CLIENT ANNOUNCEMENT: I will be out of the country from January 1 through January 9 for a family wedding. I will still be working during this time, but from a different time zone, so response times will vary. Text my cell or leave me a voicemail on my work line, and I will respond as soon as I can.

Last week was a reminder that price can look fine while structure quietly changes.

We came into year-end with the market leaning on supportive flows and contained vol. We exit the first session of 2026 with dealer gamma flipping negative, breadth still banging against the ceiling, and the model moving to defense.

That does not mean “crash.” It means the tape gets less forgiving, faster.

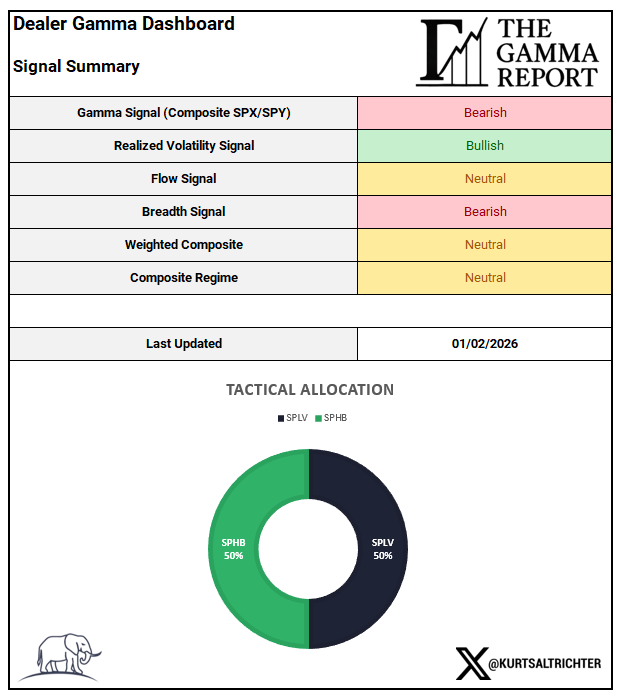

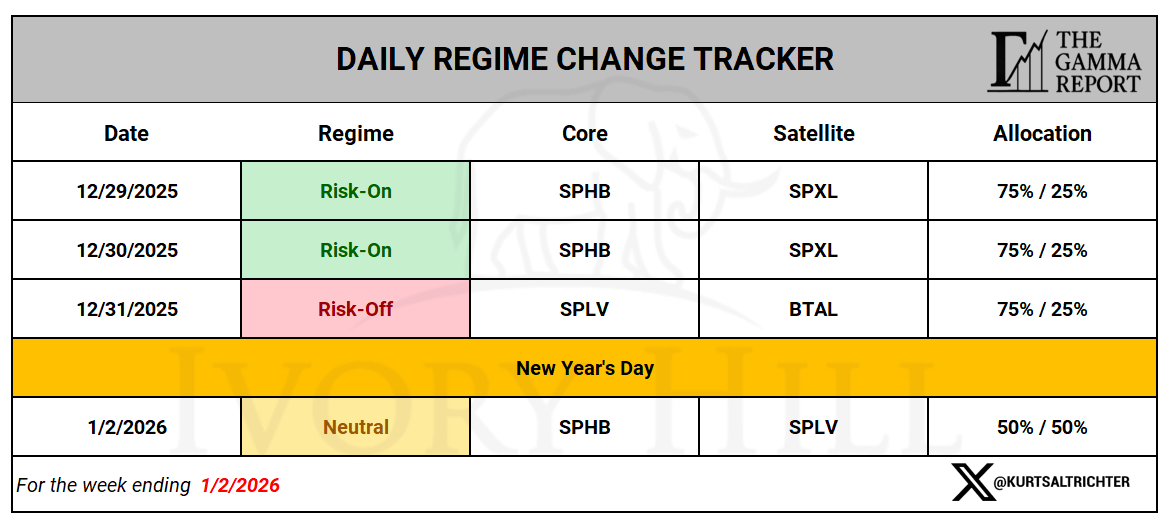

Signal Summary

As of the 1/2 close, the stack reads:

