S&P 500 7,000 Still in Play

Momentum reset, buyers still in control into year-end

The Ivory Hill RiskSIGNAL™ remains green. Pullbacks remain buyable, not because they feel good, but because the market keeps proving that buyers are still in control at the levels that matter. With seven trading days left in 2025, I still expect the S&P 500 to close the year above 7,000.

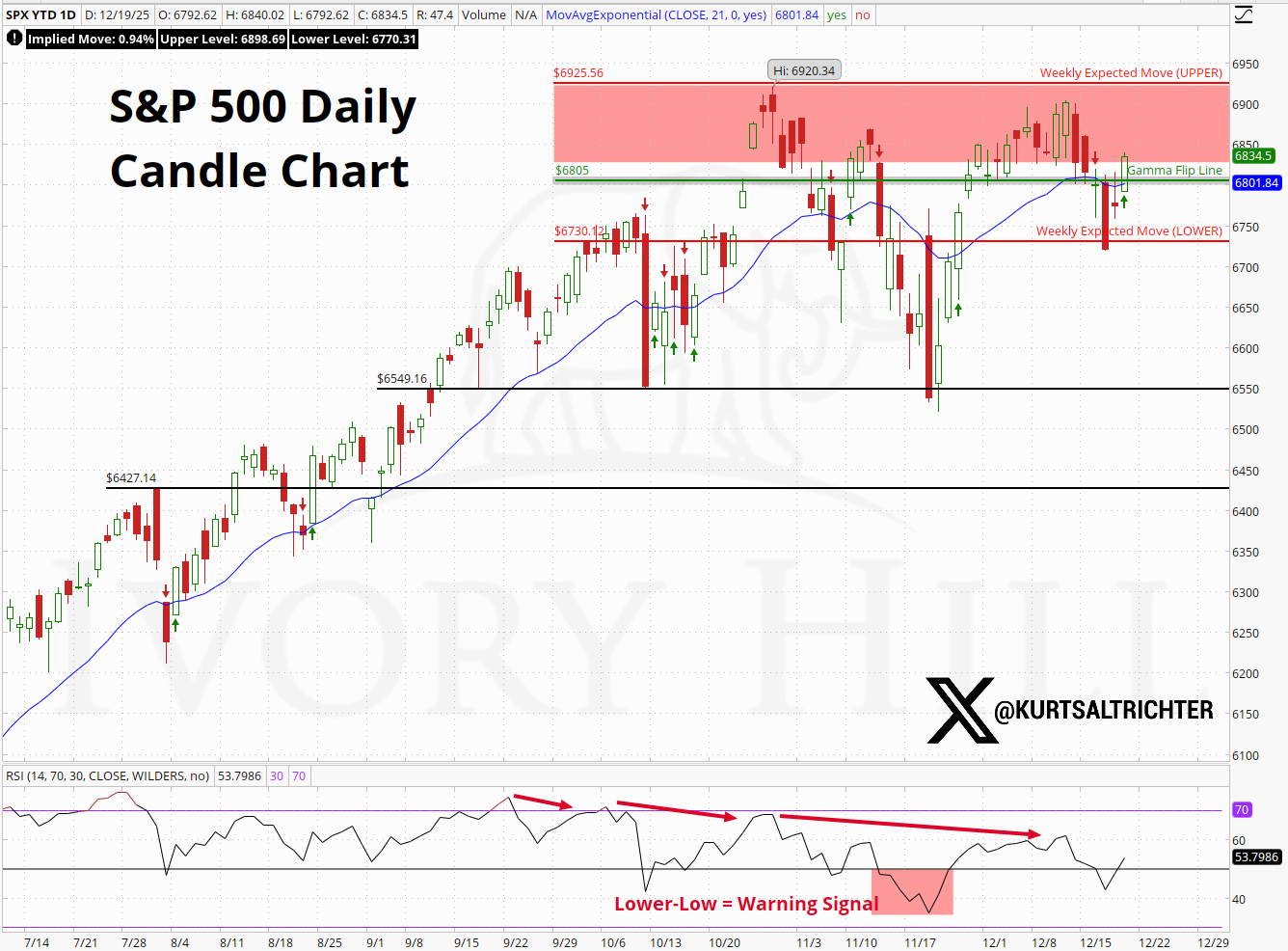

This week reinforced that view. The S&P 500 sold off and tagged the lower end of the weekly expected move that I published in Monday’s Gamma Report, then reversed immediately. That level did its job. Buyers showed up, downside stalled, and the trend stayed intact.

