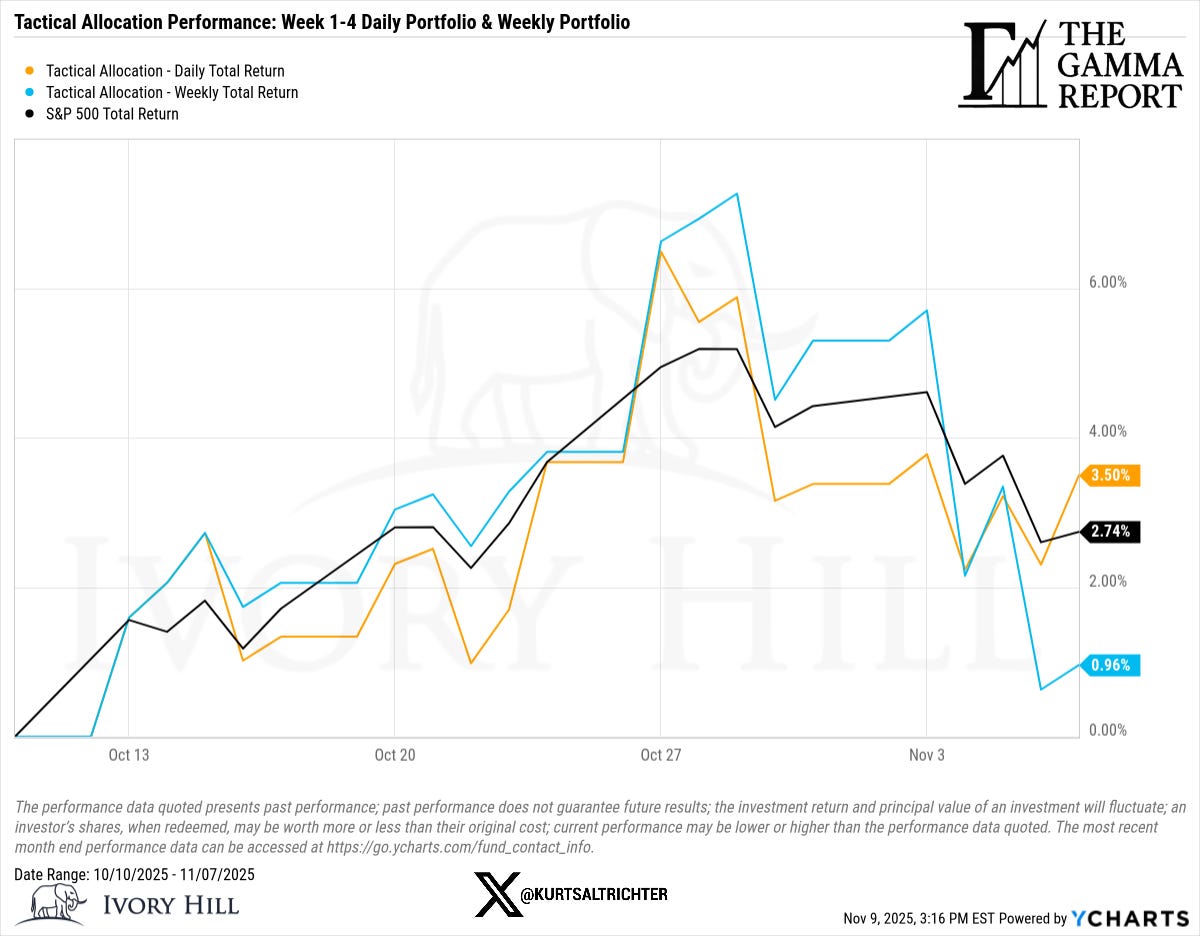

From a performance standpoint, the daily model is leading (for now). It’s currently outpacing both the S&P 500 and the weekly model because it is adapting faster to the shifts in gamma and realized volatility.

The weekly model still has the benefit of suppressing noise, but this week, the price of that slower reaction speed was underperformance relative to the daily sleeve.

Final Thoughts

The bottom line here is simple. We are not in a market that rewards conviction in a single direction. We are in a market that rewards reading the regime and letting the structure tell you when to lean in and when to back off.

Gamma is soft. Breadth is slipping. The trend is weakening. Realized vol is firmer but not yet disruptive. That combination does not call for big offense moves or panic selling. It calls for staying balanced and letting the model dictate exposure instead of using your emotions.

Having an opinion is not an edge.

The edge is in knowing which environment you are in.

You cannot control outcomes. You can only control alignment.

If you stay aligned with the structure, you avoid the forced errors that kill performance. This model is being built in real time and will continue to evolve week by week as we collect more signals and calibrate the weightings.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The Gamma Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.