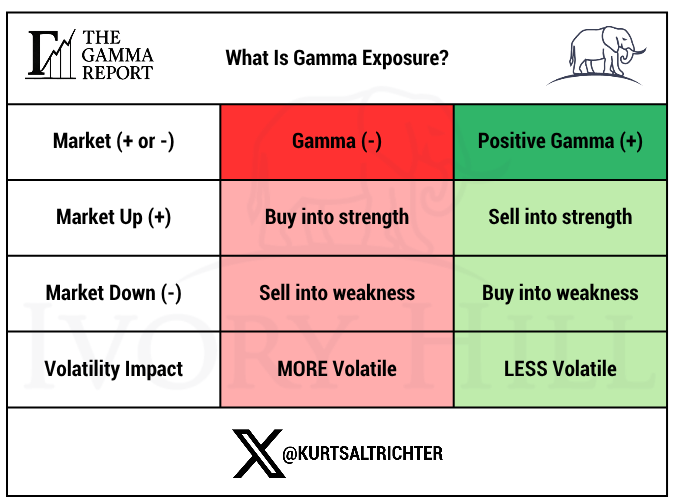

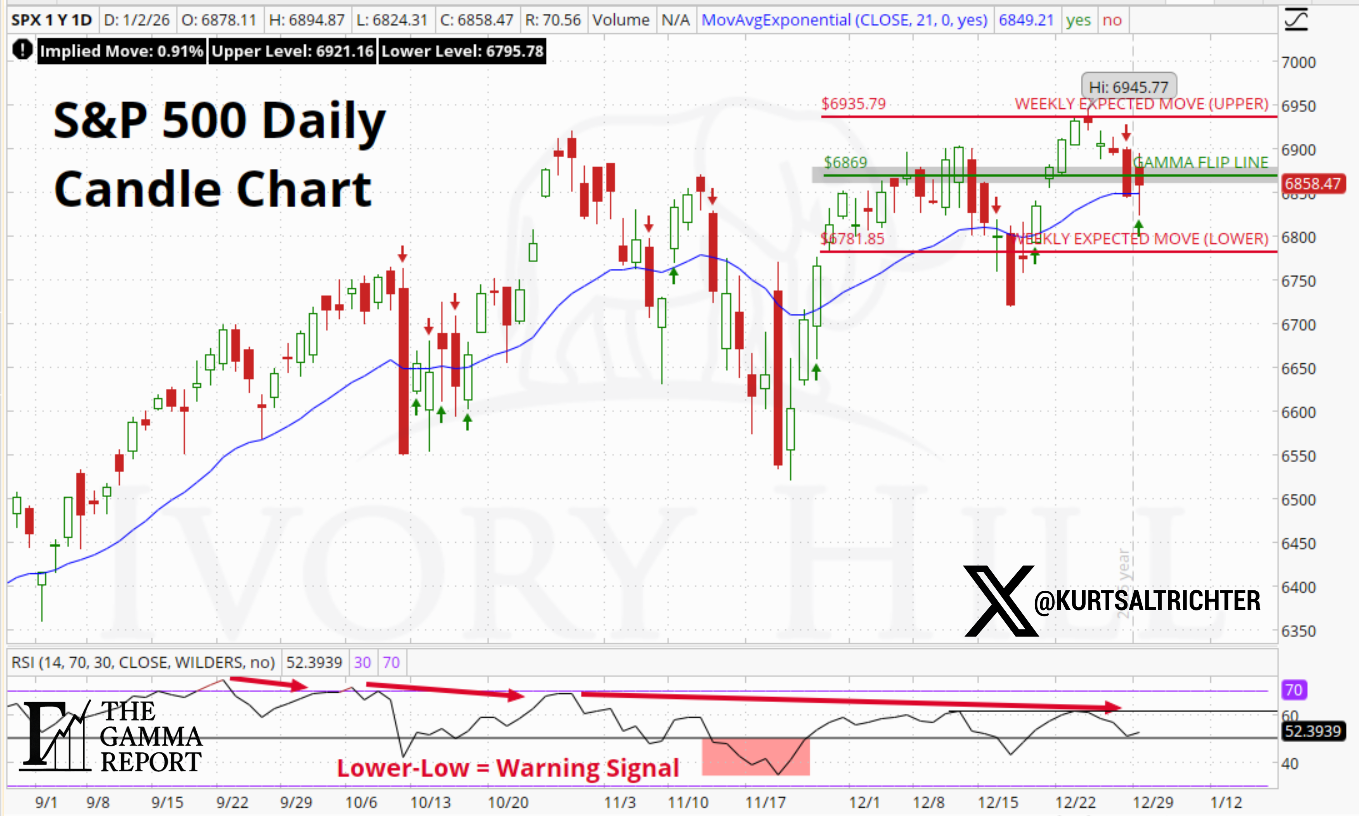

Gamma and Price Structure

SPX closed 1/2/26 at 6,858.47 with the Gamma Flip Line near 6,869, meaning spot is sitting just below the line.

That is basically the whole story.