This bounce has important context. Price turned precisely where risk was defined for the week. Selling pressure ran into real positioning and reversed.

From there, price rotated back toward the Gamma Flip Line, which continues to act as the market’s center of gravity. Above the gamma zero zone, dips continued to get bought. Below it, the tone can change quickly. For now, that line is still holding.

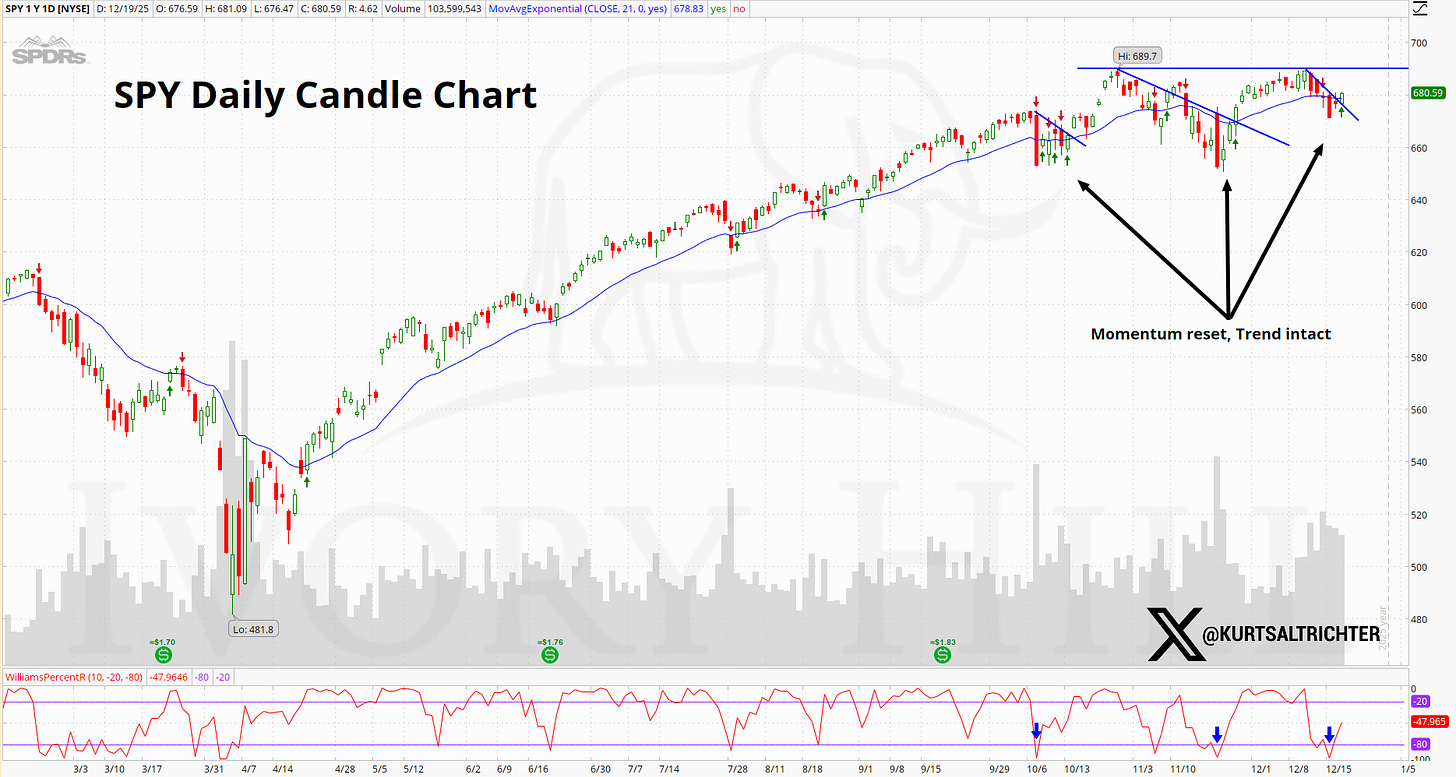

The Froth is Gone

SPY worked off the late-November froth. The pullback reset Williams %R, which tracks how extended the price is within its recent trading range, shows that while price held trend support, the indicator rolled from the top of its range down toward the lower band, indicating momentum cooled without meaningful price damage. Moves that come after that kind of reset usually have more room to run, keeping fresh highs in play into year-end.

Now it comes down to execution and levels.

On the upside, SPX needs a clean daily close above 6,920. That would clear the ceiling that has been rejected since October and reopen upside into year-end. That is the Santa path.

On that, as a reminder, the Santa Rally has a specific definition. It refers to the final five trading days of December plus the first two trading days of January. Based on the 2025 calendar, that window runs from December 24, 2025, through January 2, 2026.

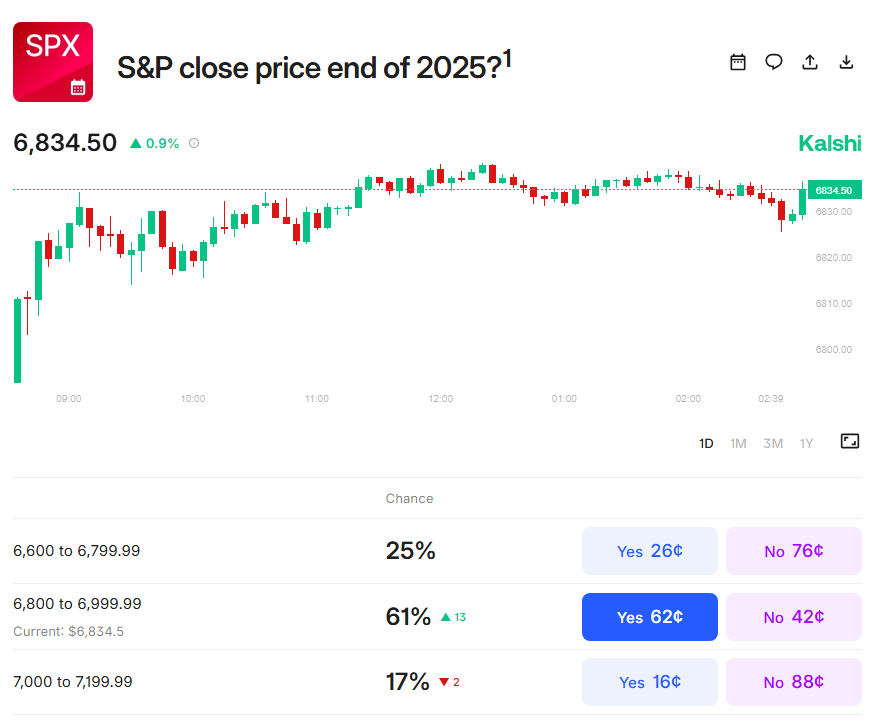

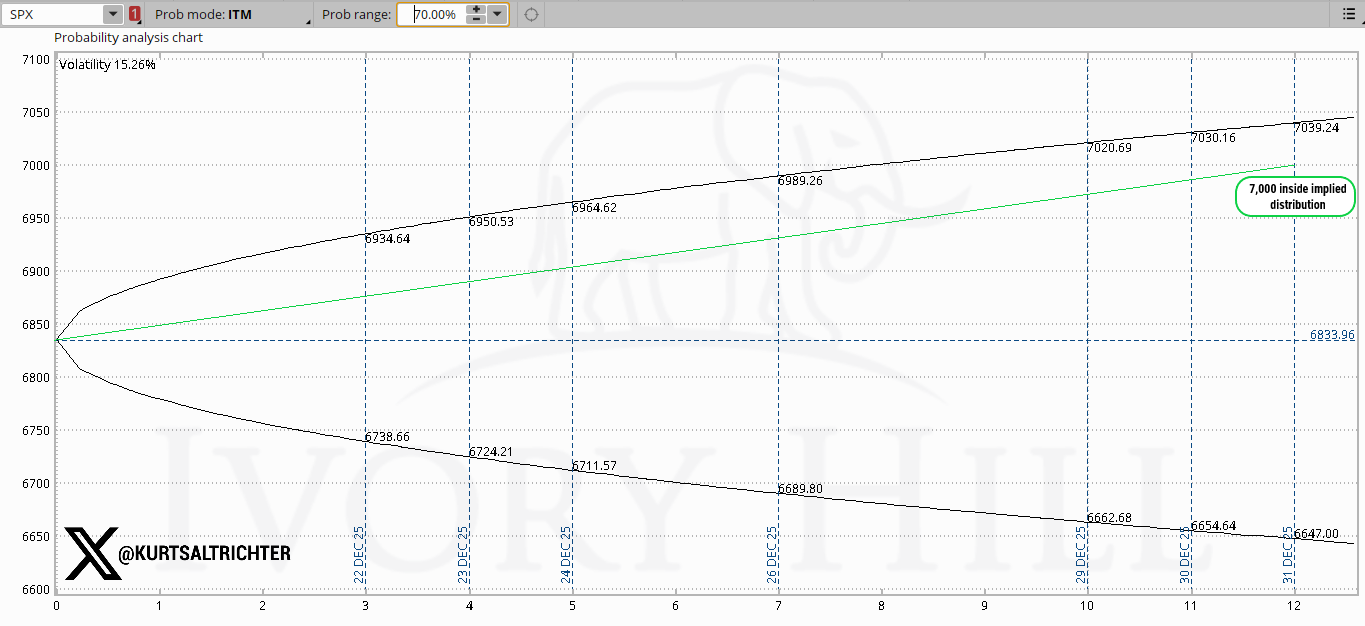

I could be wrong on the S&P 500 finishing 2025 above 7,000. But the chart below is a helpful piece of narrative confirmation.

This is an option-implied probability cone. It shows what the options market is pricing based on current implied volatility.

With the range set near 70%, SPX finishes inside the cone about two-thirds of the time under “normal” market conditions, assuming volatility stays contained. The horizontal black line marks the latest close level. The green line shows that a steady grind higher can reach 7,000 without leaving the implied distribution.

Here’s the takeaway. The options market is not pricing in 7,000 as a tail event. In other words, we don’t need some event-driven volatility spike or a Trump Tape Bomb headline shock to get there.

As long as volatility stays contained and price holds above key gamma levels, the path to 7,000 stays open into year-end.

This is also the point on the calendar where investor behavior changes. From personal experience, portfolio managers are not hunting for new ideas with seven trading days left in the year. Generally speaking, the stocks that have been working tend to keep working. And stocks that have not been working tend to continue to fall into the year-end.

And remember - The one fact pertaining to all conditions is that they will change.

Follow me on X for more updates.

Best regards,

-Kurt

Schedule a call with me by clicking HERE

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Disclosure

The RiskSignal Report is published by Ivory Hill, LLC. All opinions and views expressed in this report reflect our analysis as of the date of publication and are subject to change without notice. The information contained herein is for informational and educational purposes only and should not be considered specific investment advice or a recommendation to buy or sell any security.

The data, models, and tactical allocations discussed in this report are designed to illustrate market structure and positioning trends and may differ from portfolio decisions made by Ivory Hill, LLC or its affiliates. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.

Ivory Hil, LLC, and its members, officers, directors, and employees expressly disclaim any and all liability for actions taken based on the information contained in this report.