Above the flip, dips get absorbed, and rallies slow down. Below the flip, hedging mechanics can start pushing in the same direction as price, which is how “normal pullbacks” turn into air pockets.

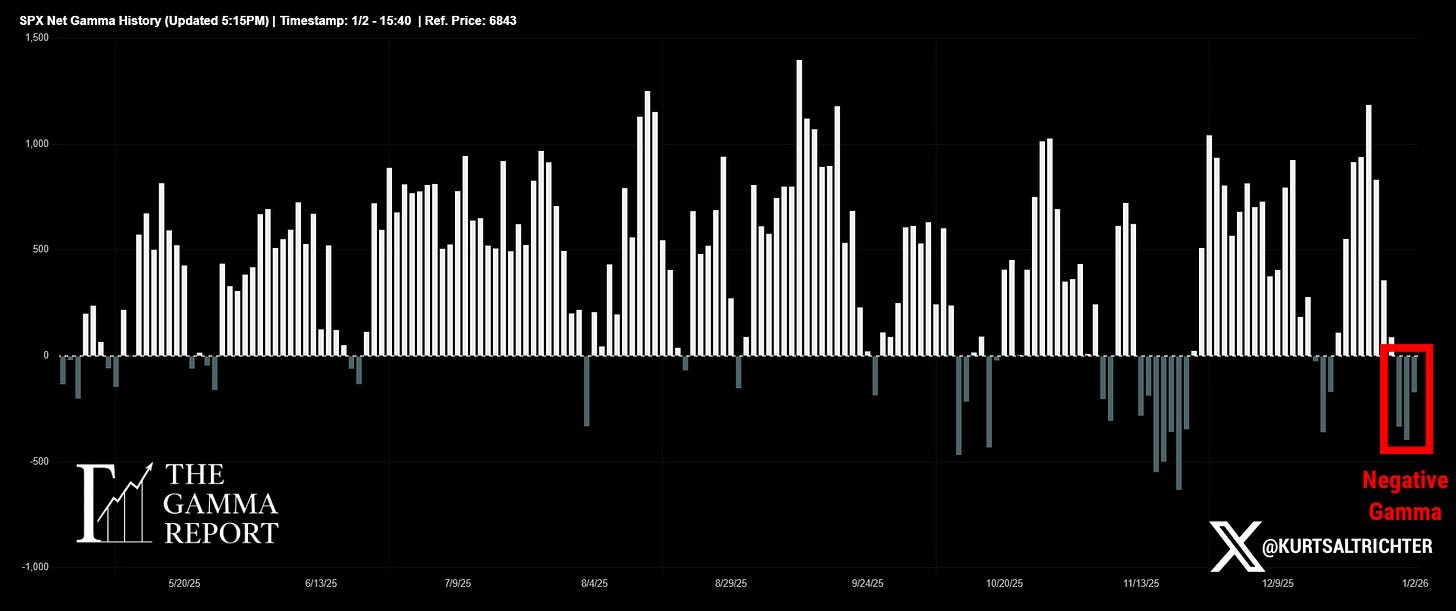

Net Gamma Positioning

Net gamma is now negative.

That is the regime change that traders feel, even when they cannot explain it. When gamma is negative, dealers hedge with the move. That means more extension on both sides.

If you want one clean line to trade off, it is this: reclaim the flip line and hold it, or respect the fact you are operating in a less stable structure.

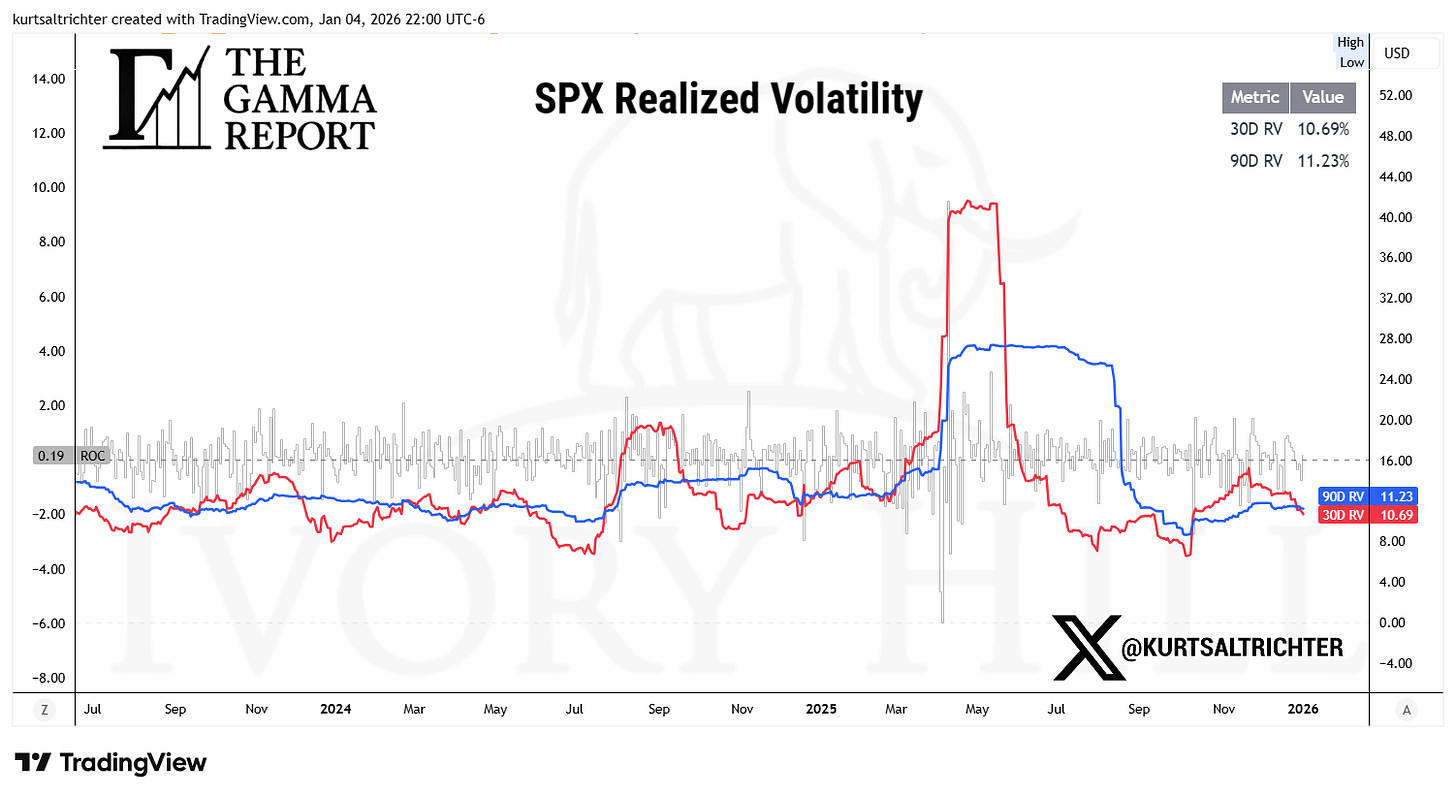

Realized Volatility

Realized volatility scored Bullish this week. Translation: vol is not the immediate problem.

That also explains why the model did not slam into full defense. The market is not signaling “forced selling.” It is signaling “structure is weaker, but not panicked.”

This is what neutral looks like when gamma is bearish, but vol is contained. You do not press leverage, and you do not short every bounce like you are the smartest guy in the room.

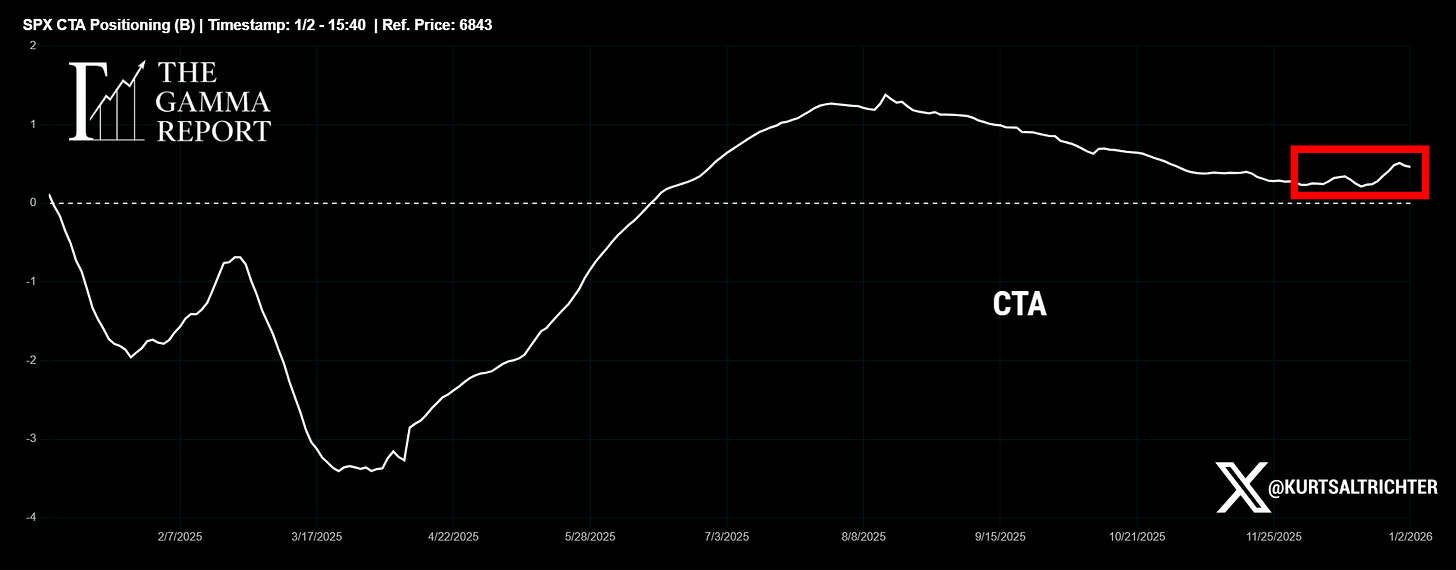

Systematic Flows

Flows are neutral, but the slope matters more.

CTA positioning is still on an uptrend but has started to curl down off recent strength, and vol control exposure is rebuilding as well, but is flattening out. That is not a green light for max risk, but it does reduce the odds of immediate mechanical downside amplification.

Think of it like this: if gamma is the road surface, CTA and vol control are the wind at your back or in your face. Right now, the wind is not screaming against you but it is not pushing you forward either.

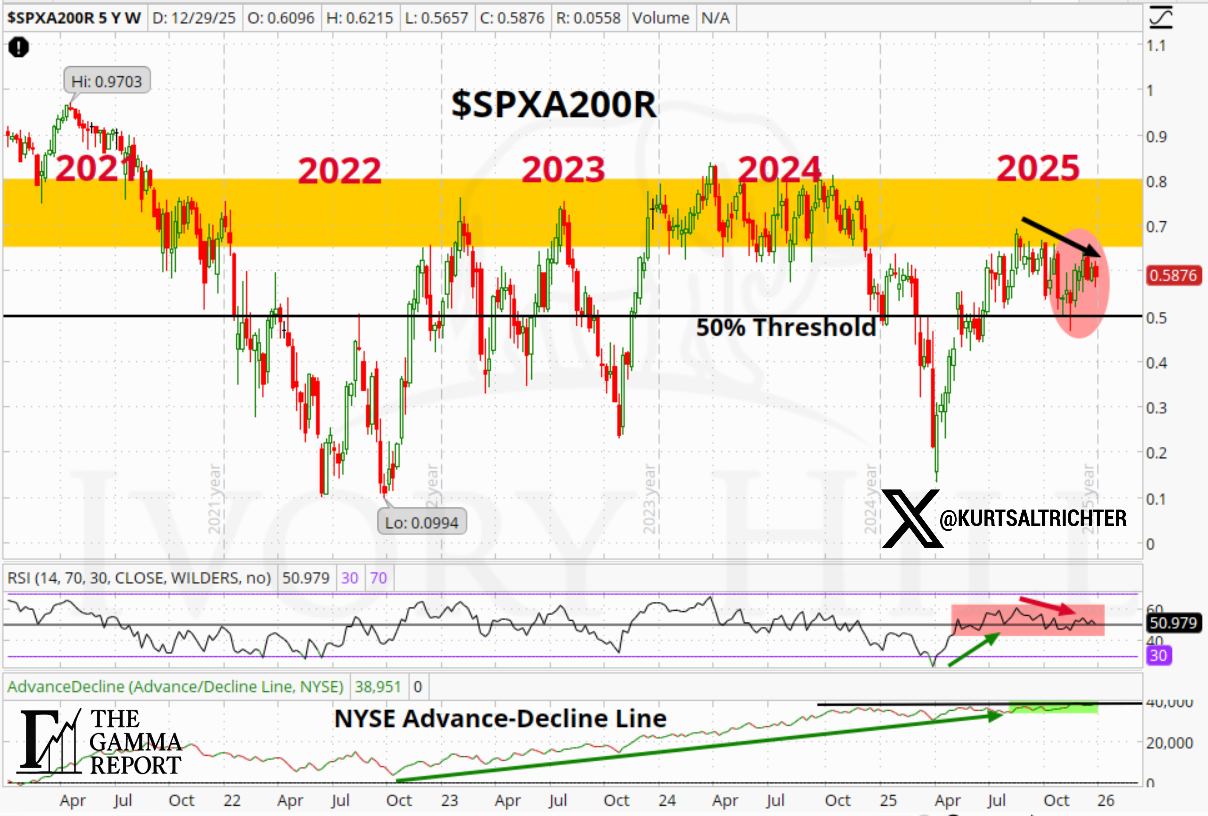

Breadth

Breadth is still the constraint.

The percent of stocks above the 200-day remains stuck in the same multi-year congestion zone that has capped participation since 2022. The NYSE advance-decline line is still trending higher, which is constructive, but RSI and participation are not screaming “new expansion leg.”

In plain English: the index can levitate, but it is still carrying a narrow engine.

That is precisely where negative gamma becomes a bigger deal. Thin participation plus negative gamma is how you get sharp downturns that start from nowhere.

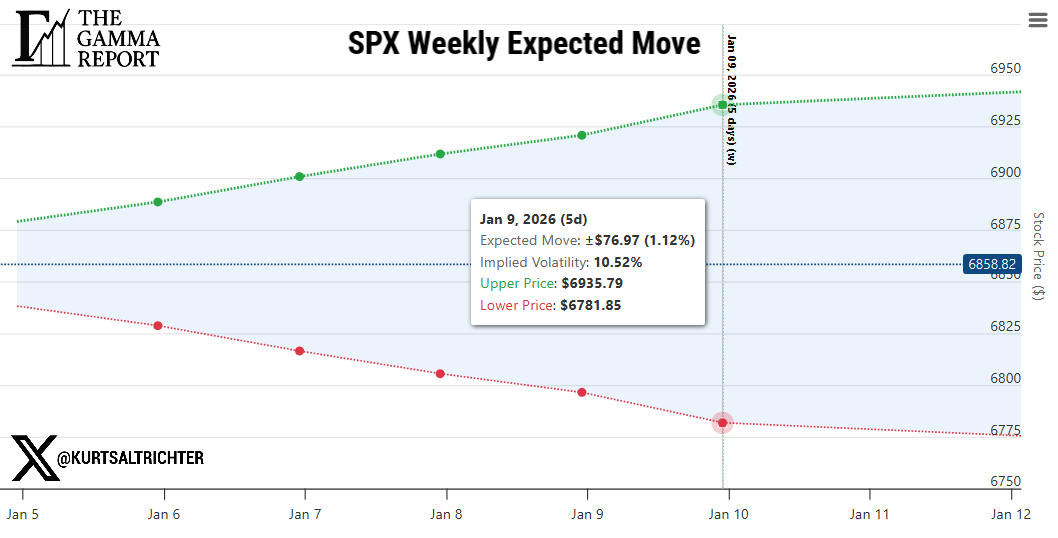

Weekly Expected Move

For the week ahead, the expected move is ±76.97 points (1.12%) with:

Upper: 6,935.79

Lower: 6,781.85

Implied Volatility: 10.52%

This range is your options-implied risk box. The market is telling you where the “should be” lives.

If the spot is below the gamma flip line, I care more about how the price behaves near the lower band than I do about hot takes on the upper band. This structure is not set up for chasing strength without confirmation.

The S&P 500 could be up or down 1% this week, and no one should be surprised.

Composite and Regime

Weighted composite is Neutral, regime is Neutral.

Gamma is bearish. Breadth is bearish. Vol is cooperative. Flows are not a headwind. Net result, stay balanced, stay liquid, and let levels dictate when to rotate back into offense.

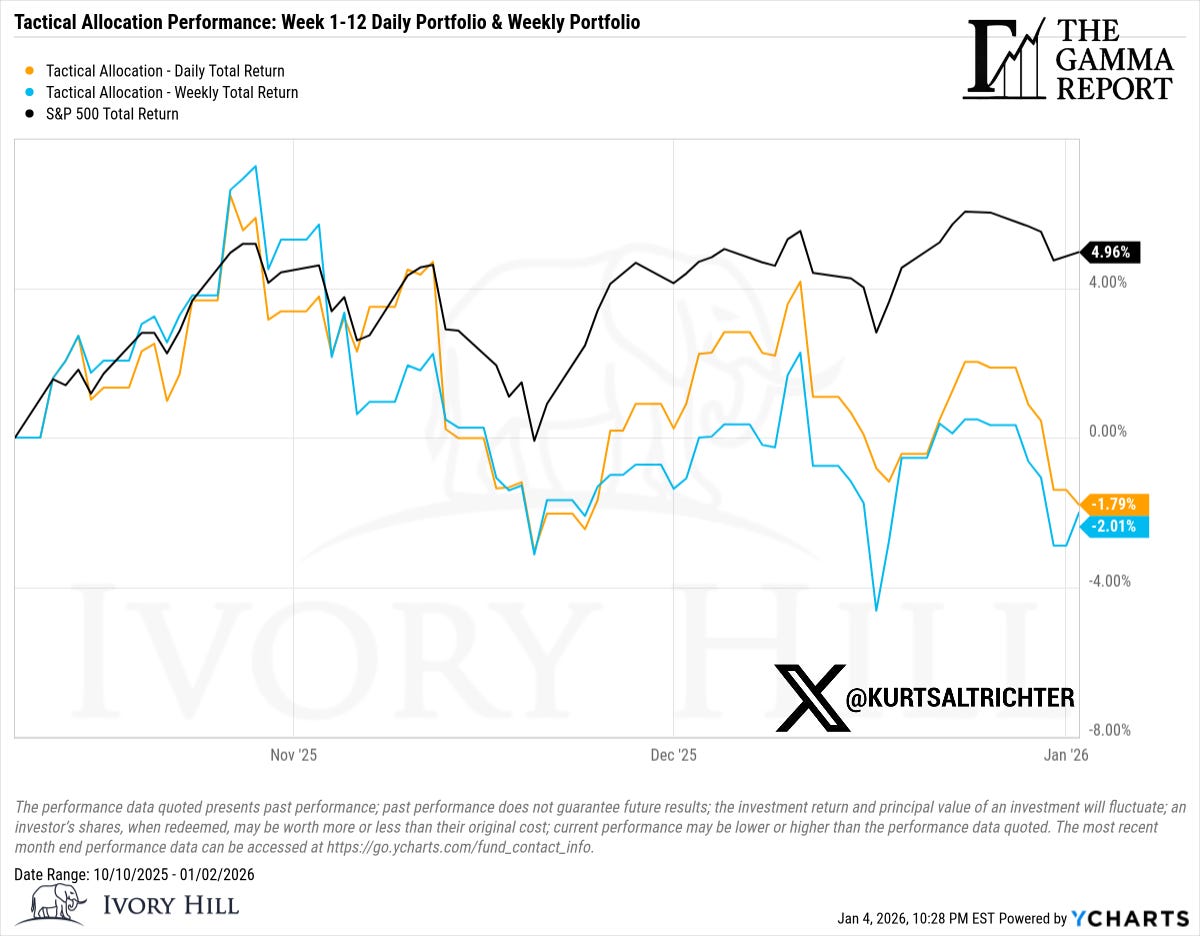

Performance

Date Range: 10/10/2025 to 01/02/2026

S&P 500 Total Return: +4.96%

Daily Tactical Portfolio: -1.79%

Weekly Tactical Portfolio: -2.01%

This is the cost of playing defense in a tape that keeps teasing breakouts, then snapping back. There is a reason we don’t take an outright short position in this model because shorting and holding is a surefire way to lose money. In other words, if we were shorting, the performance would be deeply negative.

If you want to beat the index in this environment, you need either sustained breadth expansion or a clean positive gamma trend that stays pinned above the flip line. We have not had that consistency at all since I started writing this report.

The process is doing its job. It is keeping you from being forced into the wrong exposure at the wrong time.

Negative gamma is back, and breadth is still capped.

Vol is not screaming risk, flows are not a headwind, but the structure is no longer supportive enough to justify chasing upside.

Neutral is the correct posture until SPX can reclaim the flip line and hold it, or breadth starts expanding in a way that makes the index less fragile.

Respect levels. Respect the box. Let the market prove itself before adding more risk.

Feel free to use me as a sounding board.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The Gamma Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.